Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 i. In the evaluation of construction companies financial statements the gearing ratio and liquidity ratio have been described as providing useful information

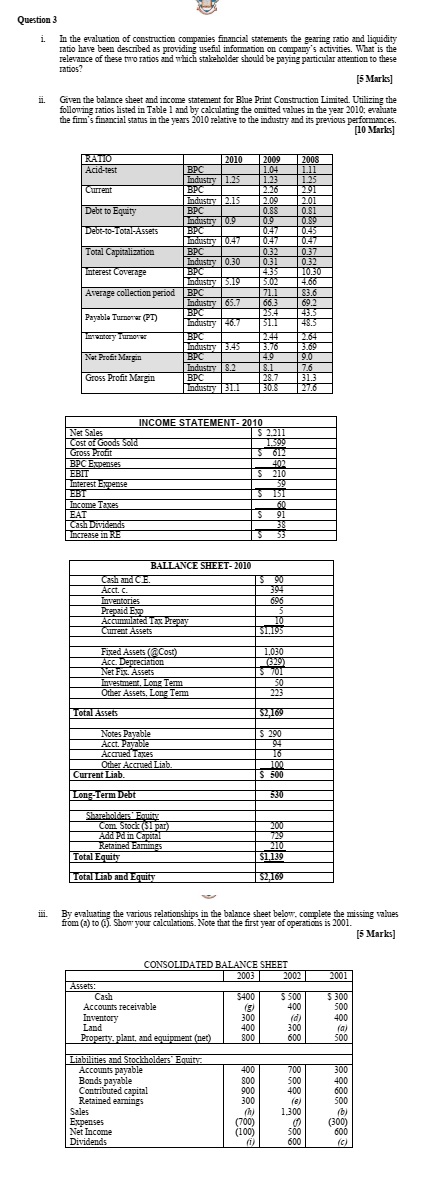

Question 3 i. In the evaluation of construction companies financial statements the gearing ratio and liquidity ratio have been described as providing useful information on company's activities. What is the relevance of these two ratios and which stakeholder should be paying particular attention to these ratios? [5 Marks] Given the balance sheet and income statement for Blue Print Construction Limited. Utilizing the following ratios listed in Table 1 and by calculating the omitted values in the year 2010; evaluate the firm's financial status in the years 2010 relative to the industry and its previous performances. [10 Marks] iii. RATIO Acid-test 2010 2009 2008 BPC 1.04 1.11 Industry 1.25 1.23 1.25 Current BPC 2.26 | 2.91 Industry 2.15 2.09 2.01 Debt to Equity BPC 0.88 0.81 Industry 0.9 0.9 0.59 Debt-to-Total-Assets BPC 0.47 0.45 Industry 0.47 0.47 0.47 Total Capitalization BPC 0.32 0.37 Industry 0.30 0.31 0.32 Interest Coverage BPC 4.35 10.30 Industry 5.19 5.02 4.66 Average collection period BPC 83.6 Industry 65.7 66.3 69.2 BPC Payable Turnover (PT) 25.4 43.5 Industry 46.7 51.1 48.5 Inventory Turnov BPC 2.44 2.64 Industry | 3.45 3.76 3.69 Net Profit Margin BPC 49 9.0 Industry 8.2 | 8.1 7.6 Gross Profit Margin BPC 28.7 31.3 Industry 31.1 30.8 27.6 Net Sales Cost of Goods Sold Gross Profit BPC Expenses EBIT Interest Expense EBT Income Taxes EAT Cash Dividends Increase in RE INCOME STATEMENT-2010 BALLANCE SHEET-2010 $ 2.211 1599 S 612 402 $ 210 59 $ 151 60 S 91 38 5 Cash and CE. $90 Acct. c. 394 Inventories 696 Prepaid Exp Accumulated Tax Prepay 10 Current Assets Fixed Assets (@Cost) 1,030 Acc. Depreciation (329) Net Fix. Assets S701 Investment, Long Term 50 Other Assets, Long Term 223 Total Assets $2,169 Notes Payable $ 290 Acct. Payable 94 Accrued Taxes 16 Other Accrued Liab 100 Current Liab. $ 500 Long-Term Debt 530 Shareholders' Equity Com. Stock ($1 par) 200 Add Pd in Capital 729 Retained Earnings 210 Total Equity $1.139 Total Liab and Equity $2,169 By evaluating the various relationships in the balance sheet below. complete the missing values from (a) to (i). Show your calculations. Note that the first year of operations is 2001. CONSOLIDATED BALANCE SHEET 2003 2002 2001 Assets: Cash $400 $500 $300 Accounts receivable (g) 400 500 Inventory 300 (d) 400 Land 400 300 (a) Property, plant, and equipment (net) 800 600 500 Liabilities and Stockholders' Equity Accounts payable Bonds payable Contributed capital Retained earnings Sales Expenses Net Income Dividends 400 700 300 800 500 400 900 400 600 300 (6) 500 (h) 1,300 (b) (700) ( (300) (100) 500 600 (1) 600 (C) [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the financial state of Blue Prime Construction Limited in the year 2010 we can analyze the given ratios and calculate the missing values Here are the calculations and interpretations of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started