Answered step by step

Verified Expert Solution

Question

1 Approved Answer

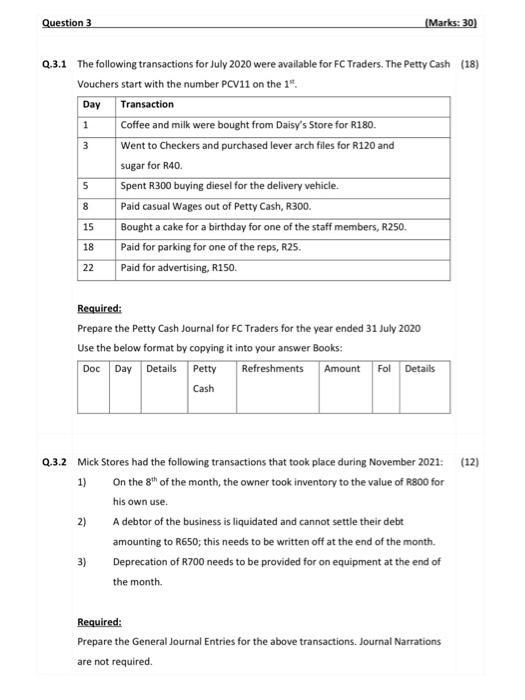

Question 3 (Marks: 30) Q.3.1 The following transactions for July 2020 were available for FC Traders. The Petty Cash (18) Vouchers start with the

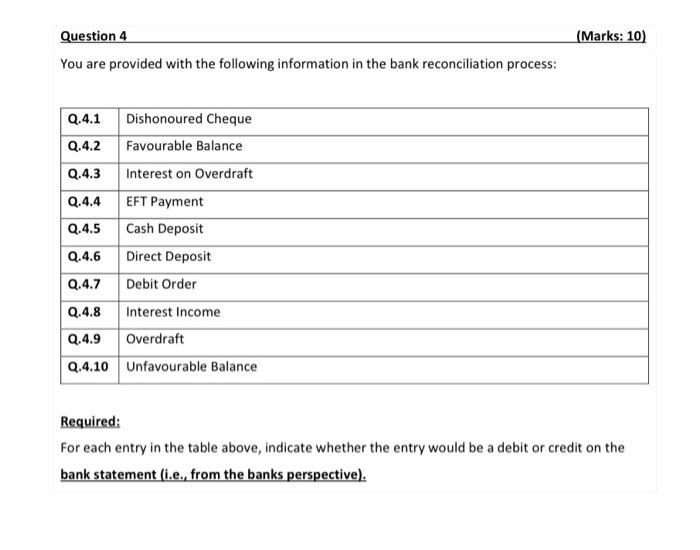

Question 3 (Marks: 30) Q.3.1 The following transactions for July 2020 were available for FC Traders. The Petty Cash (18) Vouchers start with the number PCV11 on the 1. Day Transaction 1 Coffee and milk were bought from Daisy's Store for R180. 3 Went to Checkers and purchased lever arch files for R120 and sugar for R40. 5 Spent R300 buying diesel for the delivery vehicle. 8 Paid casual Wages out of Petty Cash, R300. 15 Bought a cake for a birthday for one of the staff members, R250. 18 Paid for parking for one of the reps, R25. 22 Paid for advertising, R150. Required: Prepare the Petty Cash Journal for FC Traders for the year ended 31 July 2020 Use the below format by copying it into your answer Books: Doc Day Details Petty Refreshments Amount Fol Details Cash Q.3.2 Mick Stores had the following transactions that took place during November 2021: (12) 1) On the 8th of the month, the owner took inventory to the value of R800 for his own use. 2) A debtor of the business is liquidated and cannot settle their debt 3) amounting to R650; this needs to be written off at the end of the month. Deprecation of R700 needs to be provided for on equipment at the end of the month. Required: Prepare the General Journal Entries for the above transactions. Journal Narrations are not required. (Marks: 10) Question 4 You are provided with the following information in the bank reconciliation process: Q.4.1 Dishonoured Cheque Q.4.2 Favourable Balance Q.4.3 Interest on Overdraft Q.4.4 EFT Payment Q.4.5 Cash Deposit Q.4.6 Direct Deposit Q.4.7 Debit Order Q.4.8 Interest Income Q.4.9 Overdraft Q.4.10 Unfavourable Balance Required: For each entry in the table above, indicate whether the entry would be a debit or credit on the bank statement (i.e., from the banks perspective).

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Petty Cash Book Petty Cash Refreshments Amount Fol Deta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started