Answered step by step

Verified Expert Solution

Question

1 Approved Answer

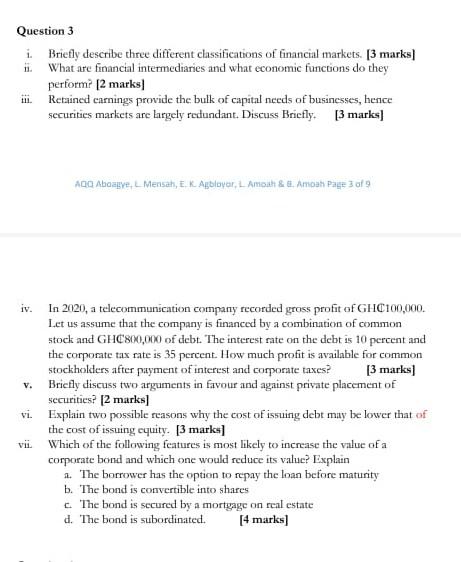

Question 3 i Briefly describe three different classifications of financial markets. [3 marks) ii. What are financial intermediaries and what economic functions do they perform

Question 3 i Briefly describe three different classifications of financial markets. [3 marks) ii. What are financial intermediaries and what economic functions do they perform [2 marks] Retained carnings provide the bulk of capital needs of businesses, hence securities markets are largely redundant. Discuss Brictly. [3 marks] AQQ Abozrye, Mensah, Ek Agbloyer, L Amoah & 8. Amoah Page 3 of 9 V. iv. In 2020, a telecommunication company recorded gross profit of GHC100,000 Let us assume that the company is financed by a combination of common stock and GHC800,000 of debt. The interest rate on the debt is 10 percent and the corporate tax rate is 35 percent. How much profit is available for common stockholders after payment of interest and corporate taxes? [3 marks] Briefly discuss two arguments in favour and against private placement of securities? [2 marks vi. Explain two possible reasons why the cost of issuing debt may be lower that of the cost of issuing equity. [3 marks] Which of the following features is most likely to increase the value of a corporate bond and which one would reduce its value? Explain 1. The borrower has the option to repay the loan before maturity b. The bond is convertible into shares The bond is secured by a mortgage on real estate d. The bond is subordinated. (4 marks vil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started