Answered step by step

Verified Expert Solution

Question

1 Approved Answer

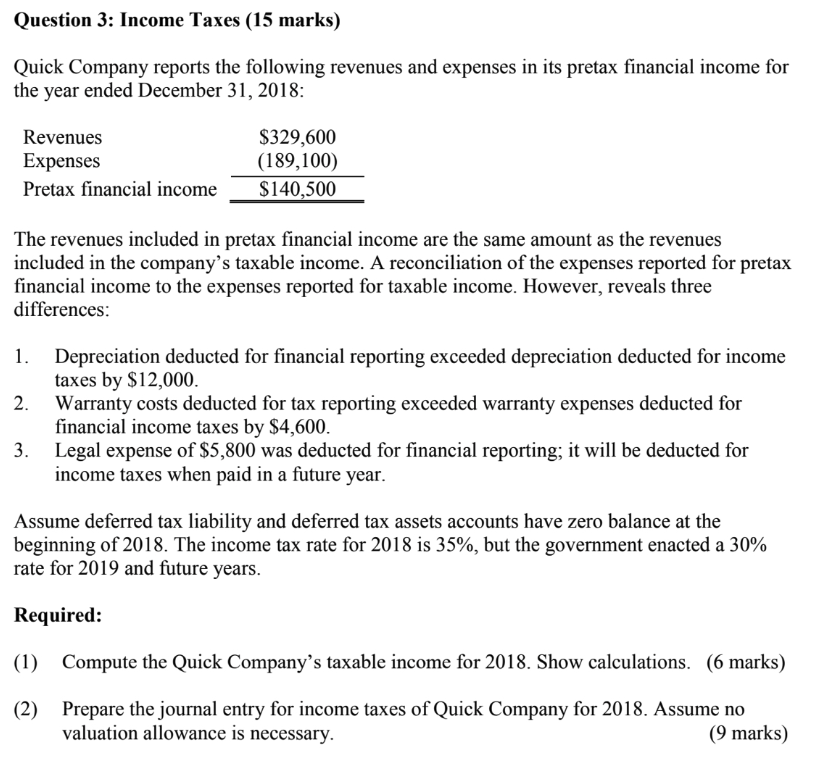

Question 3: Income Taxes (15 marks) Quick Company reports the following revenues and expenses in its pretax financial income for the year ended December 31,

Question 3: Income Taxes (15 marks) Quick Company reports the following revenues and expenses in its pretax financial income for the year ended December 31, 2018: The revenues included in pretax financial income are the same amount as the revenues included in the company's taxable income. A reconciliation of the expenses reported for pretax financial income to the expenses reported for taxable income. However, reveals three differences: 1. Depreciation deducted for financial reporting exceeded depreciation deducted for income taxes by $12,000. 2. Warranty costs deducted for tax reporting exceeded warranty expenses deducted for financial income taxes by $4,600. 3. Legal expense of $5,800 was deducted for financial reporting; it will be deducted for income taxes when paid in a future year. Assume deferred tax liability and deferred tax assets accounts have zero balance at the beginning of 2018 . The income tax rate for 2018 is 35%, but the government enacted a 30% rate for 2019 and future years. Required: (1) Compute the Quick Company's taxable income for 2018. Show calculations. (6 marks) (2) Prepare the journal entry for income taxes of Quick Company for 2018. Assume no valuation allowance is necessary. (9 marks)

Question 3: Income Taxes (15 marks) Quick Company reports the following revenues and expenses in its pretax financial income for the year ended December 31, 2018: The revenues included in pretax financial income are the same amount as the revenues included in the company's taxable income. A reconciliation of the expenses reported for pretax financial income to the expenses reported for taxable income. However, reveals three differences: 1. Depreciation deducted for financial reporting exceeded depreciation deducted for income taxes by $12,000. 2. Warranty costs deducted for tax reporting exceeded warranty expenses deducted for financial income taxes by $4,600. 3. Legal expense of $5,800 was deducted for financial reporting; it will be deducted for income taxes when paid in a future year. Assume deferred tax liability and deferred tax assets accounts have zero balance at the beginning of 2018 . The income tax rate for 2018 is 35%, but the government enacted a 30% rate for 2019 and future years. Required: (1) Compute the Quick Company's taxable income for 2018. Show calculations. (6 marks) (2) Prepare the journal entry for income taxes of Quick Company for 2018. Assume no valuation allowance is necessary. (9 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started