Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Jack is a Malaysian and is tax resident in Malaysia. His sources of income for the year ended 31 December 2020 are

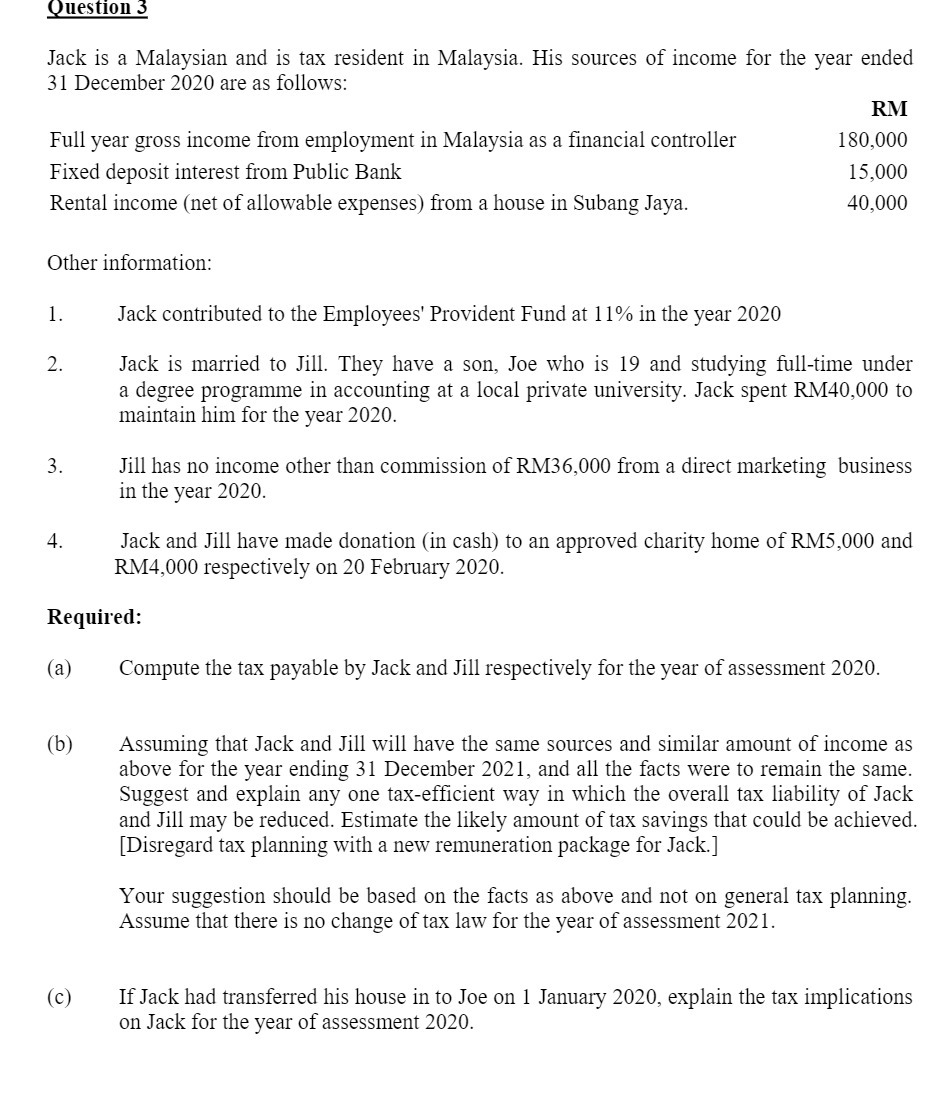

Question 3 Jack is a Malaysian and is tax resident in Malaysia. His sources of income for the year ended 31 December 2020 are as follows: Full year gross income from employment in Malaysia as a financial controller Fixed deposit interest from Public Bank Rental income (net of allowable expenses) from a house in Subang Jaya. Other information: 1. 2. 3. 4. (a) (b) Required: (c) RM 180,000 15,000 40,000 Jack contributed to the Employees' Provident Fund at 11% in the year 2020 Jack is married to Jill. They have a son, Joe who is 19 and studying full-time under a degree programme in accounting at a local private university. Jack spent RM40,000 to maintain him for the year 2020. Jill has no income other than commission of RM36,000 from a direct marketing business in the year 2020. Jack and Jill have made donation (in cash) to an approved charity home of RM5,000 and RM4,000 respectively on 20 February 2020. Compute the tax payable by Jack and Jill respectively for the year of assessment 2020. Assuming that Jack and Jill will have the same sources and similar amount of income as above for the year ending 31 December 2021, and all the facts were to remain the same. Suggest and explain any one tax-efficient way in which the overall tax liability of Jack and Jill may be reduced. Estimate the likely amount of tax savings that could be achieved. [Disregard tax planning with a new remuneration package for Jack.] Your suggestion should be based on the facts as above and not on general tax planning. Assume that there is no change of tax law for the year of assessment 2021. If Jack had transferred his house in to Joe on 1 January 2020, explain the tax implications on Jack for the year of assessment 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the tax payable by Jack and Jill for the year of assessment 2020 we need to calculate their respective total incomes and then apply the M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started