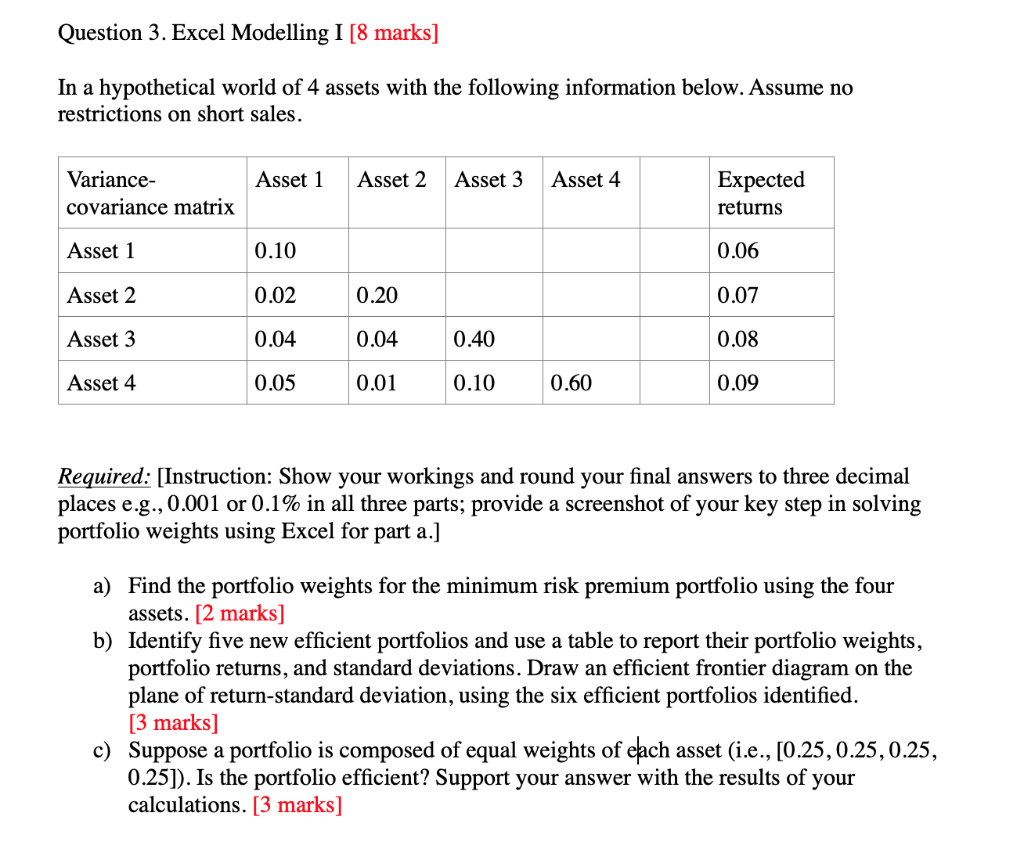

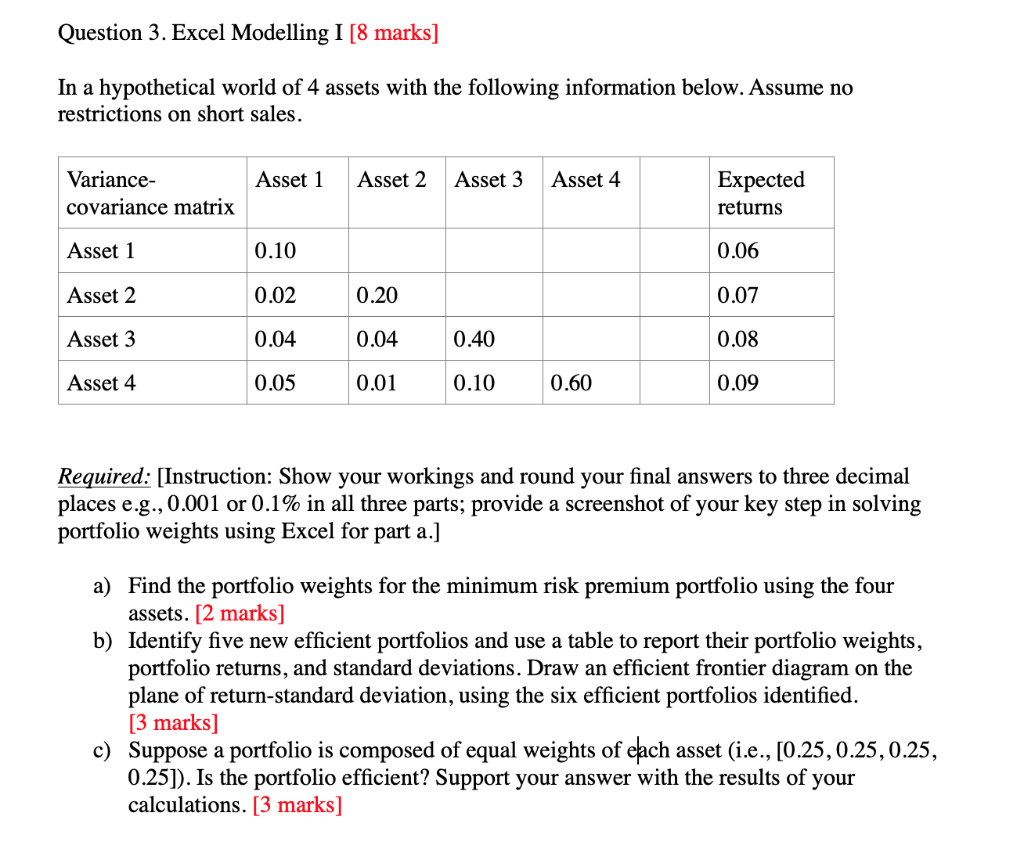

Question 3. Excel Modelling I 8 marks] In a hypothetical world of 4 assets with the following information below. Assume no restrictions on short sales. Asset 1 Asset 2 Asset 3 Asset 4 Variance- covariance matrix Expected returns Asset 1 0.10 0.06 Asset 2 0.02 0.20 0.07 Asset 3 0.04 0.04 0.40 0.08 Asset 4 0.05 0.01 0.10 0.60 0.09 Required: [Instruction: Show your workings and round your final answers to three decimal places e.g., 0.001 or 0.1% in all three parts; provide a screenshot of your key step in solving portfolio weights using Excel for part a.] a) Find the portfolio weights for the minimum risk premium portfolio using the four assets. [2 marks] b) Identify five new efficient portfolios and use a table to report their portfolio weights, portfolio returns, and standard deviations. Draw an efficient frontier diagram on the plane of return-standard deviation, using the six efficient portfolios identified. [3 marks] c) Suppose a portfolio is composed of equal weights of each asset (i.e., [0.25, 0.25,0.25, 0.25]). Is the portfolio efficient? Support your answer with the results of your calculations. [3 marks] Question 3. Excel Modelling I 8 marks] In a hypothetical world of 4 assets with the following information below. Assume no restrictions on short sales. Asset 1 Asset 2 Asset 3 Asset 4 Variance- covariance matrix Expected returns Asset 1 0.10 0.06 Asset 2 0.02 0.20 0.07 Asset 3 0.04 0.04 0.40 0.08 Asset 4 0.05 0.01 0.10 0.60 0.09 Required: [Instruction: Show your workings and round your final answers to three decimal places e.g., 0.001 or 0.1% in all three parts; provide a screenshot of your key step in solving portfolio weights using Excel for part a.] a) Find the portfolio weights for the minimum risk premium portfolio using the four assets. [2 marks] b) Identify five new efficient portfolios and use a table to report their portfolio weights, portfolio returns, and standard deviations. Draw an efficient frontier diagram on the plane of return-standard deviation, using the six efficient portfolios identified. [3 marks] c) Suppose a portfolio is composed of equal weights of each asset (i.e., [0.25, 0.25,0.25, 0.25]). Is the portfolio efficient? Support your answer with the results of your calculations. [3 marks]