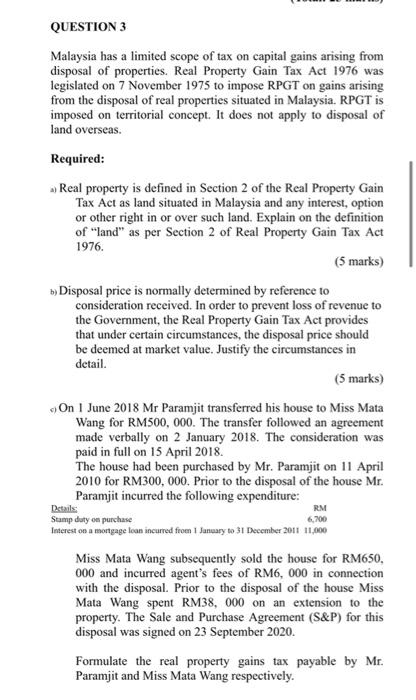

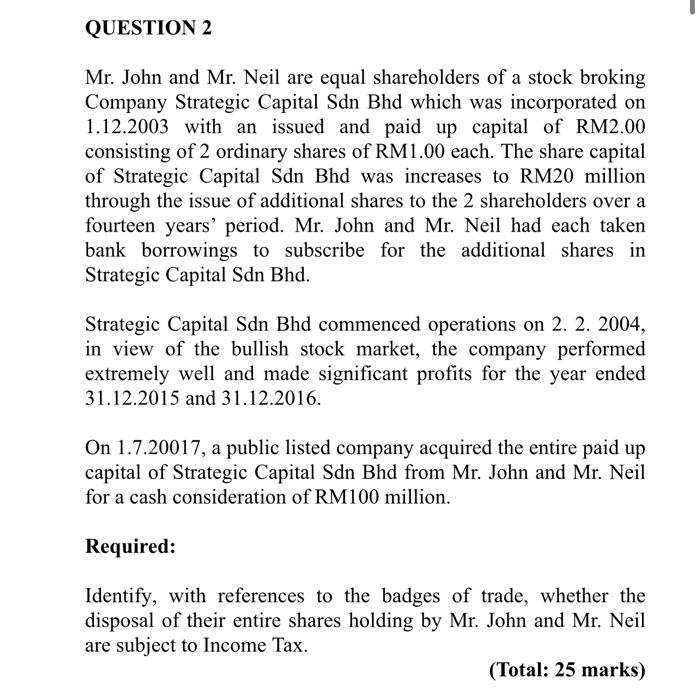

QUESTION 3 Malaysia has a limited scope of tax on capital gains arising from disposal of properties. Real Property Gain Tax Act 1976 was legislated on 7 November 1975 to impose RPGT on gains arising from the disposal of real properties situated in Malaysia. RPGT is imposed on territorial concept. It does not apply to disposal of land overseas. Required: Real property is defined in Section 2 of the Real Property Gain Tax Act as land situated in Malaysia and any interest, option or other right in or over such land. Explain on the definition of "land" as per Section 2 of Real Property Gain Tax Act 1976. (5 marks) b) Disposal price is normally determined by reference to consideration received. In order to prevent loss of revenue to the Government, the Real Property Gain Tax Act provides that under certain circumstances, the disposal price should be deemed at market value. Justify the circumstances in detail. (5 marks) On 1 June 2018 Mr Paramjit transferred his house to Miss Mata Wang for RM500,000. The transfer followed an agreement made verbally on 2 January 2018. The consideration was paid in full on 15 April 2018. The house had been purchased by Mr. Paramjit on 11 April 2010 for RM300,000. Prior to the disposal of the house Mr. Paramjit incurred the following expenditure: Details: RM Stamp duty on purchase 6.700 Interest on a mortgage loan incurred from 1 January to 31 December 2011 11,000 Miss Mata Wang subsequently sold the house for RM650, 000 and incurred agent's fees of RM6,000 in connection with the disposal. Prior to the disposal of the house Miss Mata Wang spent RM38, 000 on an extension to the property. The Sale and Purchase Agreement (S&P) for this disposal was signed on 23 September 2020. Formulate the real property gains tax payable by Mr. Paramjit and Miss Mata Wang respectively. QUESTION 2 Mr. John and Mr. Neil are equal shareholders of a stock broking Company Strategic Capital Sdn Bhd which was incorporated on 1.12.2003 with an issued and paid up capital of RM2.00 consisting of 2 ordinary shares of RM1.00 each. The share capital of Strategic Capital Sdn Bhd was increases to RM20 million through the issue of additional shares to the 2 shareholders over a fourteen years' period. Mr. John and Mr. Neil had each taken bank borrowings to subscribe for the additional shares in Strategic Capital Sdn Bhd. Strategic Capital Sdn Bhd commenced operations on 2. 2. 2004, in view of the bullish stock market, the company performed extremely well and made significant profits for the year ended 31.12.2015 and 31.12.2016. On 1.7.20017, a public listed company acquired the entire paid up capital of Strategic Capital Sdn Bhd from Mr. John and Mr. Neil for a cash consideration of RM100 million. Required: Identify, with references to the badges of trade, whether the disposal of their entire shares holding by Mr. John and Mr. Neil are subject to Income Tax. (Total: 25 marks)