Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Juniper has been resident in the UK for the last five years and has spent at least 300 days in the UK

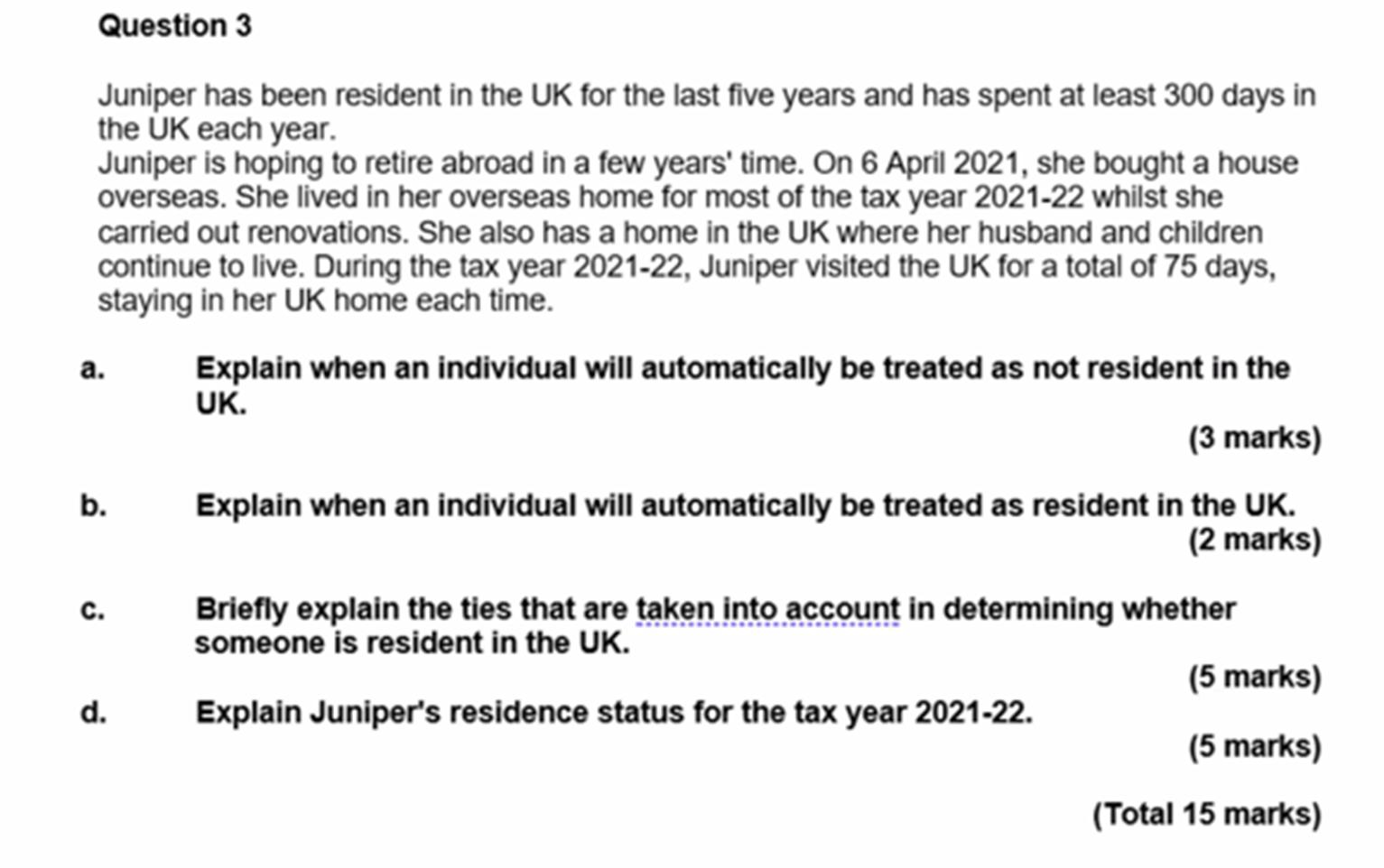

Question 3 Juniper has been resident in the UK for the last five years and has spent at least 300 days in the UK each year. Juniper is hoping to retire abroad in a few years' time. On 6 April 2021, she bought a house overseas. She lived in her overseas home for most of the tax year 2021-22 whilst she carried out renovations. She also has a home in the UK where her husband and children continue to live. During the tax year 2021-22, Juniper visited the UK for a total of 75 days, staying in her UK home each time. a. b. C. d. Explain when an individual will automatically be treated as not resident in the UK. (3 marks) Explain when an individual will automatically be treated as resident in the UK. (2 marks) Briefly explain the ties that are taken into account in determining whether someone is resident in the UK. (5 marks) Explain Juniper's residence status for the tax year 2021-22. (5 marks) (Total 15 marks)

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

aAn individual will automatically be treated as not resident in the UK if they meet the automatic overseas test or the sufficient ties test for a given tax year The automatic overseas test is met if a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started