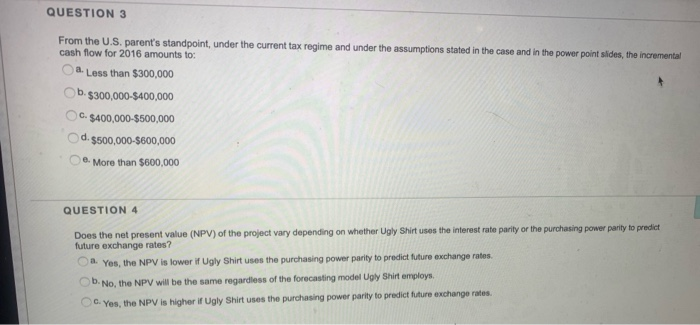

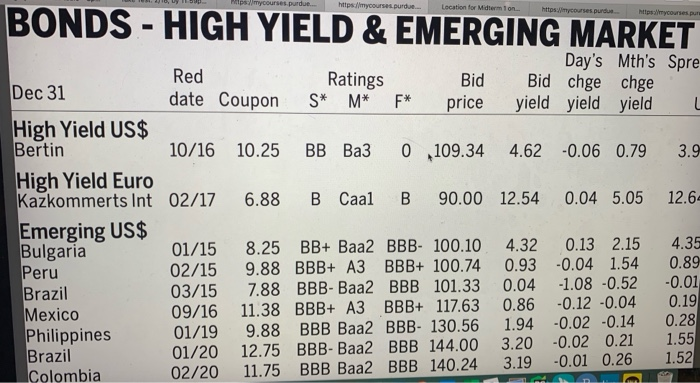

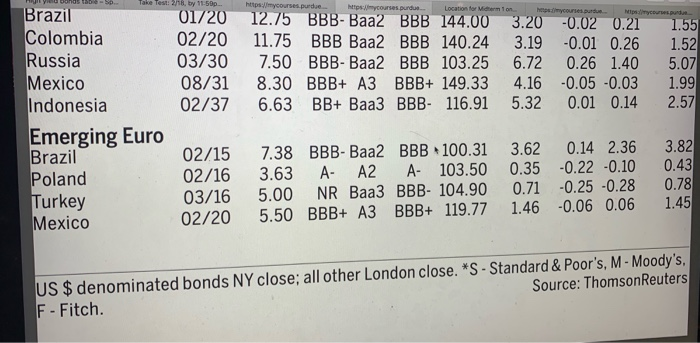

QUESTION 3 From the U.S. parent's standpoint, under the current tax regime and under the assumptions stated in the case and in the power point slides, the incremental cash flow for 2016 amounts to: a. Less than $300,000 b. $300,000-$400,000 $400,000-$500,000 d.$500,000-5600,000 . More than $600,000 QUESTION 4 Does the net present value (NPV) of the project vary depending on whether Ugly Shirt uses the interest rate parity or the purchasing power parity to predict future exchange rates? 3. Yes, the NPV is lower if Ugly Shirt uses the purchasing power party to predict future exchange rates No, the NPV will be the same regardless of the forecasting model Ugly Shirt employs. 6. Yes, the NPV is higher if Ugly Shirt uses the purchasing power parity to predict future exchange rates U UI, U ILGU M courses.purdue tips you ourd Location for Midterm ton. httpswimycourses purdue M samycorespun BONDS - HIGH YIELD & EMERGING MARKET Bid yield Day's Mth's Spre chge chge yield yield L 4.62 -0.06 0.79 3.9 12.54 0.04 5.05 12.6 Red Ratings Bid Dec 31 date Coupon S* M* F* price High Yield US$ Bertin 10/16 10.25 BB Ba3 0 ,109.34 High Yield Euro Kazkommerts Int 02/17 6.88 B Caal B 90.00 Emerging US$ Bulgaria 01/15 8.25 BB+ Baa2 BBB- 100.10 Peru 02/15 9.88 BBB+ A3 BBB+ 100.74 Brazil 03/15 7.88 BBB- Baa2 BBB 101.33 Mexico 09/16 11.38 BBB+ A3 BBB+ 117.63 Philippines 01/199.88 BBB Baa2 BBB- 130.56 Brazil 01/20 12.75 BBB- Baa2 BBB 144.00 Colombia 02/20 11.75 BBB Baa2 BBB 140.24 4.32 0.93 0.04 0.86 1.94 3.20 3.19 0.13 2.15 -0.04 1.54 -1.08 -0.52 -0.12 -0.04 -0.02 -0.14 -0.02 0.21 -0.01 0.26 4.35 0.89 -0.01 0.19 0.28 1.55 1.52 ID Tole Test: 2 by 11.50p h pmycorespunde courses 01720 02/20 03/30 08/31 02/37 12.75 BBB- Baa2 BBB 144.00 11.75 BBB Baa2 BBB 140.24 7.50 BBB- Baa2 BBB 103.25 8.30 BBB+ A3 BBB+ 149.33 6.63 BB+ Baa3 BBB- 116.91 3.20 3.19 6.72 4.16 5.32 -0.02 0.21 1.55 -0.01 0.26 1.52 0.26 1.405.07 -0.05 -0.03 1.99 0.01 0.14 2.57 Brazil Colombia Russia Mexico Indonesia Emerging Euro Brazil Poland Turkey Mexico 02/15 02/16 03/16 02/20 7.38 BBB- Baa2 BBB 100.31 3.63 A- A2 A- 103.50 5.00 NR Baa3 BBB- 104.90 5.50 BBB+ A3 BBB+ 119.77 3.62 0.14 2.36 0.35 -0.22 -0.10 0.71 -0.25 -0.28 1.46 -0.06 0.06 3.82 0.43 0.78 1.45 US $ denominated bonds NY close; all other London close. *S - Standard & Poor's, M- Moody's. F - Fitch. Source: Thomson Reuters QUESTION 3 From the U.S. parent's standpoint, under the current tax regime and under the assumptions stated in the case and in the power point slides, the incremental cash flow for 2016 amounts to: a. Less than $300,000 b. $300,000-$400,000 $400,000-$500,000 d.$500,000-5600,000 . More than $600,000 QUESTION 4 Does the net present value (NPV) of the project vary depending on whether Ugly Shirt uses the interest rate parity or the purchasing power parity to predict future exchange rates? 3. Yes, the NPV is lower if Ugly Shirt uses the purchasing power party to predict future exchange rates No, the NPV will be the same regardless of the forecasting model Ugly Shirt employs. 6. Yes, the NPV is higher if Ugly Shirt uses the purchasing power parity to predict future exchange rates U UI, U ILGU M courses.purdue tips you ourd Location for Midterm ton. httpswimycourses purdue M samycorespun BONDS - HIGH YIELD & EMERGING MARKET Bid yield Day's Mth's Spre chge chge yield yield L 4.62 -0.06 0.79 3.9 12.54 0.04 5.05 12.6 Red Ratings Bid Dec 31 date Coupon S* M* F* price High Yield US$ Bertin 10/16 10.25 BB Ba3 0 ,109.34 High Yield Euro Kazkommerts Int 02/17 6.88 B Caal B 90.00 Emerging US$ Bulgaria 01/15 8.25 BB+ Baa2 BBB- 100.10 Peru 02/15 9.88 BBB+ A3 BBB+ 100.74 Brazil 03/15 7.88 BBB- Baa2 BBB 101.33 Mexico 09/16 11.38 BBB+ A3 BBB+ 117.63 Philippines 01/199.88 BBB Baa2 BBB- 130.56 Brazil 01/20 12.75 BBB- Baa2 BBB 144.00 Colombia 02/20 11.75 BBB Baa2 BBB 140.24 4.32 0.93 0.04 0.86 1.94 3.20 3.19 0.13 2.15 -0.04 1.54 -1.08 -0.52 -0.12 -0.04 -0.02 -0.14 -0.02 0.21 -0.01 0.26 4.35 0.89 -0.01 0.19 0.28 1.55 1.52 ID Tole Test: 2 by 11.50p h pmycorespunde courses 01720 02/20 03/30 08/31 02/37 12.75 BBB- Baa2 BBB 144.00 11.75 BBB Baa2 BBB 140.24 7.50 BBB- Baa2 BBB 103.25 8.30 BBB+ A3 BBB+ 149.33 6.63 BB+ Baa3 BBB- 116.91 3.20 3.19 6.72 4.16 5.32 -0.02 0.21 1.55 -0.01 0.26 1.52 0.26 1.405.07 -0.05 -0.03 1.99 0.01 0.14 2.57 Brazil Colombia Russia Mexico Indonesia Emerging Euro Brazil Poland Turkey Mexico 02/15 02/16 03/16 02/20 7.38 BBB- Baa2 BBB 100.31 3.63 A- A2 A- 103.50 5.00 NR Baa3 BBB- 104.90 5.50 BBB+ A3 BBB+ 119.77 3.62 0.14 2.36 0.35 -0.22 -0.10 0.71 -0.25 -0.28 1.46 -0.06 0.06 3.82 0.43 0.78 1.45 US $ denominated bonds NY close; all other London close. *S - Standard & Poor's, M- Moody's. F - Fitch. Source: Thomson Reuters