Answered step by step

Verified Expert Solution

Question

1 Approved Answer

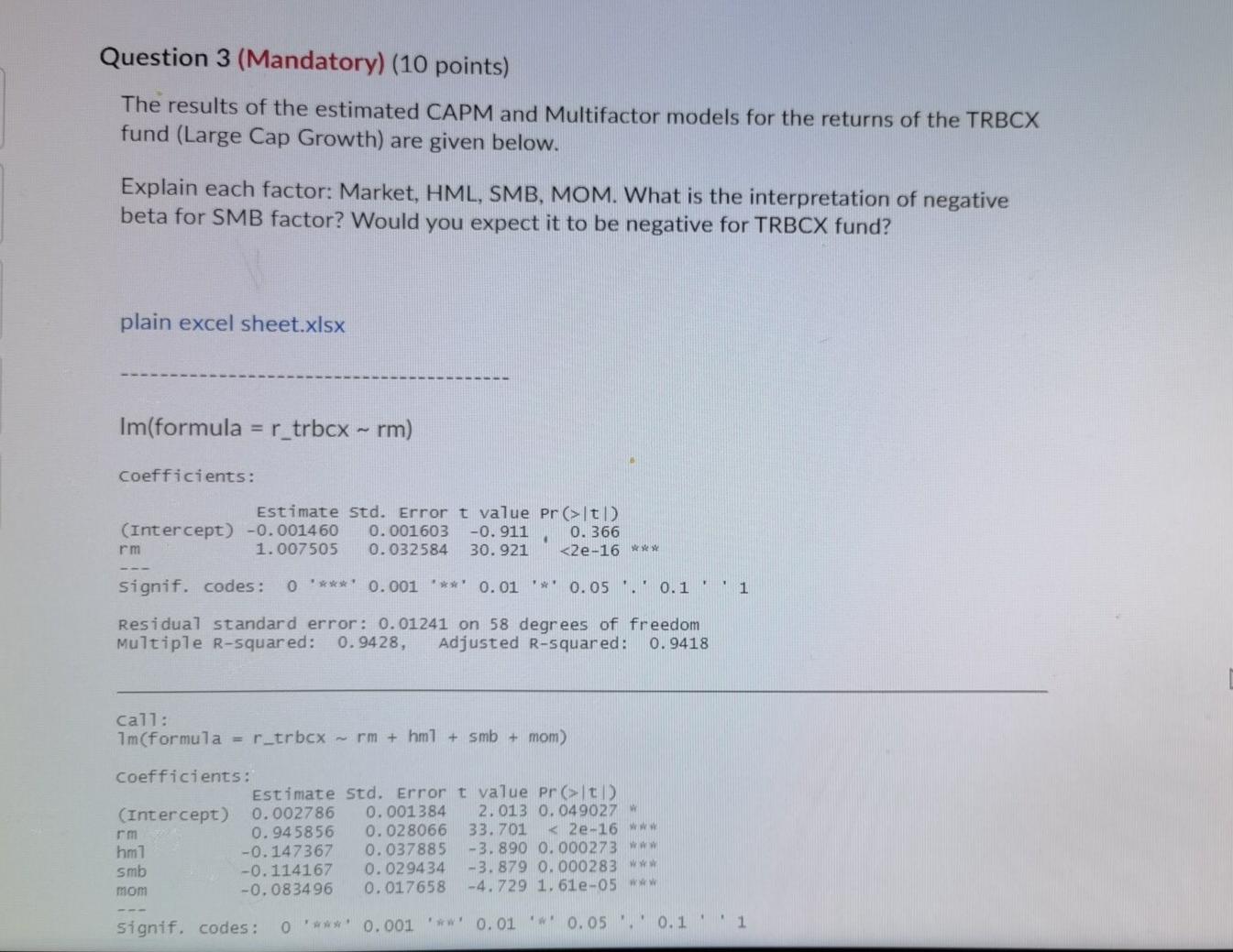

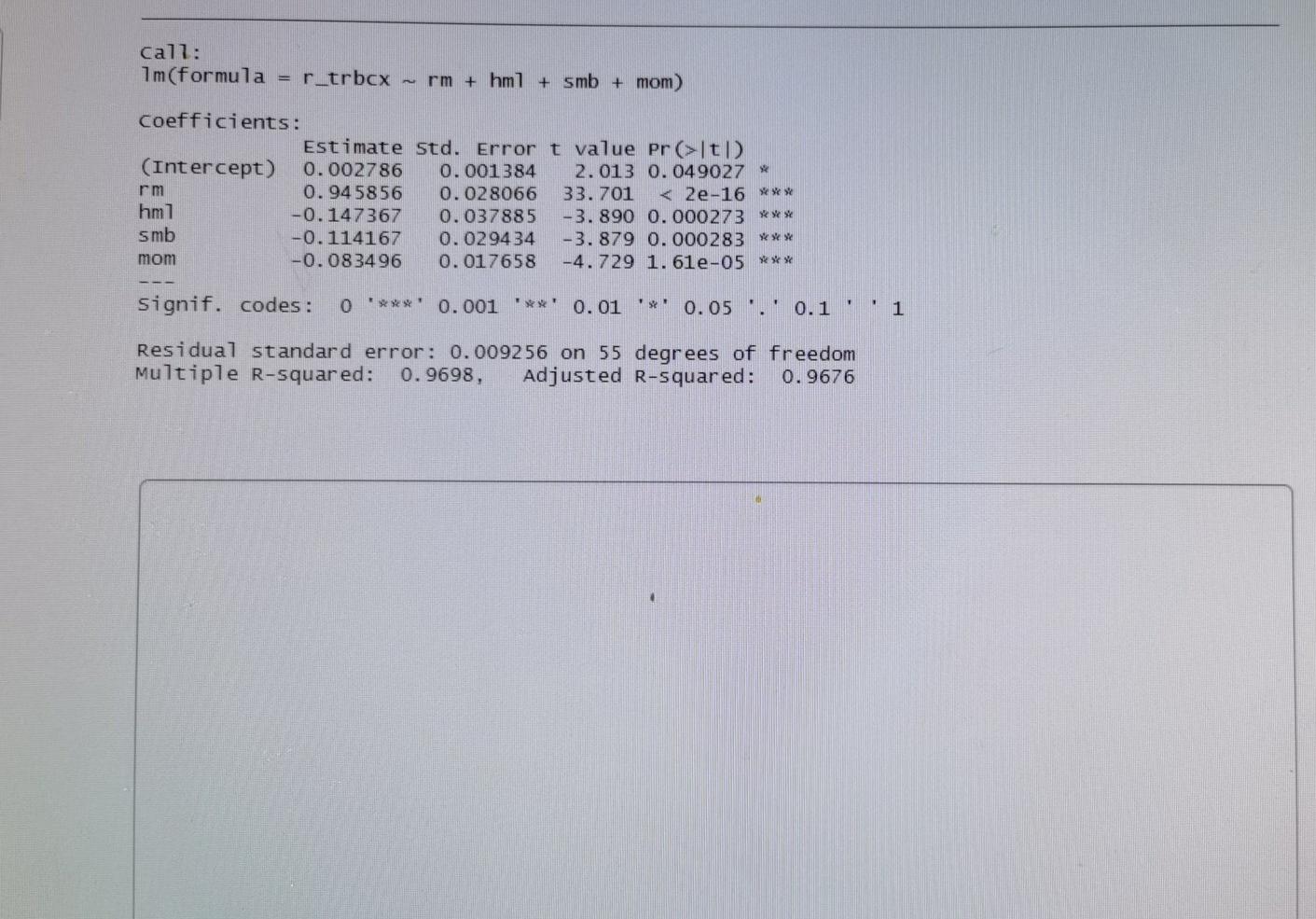

Question 3 (Mandatory) (10 points) The results of the estimated CAPM and Multifactor models for the returns of the TRBCX fund (Large Cap Growth) are

Question 3 (Mandatory) (10 points) The results of the estimated CAPM and Multifactor models for the returns of the TRBCX fund (Large Cap Growth) are given below. Explain each factor: Market, HML, SMB, MOM. What is the interpretation of negative beta for SMB factor? Would you expect it to be negative for TRBCX fund? plain excel sheet.xlsx Im(formula = r_trbcx - rm) coefficients: Estimate std. Error t value Pr (>It (Intercept) -0.001460 0.001603 -0.911 0.366 rm 1.007505 0.032584 30.921 1t| (Intercept) 0.002786 0.001384 2.013 0.049027 * rm 0.945856 0.028066 33.701

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started