Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Matter 1 Transport business (50 Marks) Salmonella Transport (pty) Ltd (Salmonella) is a transport operating company in Namibia. The company provides buses

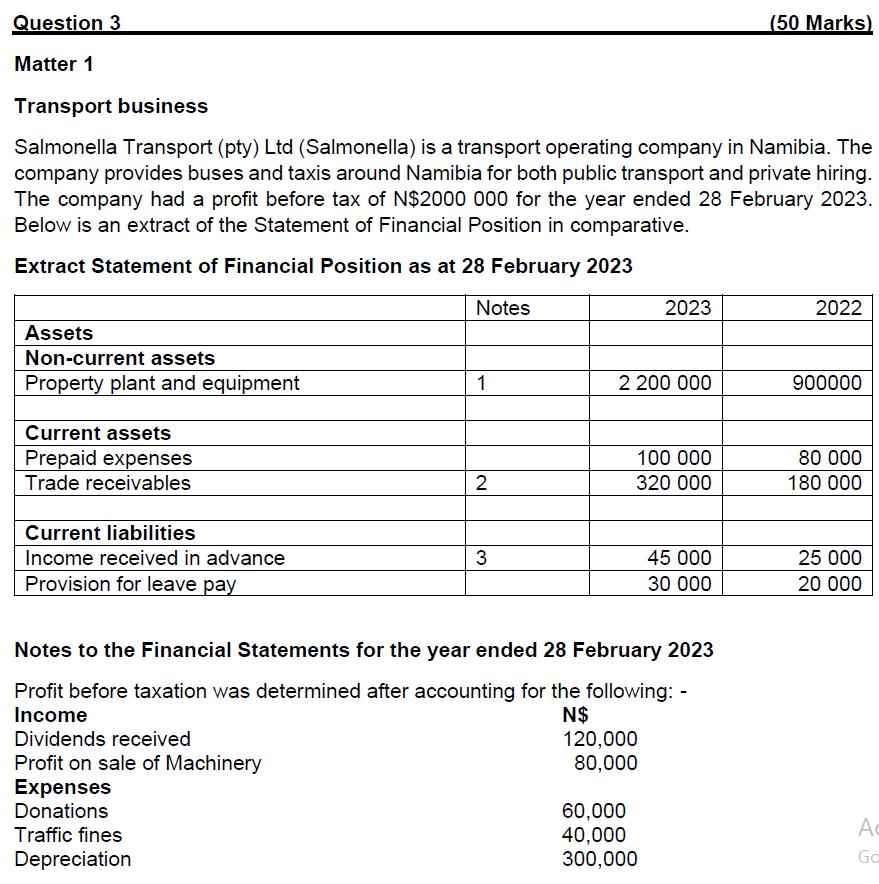

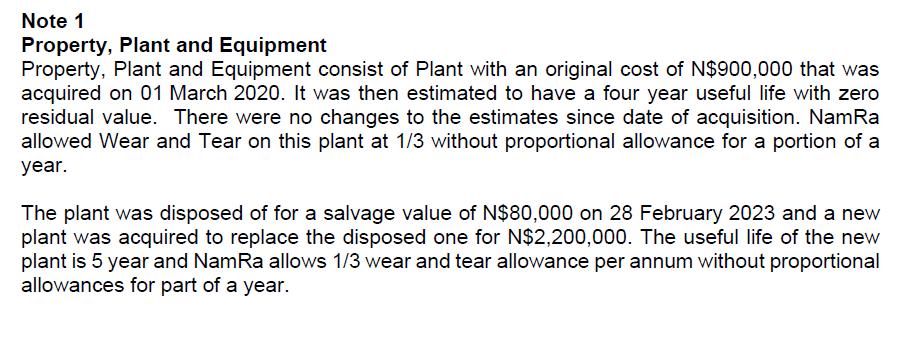

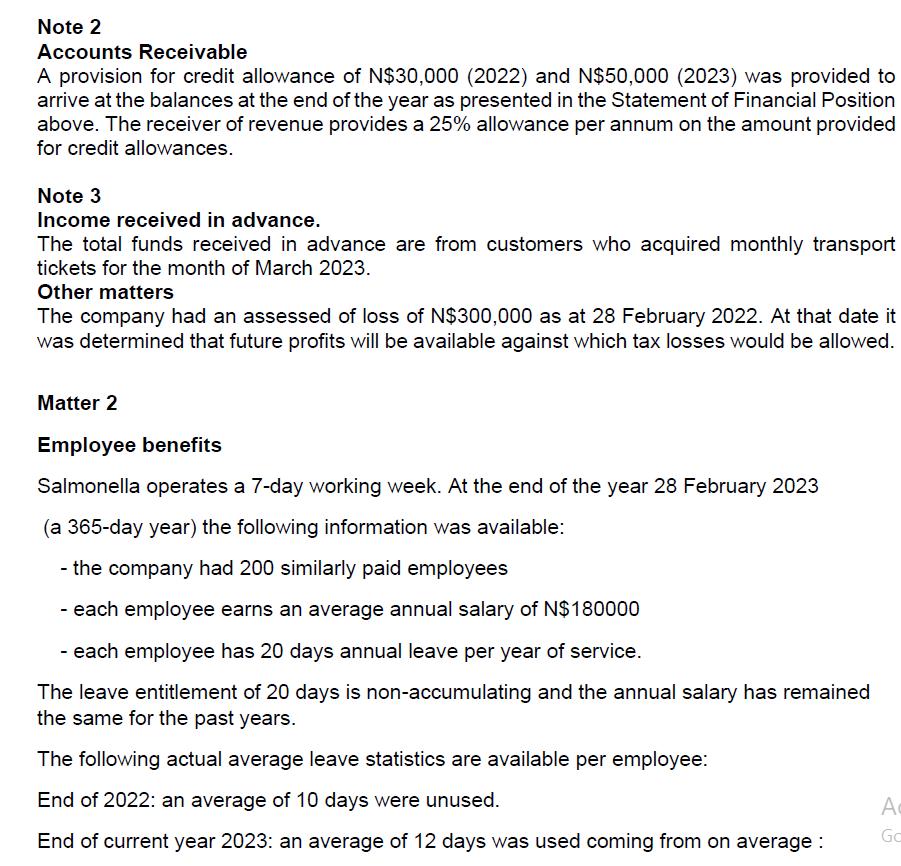

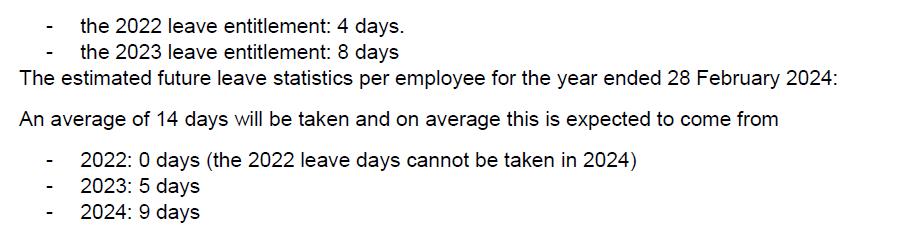

Question 3 Matter 1 Transport business (50 Marks) Salmonella Transport (pty) Ltd (Salmonella) is a transport operating company in Namibia. The company provides buses and taxis around Namibia for both public transport and private hiring. The company had a profit before tax of N$2000 000 for the year ended 28 February 2023. Below is an extract of the Statement of Financial Position in comparative. Extract Statement of Financial Position as at 28 February 2023 Notes 2023 2022 Assets Non-current assets Property plant and equipment 1 2 200 000 900000 Current assets Prepaid expenses Trade receivables 100 000 80 000 2 320 000 180 000 Current liabilities Income received in advance Provision for leave pay 3 45 000 25 000 30 000 20 000 Notes to the Financial Statements for the year ended 28 February 2023 Profit before taxation was determined after accounting for the following: - Income N$ Dividends received 120,000 Profit on sale of Machinery 80,000 Expenses Donations Traffic fines Depreciation 60,000 Ac 40,000 300,000 Go Note 1 Property, Plant and Equipment Property, Plant and Equipment consist of Plant with an original cost of N$900,000 that was acquired on 01 March 2020. It was then estimated to have a four year useful life with zero residual value. There were no changes to the estimates since date of acquisition. NamRa allowed Wear and Tear on this plant at 1/3 without proportional allowance for a portion of a year. The plant was disposed of for a salvage value of N$80,000 on 28 February 2023 and a new plant was acquired to replace the disposed one for N$2,200,000. The useful life of the new plant is 5 year and NamRa allows 1/3 wear and tear allowance per annum without proportional allowances for part of a year. Note 2 Accounts Receivable A provision for credit allowance of N$30,000 (2022) and N$50,000 (2023) was provided to arrive at the balances at the end of the year as presented in the Statement of Financial Position above. The receiver of revenue provides a 25% allowance per annum on the amount provided for credit allowances. Note 3 Income received in advance. The total funds received in advance are from customers who acquired monthly transport tickets for the month of March 2023. Other matters The company had an assessed of loss of N$300,000 as at 28 February 2022. At that date it was determined that future profits will be available against which tax losses would be allowed. Matter 2 Employee benefits Salmonella operates a 7-day working week. At the end of the year 28 February 2023 (a 365-day year) the following information was available: - the company had 200 similarly paid employees - each employee earns an average annual salary of N$180000 each employee has 20 days annual leave per year of service. The leave entitlement of 20 days is non-accumulating and the annual salary has remained the same for the past years. The following actual average leave statistics are available per employee: End of 2022: an average of 10 days were unused. Ac End of current year 2023: an average of 12 days was used coming from on average: Go the 2022 leave entitlement: 4 days. the 2023 leave entitlement: 8 days The estimated future leave statistics per employee for the year ended 28 February 2024: An average of 14 days will be taken and on average this is expected to come from - 2022: 0 days (the 2022 leave days cannot be taken in 2024) - 2023: 5 days 2024: 9 days Matter 3 Campus Circle shopping Centre (Campus Circle) acquisition Salmonella decided to invest in other ventures and acquired Campus Circle a shopping Centre on 1 December 2022 for N$15 million. As the Campus Circle acquisition is fairly recent, the cost is considered to approximate fair value at 28 February 2022. The building was constructed 10 years ago and was not particularly well maintained by the previous owners. Salmonellas decided to re-furbish the shopping centre extensively and also build a new parking lot at the Centre for customers and for Salmonella taxis. 1.1 Gestetnerz Limited agreement On 1 April 2022, the director of operations signed a contract with Gestetnerz Limited. Gestetnerz Limited performs general construction and civil engineering works. They own all the equipment which they require to perform construction work. On occasion, they have rented unused equipment to smaller construction firms and companies. The contract between Gestetnerz Limited and Salmonella stipulated that Salmonella may use any of the machinery owned by Gestetnerz Limited, so long as they provide them with two weeks' notice of their expected equipment needs. If the requested equipment is available, Gestetnerz Limited will deliver the equipment on-site with a trained operator for the agreed time. Salmonella may only use the equipment on the Campus Circle building site. If the equipment that Salmonella need is unavailable for use, Gestetnerz Limited will inform Salmonella and will make suggestions for alternative machinery based on their years of industry experience. If Salmonella is not satisfied with the suggestions, Gestetnerz Limited will rent the equipment from a third party and ensure that it is delivered to Campus Circle with one of Gestetnerz Limited's own, trained operators. In exchange for this right, Salmonella will pay Gestetnerz Limited a flat fee of N$100 000 per month plus an additional amount for diesel used, which will vary based on the actual machine usage per month. Ac The agreement is binding for at least 12 months, with the option to renew the contract on a month-to-month basis after the initial term. Should either party cancel the contract before the 12 months expire, a penalty of 50% of the minimum remaining lease payments becomes payable to the other party within six months after the cancellation is formally communicated and accepted. During the period September 2022 and October 2022, Gestetnerz Limited did not have any of their own equipment available to meet the scheduled equipment needs of Salmonella. Per the agreement, they sourced alternative equipment from third parties. However, the alternative equipment continuously failed. Eventually, a cement mixer broke down and 2 tons of cement spilt into the Campus Circle parking lot. Salmonella had to spend an additional amounts to clean up the spill and lost cement in the process. Salmonella decided to cancel the agreement and communicated the cancellation of the agreement to Gestetnerz Limited on 1 November 2022, and it was accepted on this date. 1.2 Godzilla (Pty) Limited agreement During October 2022, Salmonella 24ealized that they will need to find another construction firm to partner with if they want to complete the renovation of Campus Circle within a reasonable amount of time. A contract was entered into with Godzilla (Pty) Limited (hereafter "Godzilla") for the rental of the following equipment: One Black mini backhoe loader, with number plate MMM123NA One Scania R-series tipper-truck, number plate JMM 126 NA To avoid a scenario like that experienced with Gestetnerz Limited, Salmonella engaged the services of a legal firm to draft the rental agreement, which cost them N$30 000, paid in cash. The key terms of the arrangement are as follows: effective date: 1 December 2022, contract term: 15 months; lease payments: N$75 000 per month; ownership remains with Godzilla and operators are employed by Salmonella. Accounting policies: 1. The applicable tax rate is 32%. 2. Ignore Secondary tax on Companies or Dividend taxation. 3. Income is taxable at the time of receipt. 4. All expenses are allowed for deduction when paid. 5. Ignore public holidays when considering leave pays Required: 2a 2b 2c 2d Calculate the current tax of Salmonella Transport (Pty) Ltd using the information in Matter 1 only, for the period ended 28 February 2023 in accordance with the IAS 12: Income tax. Calculate the deferred tax balance (closing) as at 28 February 2023, where it is applicable in respect of Matter 1 financial information above, Indicate if the temporary differences are taxable or deductible. Calculate the leave pay liability for Salmonella for the year ended 28 February 2023, (using information from Matter 2 only) in accordance with IAS 19: Employee Benefits under each of the 2 scenarios below: Scenario 1: annual leave is carried forward and available for use in the next financial year and is paid out in cash at the end of the next period if not used. Scenario 2: annual leave is carried forward to the next financial year (i.e. accumulating) but simply expires if not used by the end of the next year-end (i.e. non- vesting) Discuss whether the agreement with Gestetnerz Ltd and Godzilla Ltd should be treated as leases under the requirements of IFRS 16: Leases Effective and efficient communication

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started