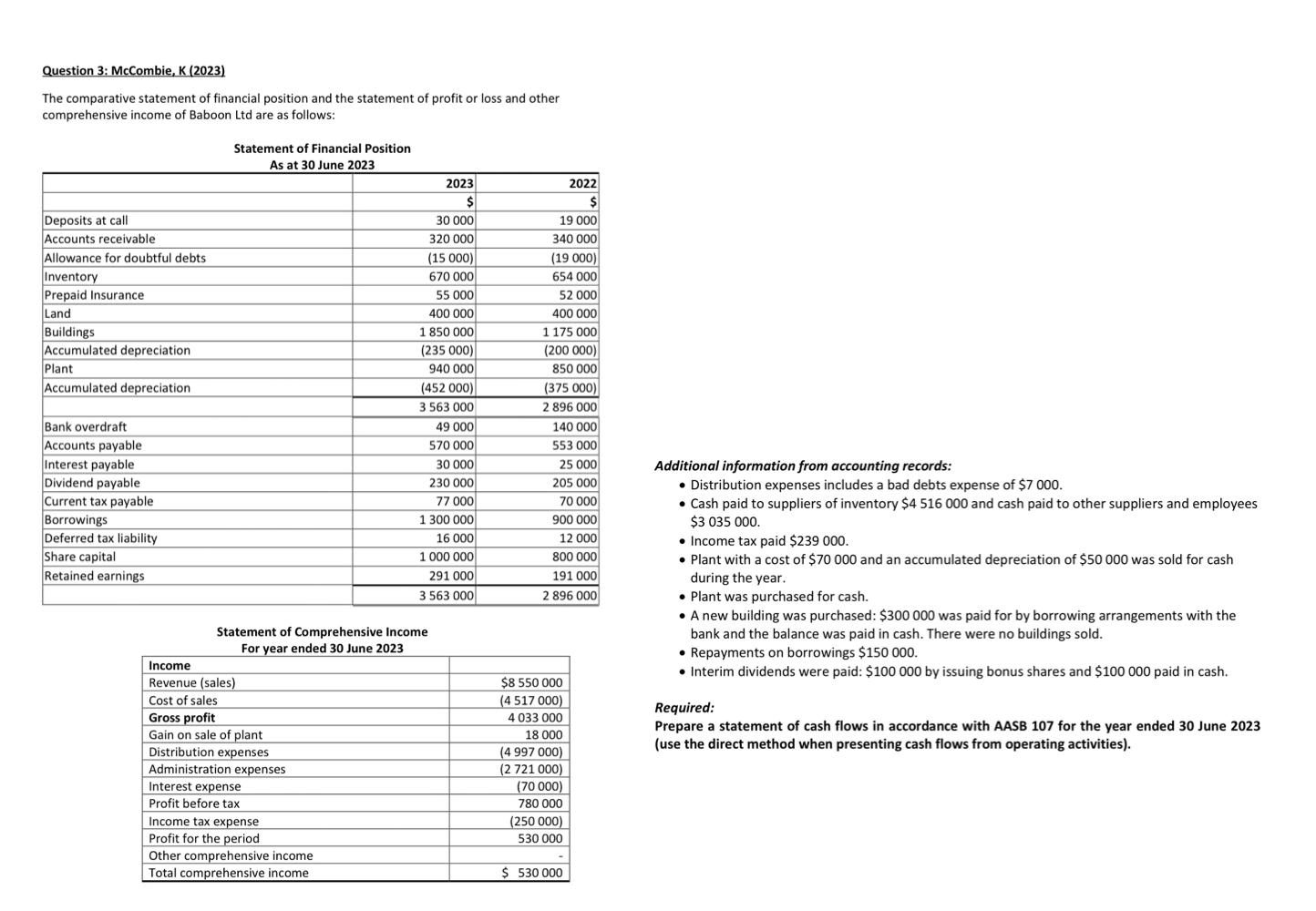

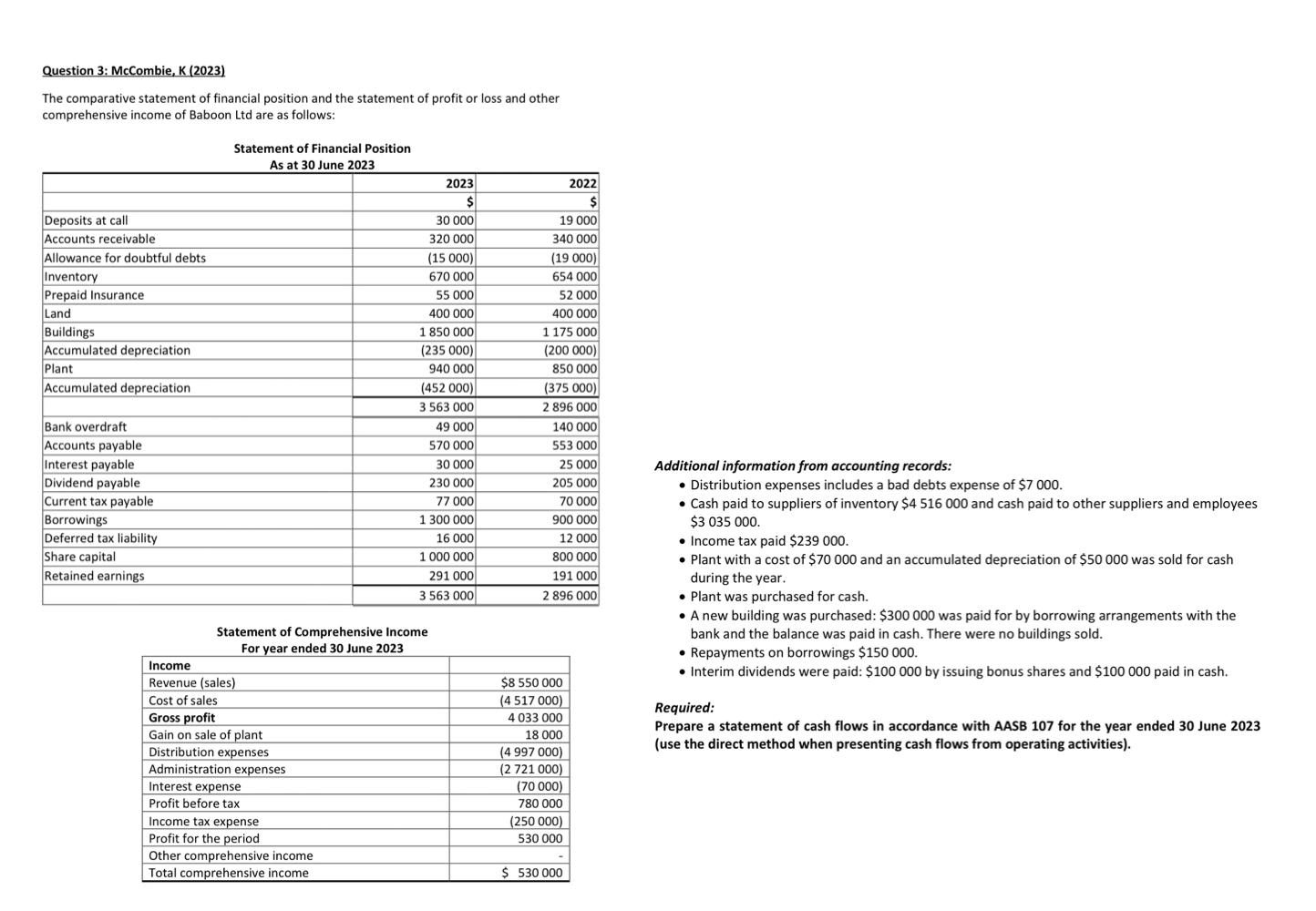

Question 3: McCombie, K (2023) The comparative statement of financial position and the statement of profit or loss and other comprehensive income of Baboon Ltd are as follows: Statement of Financial Position \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|l|}{ As at 30 June 2023 } \\ \hline & 2023 & 2022 \\ \hline Deposits at call & 3 & 19000 \\ \hline Accounts receivable & 30000 & 340000 \\ \hline Allowance for doubtful debts & 320000 & (19000) \\ \hline Inventory & (15000) & 654000 \\ \hline Prepaid Insurance & 670000 & 52000 \\ \hline Land & 55000 & 400000 \\ \hline Buildings & 400000 & 1175000 \\ \hline Accumulated depreciation & 1850000 & (200000) \\ \hline Plant & (235000) & 850000 \\ \hline Accumulated depreciation & 940000 & (375000) \\ \hline & (452000) & 2896000 \\ \hline Bank overdraft & 3563000 & 140000 \\ \hline Accounts payable & 49000 & 553000 \\ \hline Interest payable & 570000 & 25000 \\ \hline Dividend payable & 30000 & 205000 \\ \hline Current tax payable & 230000 & 70000 \\ \hline Borrowings & 77000 & 900000 \\ \hline Deferred tax liability & 1300000 & 12000 \\ \hline Share capital & 16000 & 800000 \\ \hline Retained earnings & 1000000 & 191000 \\ \hline & 291000 & 2896000 \\ \hline \end{tabular} Additional information from accounting records: - Distribution expenses includes a bad debts expense of $7000. - Cash paid to suppliers of inventory $4516000 and cash paid to other suppliers and employees $3035000. - Income tax paid $239000. - Plant with a cost of $70000 and an accumulated depreciation of $50000 was sold for cash during the year. - Plant was purchased for cash. - A new building was purchased: $300000 was paid for by borrowing arrangements with the Statement of Comprehensive Income bank and the balance was paid in cash. There were no buildings sold. - Repayments on borrowings $150000. \begin{tabular}{|l|r|} \hline Income & \\ \hline Revenue (sales) & $8550000 \\ \hline Cost of sales & (4517000) \\ \hline Gross profit & 4033000 \\ \hline Gain on sale of plant & 18000 \\ \hline Distribution expenses & (4997000) \\ \hline Administration expenses & (2721000) \\ \hline Interest expense & (70000) \\ \hline Profit before tax & 780000 \\ \hline Income tax expense & (250000) \\ \hline Profit for the period & 530000 \\ \hline Other comprehensive income & - \\ \hline Total comprehensive income & $530000 \\ \hline \end{tabular} - Interim dividends were paid: $100000 by issuing bonus shares and $100000 paid in cash. Required: Prepare a statement of cash flows in accordance with AASB 107 for the year ended 30 June 2023 (use the direct method when presenting cash flows from operating activities)