Answered step by step

Verified Expert Solution

Question

1 Approved Answer

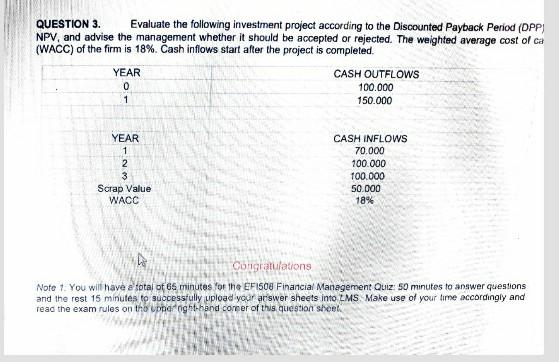

QUESTION 3. Evaluate the following investment project according to the Discounted Payback Period (OPP) NPV, and advise the management whether it should be accepted or

QUESTION 3. Evaluate the following investment project according to the Discounted Payback Period (OPP) NPV, and advise the management whether it should be accepted or rejected. The weighted average cost of cu (WACC) of the firm is 18% Cash inflows start after the project is completed YEAR CASH OUTFLOWS 100.000 150.000 0 1 YEAR 1 2 3 Sorap Value WACC CASH INFLOWS 70.000 100.000 100.000 50.000 18% Congratulations Note 1. You will have a total of 66 minutes for the EF1508 Financial Management Quiz 50 minutes to answer questions and the rest 15 minutes to successfully upload your arswer sheets into LMS Make use of your time accordingly and read the exam rules on the uppdraght-hand corner of this question sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started