Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Maju Holdings Sdn Bhd (MHSB) was established on 1 February 2020 as a firm specializing in investment holdings. The company has two

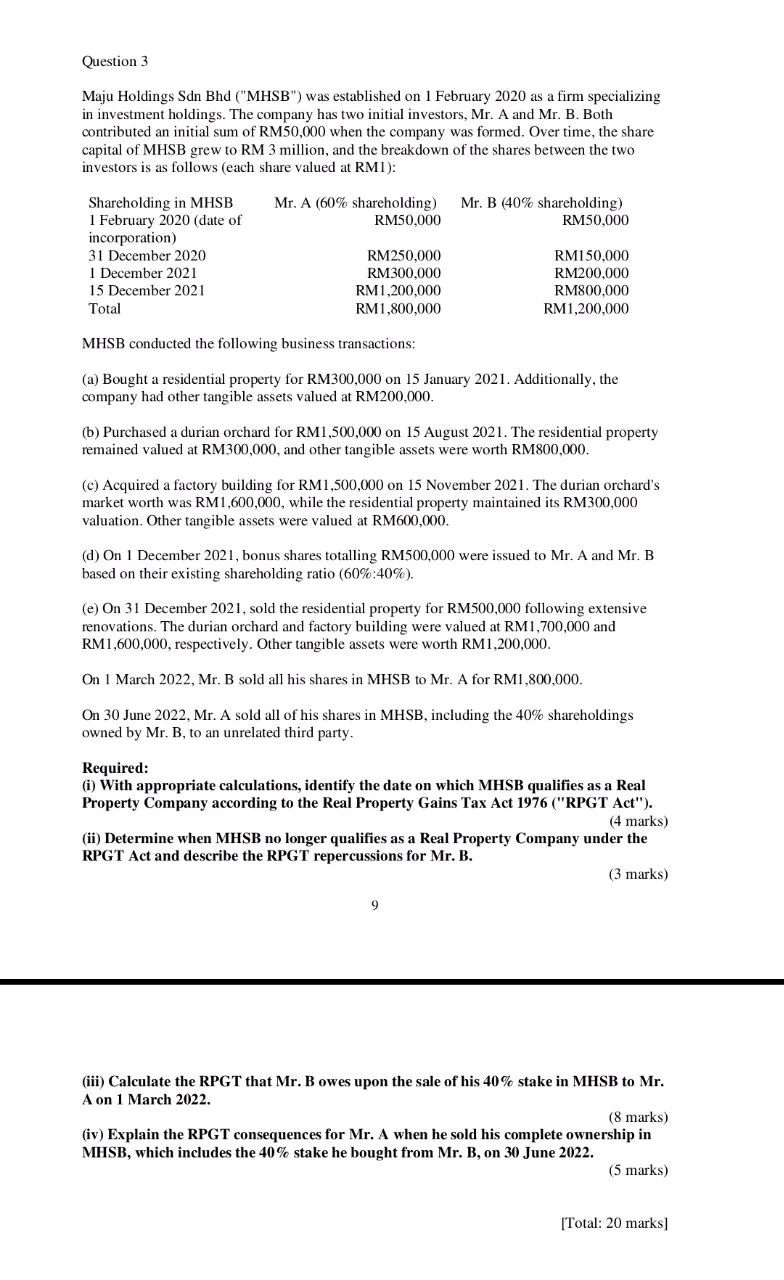

Question 3 Maju Holdings Sdn Bhd ("MHSB") was established on 1 February 2020 as a firm specializing in investment holdings. The company has two initial investors, Mr. A and Mr. B. Both contributed an initial sum of RM50,000 when the company was formed. Over time, the share capital of MHSB grew to RM 3 million, and the breakdown of the shares between the two investors is as follows (each share valued at RMI): Shareholding in MHSB 1 February 2020 (date of incorporation) 31 December 2020 Mr. A (60% shareholding) Mr. B (40% shareholding) RM50,000 RM250,000 RM50,000 RM150,000 1 December 2021 15 December 2021 Total RM300,000 RM1,200,000 RM1,800,000 MHSB conducted the following business transactions: RM200,000 RM800,000 RM1,200,000 (a) Bought a residential property for RM300,000 on 15 January 2021. Additionally, the company had other tangible assets valued at RM200,000. (b) Purchased a durian orchard for RM1,500,000 on 15 August 2021. The residential property remained valued at RM300,000, and other tangible assets were worth RM800,000. (c) Acquired a factory building for RM1,500,000 on 15 November 2021. The durian orchard's market worth was RM1,600,000, while the residential property maintained its RM300,000 valuation. Other tangible assets were valued at RM600,000. (d) On 1 December 2021, bonus shares totalling RM500,000 were issued to Mr. A and Mr. B based on their existing shareholding ratio (60%:40%). (e) On 31 December 2021, sold the residential property for RM500,000 following extensive renovations. The durian orchard and factory building were valued at RM1,700,000 and RM1,600,000, respectively. Other tangible assets were worth RM1,200,000. On 1 March 2022, Mr. B sold all his shares in MHSB to Mr. A for RM1,800,000. On 30 June 2022, Mr. A sold all of his shares in MHSB, including the 40% shareholdings owned by Mr. B, to an unrelated third party. Required: (i) With appropriate calculations, identify the date on which MHSB qualifies as a Real Property Company according to the Real Property Gains Tax Act 1976 ("RPGT Act"). (4 marks) (ii) Determine when MHSB no longer qualifies as a Real Property Company under the RPGT Act and describe the RPGT repercussions for Mr. B. (3 marks) (iii) Calculate the RPGT that Mr. B owes upon the sale of his 40% stake in MHSB to Mr. A on 1 March 2022. (8 marks) (iv) Explain the RPGT consequences for Mr. A when he sold his complete ownership in MHSB, which includes the 40% stake he bought from Mr. B, on 30 June 2022. (5 marks) [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started