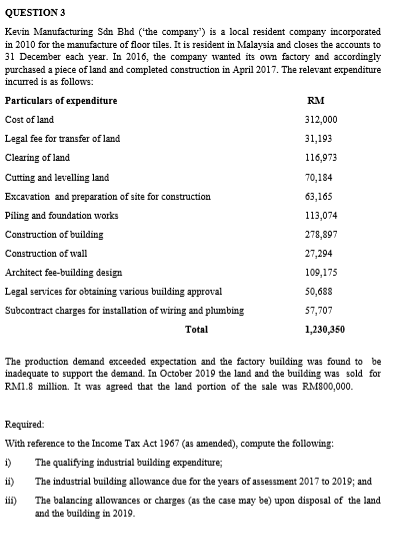

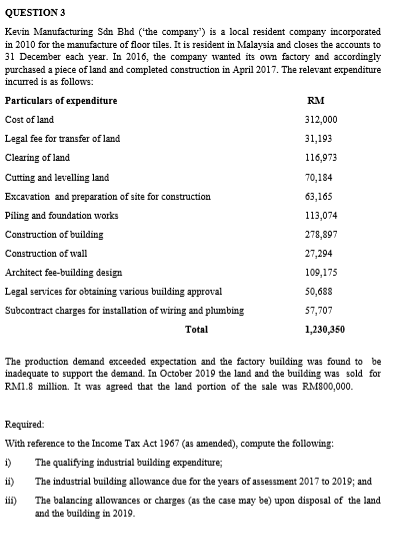

QUESTION 3 Kevin Manufacturing Sdn Bhd ('the company") is a local resident company incorporated in 2010 for the manufacture of floor tiles. It is resident in Malaysia and closes the accounts to 31 December each year. In 2016, the company wanted its own factory and accordingly purchased a piece of land and completed construction in April 2017. The relevant expenditure incurred is as follows: Particulars of expenditure RM Cost of land 312,000 Legal fee for transfer of land 31,193 Clearing of land 116,973 Cutting and levelling land 70,184 Excavation and preparation of site for construction 63,165 Piling and foundation works 113,074 Construction of building 278,897 Construction of wall 27,294 Architect fee-building design 109,175 Legal services for obtaining various building approval 50,688 Subcontract charges for installation of wiring and plumbing 57,707 Total 1,230,350 The production demand exceeded expectation and the factory building was found to be inadequate to support the demand. In October 2019 the land and the building was sold for RM1.8 million. It was agreed that the land portion of the sale was RM800,000 Required: With reference to the Income Tax Act 1967 (as amended), compute the following: 1) The qualifying industrial building expenditure; The industrial building allowance due for the years of assessment 2017 to 2019; and The balancing allowances or charges (as the case may be) upon disposal of the land and the building in 2019. ii) iii) QUESTION 3 Kevin Manufacturing Sdn Bhd ('the company") is a local resident company incorporated in 2010 for the manufacture of floor tiles. It is resident in Malaysia and closes the accounts to 31 December each year. In 2016, the company wanted its own factory and accordingly purchased a piece of land and completed construction in April 2017. The relevant expenditure incurred is as follows: Particulars of expenditure RM Cost of land 312,000 Legal fee for transfer of land 31,193 Clearing of land 116,973 Cutting and levelling land 70,184 Excavation and preparation of site for construction 63,165 Piling and foundation works 113,074 Construction of building 278,897 Construction of wall 27,294 Architect fee-building design 109,175 Legal services for obtaining various building approval 50,688 Subcontract charges for installation of wiring and plumbing 57,707 Total 1,230,350 The production demand exceeded expectation and the factory building was found to be inadequate to support the demand. In October 2019 the land and the building was sold for RM1.8 million. It was agreed that the land portion of the sale was RM800,000 Required: With reference to the Income Tax Act 1967 (as amended), compute the following: 1) The qualifying industrial building expenditure; The industrial building allowance due for the years of assessment 2017 to 2019; and The balancing allowances or charges (as the case may be) upon disposal of the land and the building in 2019. ii) iii)