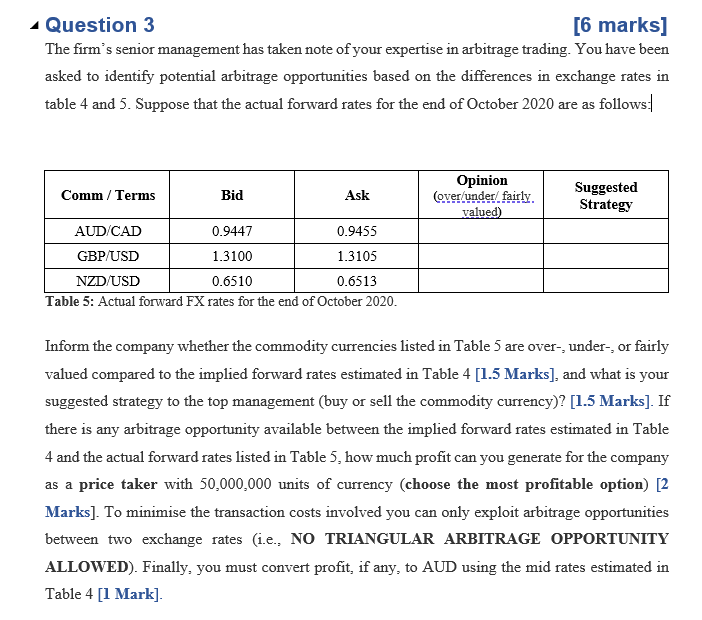

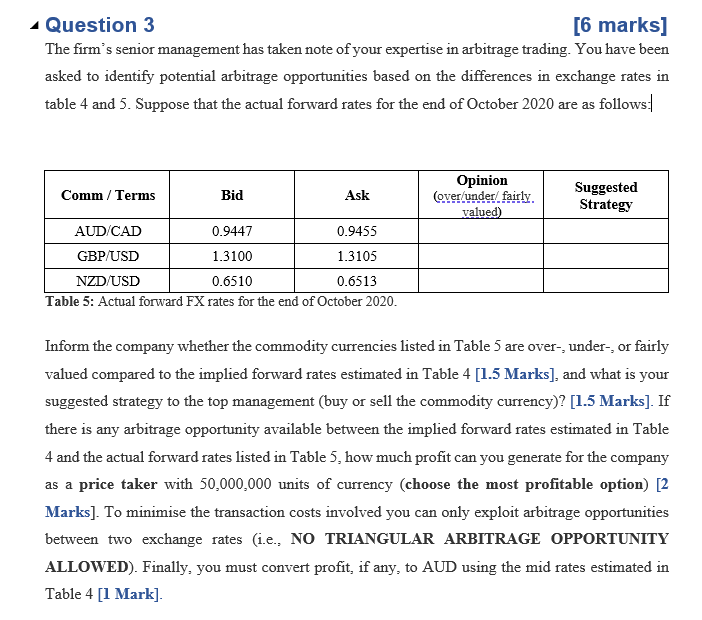

Question 3

Is any arbitrage opportunity available between the implied forward rates estimated in Table 4 and the actual forward rates listed in Table 5, how much profit can you generate for the company as a price taker with 50,000,000 units of currency (choose the most profitable option) [2 Marks]. To minimise the transaction costs involved you can only exploit arbitrage opportunities between two exchange rates (i.e., NO TRIANGULAR ARBITRAGE OPPORTUNITY ALLOWED). Finally, you must convert profit, if any, to AUD using the mid rates estimated in Table 4 [1 Mark].

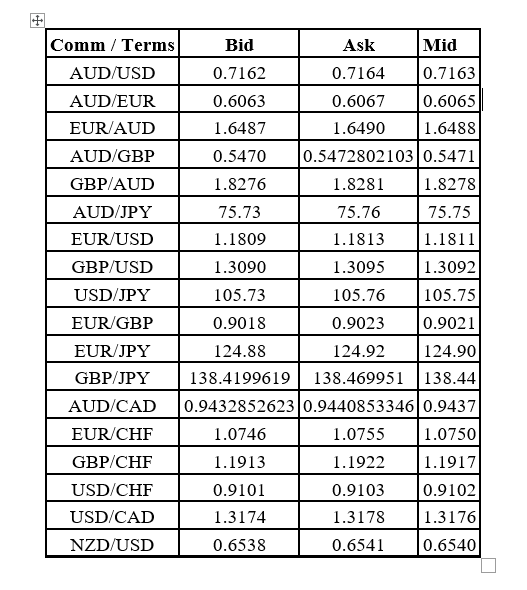

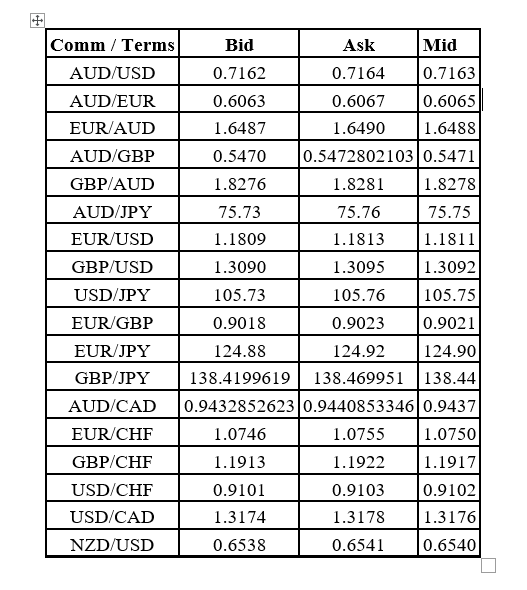

This is table 4 as specified in the question, they are the estimated implied forward rates:

Comm/ Terms Bid Ask Mid AUD/USD 0.7162 0.7164 0.7163 AUD/EUR 0.6063 0.6067 0.6065 EUR/AUD 1.6487 1.6490 1.6488 AUD/GBP 0.5470 0.5472802103 0.5471 GBP/AUD 1.8276 1.8281 1.8278 AUD/JPY 75.73 75.76 75.75 EUR/USD 1.1809 1.1813 1.1811 GBP/USD 1.3090 1.3095 1.3092 USD/JPY 105.73 105.76 105.75 EUR/GBP 0.9018 0.9023 0.9021 EUR/JPY 124.88 124.92 124.90 GBP/JPY 138.4199619 138.469951 138.44 AUD/CAD 0.9432852623 0.9440853346 0.9437 EUR/CHF 1.0746 1.0755 1.0750 GBP/CHF 1.1913 1.1922 1.1917 USD/CHF 0.9101 0.9103 0.9102 USD/CAD 1.3174 1.3178 1.3176 NZD/USD 0.6538 0.6541 0.6540 Question 3 [6 marks] The firm's senior management has taken note of your expertise in arbitrage trading. You have been asked to identify potential arbitrage opportunities based on the differences in exchange rates in table 4 and 5. Suppose that the actual forward rates for the end of October 2020 are as follows: Comm / Terms Bid Ask Opinion Cover/under/ fairly. valued) Suggested Strategy AUD CAD 47 0.9 GBP/USD 1.3100 1.3105 NZD/USD 0.6510 0.6513 Table 5: Actual forward FX rates for the end of October 2020. Inform the company whether the commodity currencies listed in Table 5 are over-, under-, or fairly valued compared to the implied forward rates estimated in Table 4 [1.5 Marks], and what is your suggested strategy to the top management (buy or sell the commodity currency)? [1.5 Marks]. If there is any arbitrage opportunity available between the implied forward rates estimated in Table 4 and the actual forward rates listed in Table 5, how much profit can you generate for the company as a price taker with 50,000,000 units of currency (choose the most profitable option) [2 Marks]. To minimise the transaction costs involved you can only exploit arbitrage opportunities between two exchange rates (i.e., NO TRIANGULAR ARBITRAGE OPPORTUNITY ALLOWED). Finally, you must convert profit, if any, to AUD using the mid rates estimated in Table 4 [1 Mark] Comm/ Terms Bid Ask Mid AUD/USD 0.7162 0.7164 0.7163 AUD/EUR 0.6063 0.6067 0.6065 EUR/AUD 1.6487 1.6490 1.6488 AUD/GBP 0.5470 0.5472802103 0.5471 GBP/AUD 1.8276 1.8281 1.8278 AUD/JPY 75.73 75.76 75.75 EUR/USD 1.1809 1.1813 1.1811 GBP/USD 1.3090 1.3095 1.3092 USD/JPY 105.73 105.76 105.75 EUR/GBP 0.9018 0.9023 0.9021 EUR/JPY 124.88 124.92 124.90 GBP/JPY 138.4199619 138.469951 138.44 AUD/CAD 0.9432852623 0.9440853346 0.9437 EUR/CHF 1.0746 1.0755 1.0750 GBP/CHF 1.1913 1.1922 1.1917 USD/CHF 0.9101 0.9103 0.9102 USD/CAD 1.3174 1.3178 1.3176 NZD/USD 0.6538 0.6541 0.6540 Question 3 [6 marks] The firm's senior management has taken note of your expertise in arbitrage trading. You have been asked to identify potential arbitrage opportunities based on the differences in exchange rates in table 4 and 5. Suppose that the actual forward rates for the end of October 2020 are as follows: Comm / Terms Bid Ask Opinion Cover/under/ fairly. valued) Suggested Strategy AUD CAD 47 0.9 GBP/USD 1.3100 1.3105 NZD/USD 0.6510 0.6513 Table 5: Actual forward FX rates for the end of October 2020. Inform the company whether the commodity currencies listed in Table 5 are over-, under-, or fairly valued compared to the implied forward rates estimated in Table 4 [1.5 Marks], and what is your suggested strategy to the top management (buy or sell the commodity currency)? [1.5 Marks]. If there is any arbitrage opportunity available between the implied forward rates estimated in Table 4 and the actual forward rates listed in Table 5, how much profit can you generate for the company as a price taker with 50,000,000 units of currency (choose the most profitable option) [2 Marks]. To minimise the transaction costs involved you can only exploit arbitrage opportunities between two exchange rates (i.e., NO TRIANGULAR ARBITRAGE OPPORTUNITY ALLOWED). Finally, you must convert profit, if any, to AUD using the mid rates estimated in Table 4 [1 Mark]