Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 Issued share capital comprised 850000 ordinary shares on 1 July 2013. The following was extracted from the books on 30 June 2014: No

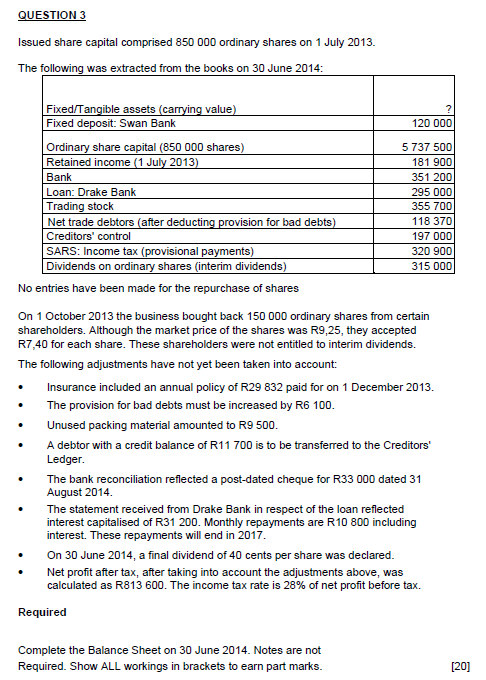

QUESTION 3 Issued share capital comprised 850000 ordinary shares on 1 July 2013. The following was extracted from the books on 30 June 2014: No entries have been made for the repurchase of shares On 1 October 2013 the business bought back 150000 ordinary shares from certain shareholders. Although the market price of the shares was R9,25, they accepted R7,40 for each share. These shareholders were not entitled to interim dividends. The following adjustments have not yet been taken into account: - Insurance included an annual policy of R29 832 paid for on 1 December 2013. - The provision for bad debts must be increased by R6 100 . - Unused packing material amounted to R9 500. - A debtor with a credit balance of R11 700 is to be transferred to the Creditors' Ledger. - The bank reconciliation reflected a post-dated cheque for R33 000 dated 31 August 2014. - The statement received from Drake Bank in respect of the loan reflected interest capitalised of R31 200. Monthly repayments are R10 800 including interest. These repayments will end in 2017. - On 30 June 2014 , a final dividend of 40 cents per share was declared. - Net profit after tax, after taking into account the adjustments above, was calculated as R813600. The income tax rate is 28% of net profit before tax. Required

QUESTION 3 Issued share capital comprised 850000 ordinary shares on 1 July 2013. The following was extracted from the books on 30 June 2014: No entries have been made for the repurchase of shares On 1 October 2013 the business bought back 150000 ordinary shares from certain shareholders. Although the market price of the shares was R9,25, they accepted R7,40 for each share. These shareholders were not entitled to interim dividends. The following adjustments have not yet been taken into account: - Insurance included an annual policy of R29 832 paid for on 1 December 2013. - The provision for bad debts must be increased by R6 100 . - Unused packing material amounted to R9 500. - A debtor with a credit balance of R11 700 is to be transferred to the Creditors' Ledger. - The bank reconciliation reflected a post-dated cheque for R33 000 dated 31 August 2014. - The statement received from Drake Bank in respect of the loan reflected interest capitalised of R31 200. Monthly repayments are R10 800 including interest. These repayments will end in 2017. - On 30 June 2014 , a final dividend of 40 cents per share was declared. - Net profit after tax, after taking into account the adjustments above, was calculated as R813600. The income tax rate is 28% of net profit before tax. Required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started