Answered step by step

Verified Expert Solution

Question

1 Approved Answer

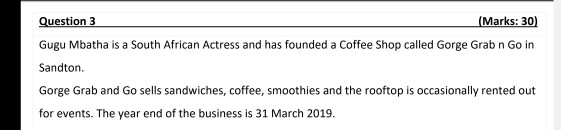

Question 3 (Marks: 30) Gugu Mbatha is a South African Actress and has founded a Coffee Shop called Gorge Grab n Go in Sandton. Gorge

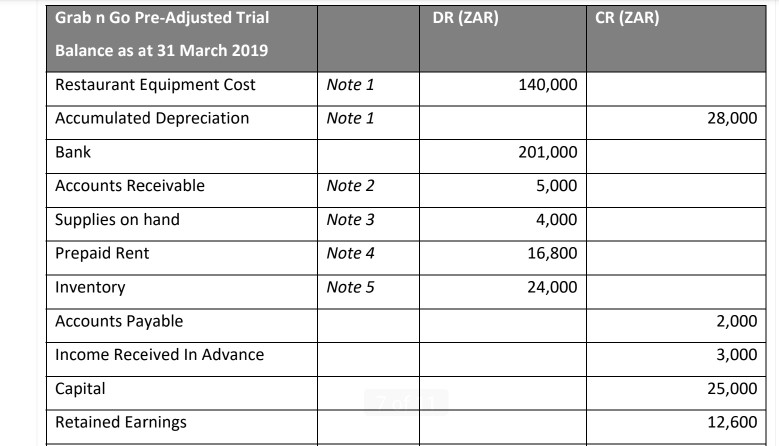

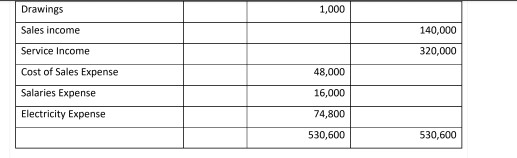

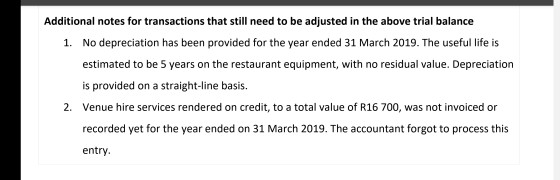

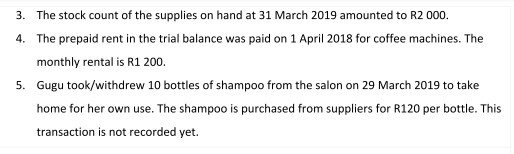

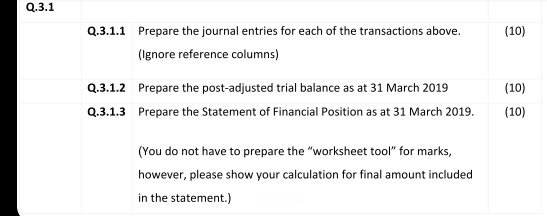

Question 3 (Marks: 30) Gugu Mbatha is a South African Actress and has founded a Coffee Shop called Gorge Grab n Go in Sandton. Gorge Grab and Go sells sandwiches, coffee, smoothies and the rooftop is occasionally rented out for events. The year end of the business is 31 March 2019. DR (ZAR) CR (ZAR) Grab n Go Pre-Adjusted Trial Balance as at 31 March 2019 Restaurant Equipment Cost Note 1 140,000 Accumulated Depreciation Note 1 28,000 Bank 201,000 Accounts Receivable Note 2 5,000 Note 3 4,000 Supplies on hand Prepaid Rent Note 4 16,800 Inventory Note 5 24,000 Accounts Payable 2,000 Income Received In Advance 3,000 Capital 25,000 Retained Earnings 12,600 Drawings 1,000 Sales income 140,000 Service Income 320,000 Cost of Sales Expense 48,000 Salaries Expense 16,000 Electricity Expense 74,800 530,600 530,600 Additional notes for transactions that still need to be adjusted in the above trial balance 1. No depreciation has been provided for the year ended 31 March 2019. The useful life is estimated to be 5 years on the restaurant equipment, with no residual value. Depreciation is provided on a straight-line basis. 2. Venue hire services rendered on credit, to a total value of R16 700, was not invoiced or recorded yet for the year ended on 31 March 2019. The accountant forgot to process this entry. 3. The stock count of the supplies on hand at 31 March 2019 amounted to R2 000. 4. The prepaid rent in the trial balance was paid on 1 April 2018 for coffee machines. The monthly rental is R1 200. 5. Gugu took/withdrew 10 bottles of shampoo from the salon on 29 March 2019 to take home for her own use. The shampoo is purchased from suppliers for R120 per bottle. This transaction is not recorded yet. Q.3.1 (10) Q.3.1.1 Prepare the journal entries for each of the transactions above. (Ignore reference columns) Q.3.1.2 Prepare the post-adjusted trial balance as at 31 March 2019 Q.3.1.3 Prepare the Statement of Financial Position as at 31 March 2019. (10) (10) (You do not have to prepare the "worksheet tool" for marks, however, please show your calculation for final amount included in the statement.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started