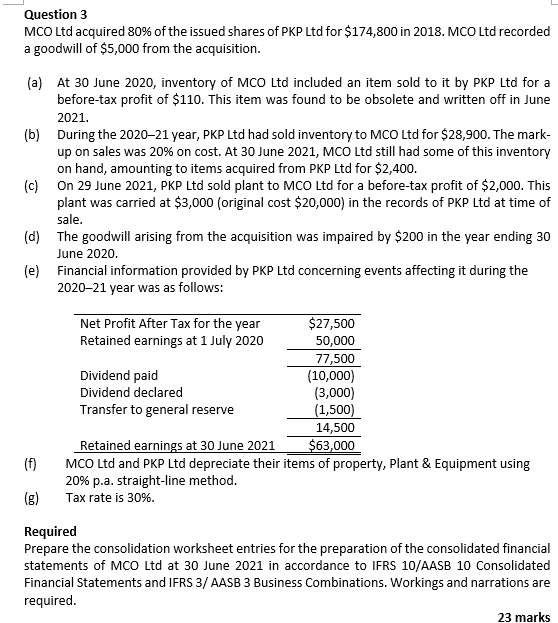

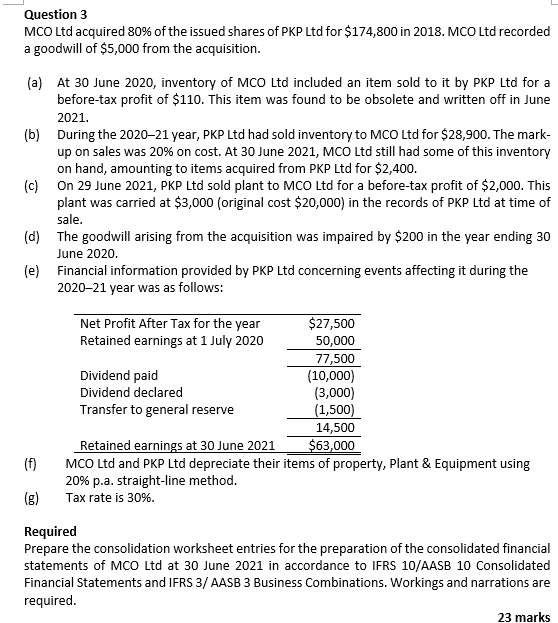

Question 3 MCO Ltd acquired 80% of the issued shares of PKP Ltd for $174,800 in 2018. MCO Ltd recorded a goodwill of $5,000 from the acquisition. (a) At 30 June 2020, inventory of MCO Ltd included an item sold to it by PKP Ltd for a before-tax profit of $110. This item was found to be obsolete and written off in June 2021. (b) During the 2020-21 year, PKP Ltd had sold inventory to MCO Ltd for $28,900. The mark- up on sales was 20% on cost. At 30 June 2021, MCo Ltd still had some of this inventory on hand, amounting to items acquired from PKP Ltd for $2,400. (c) On 29 June 2021, PKP Ltd sold plant to MCO Ltd for a before-tax profit of $2,000. This plant was carried at $3,000 (original cost $20,000) in the records of PKP Ltd at time of sale. (d) The goodwill arising from the acquisition was impaired by $200 in the year ending 30 June 2020. (e) Financial information provided by PKP Ltd concerning events affecting it during the 2020-21 year was as follows: Net Profit After Tax for the year $27,500 Retained earnings at 1 July 2020 50,000 77,500 Dividend paid (10,000) Dividend declared (3,000) Transfer to general reserve (1,500) 14,500 Retained earnings at 30 June 2021 $63,000 MCO Ltd and PKP Ltd depreciate their items of property, Plant & Equipment using 20% p.a. straight-line method. Tax rate is 30%. (1) (g) Required Prepare the consolidation worksheet entries for the preparation of the consolidated financial statements of MCO Ltd at 30 June 2021 in accordance to IFRS 10/AASB 10 Consolidated Financial Statements and IFRS 3/ AASB 3 Business Combinations. Workings and narrations are required. 23 marks Question 3 MCO Ltd acquired 80% of the issued shares of PKP Ltd for $174,800 in 2018. MCO Ltd recorded a goodwill of $5,000 from the acquisition. (a) At 30 June 2020, inventory of MCO Ltd included an item sold to it by PKP Ltd for a before-tax profit of $110. This item was found to be obsolete and written off in June 2021. (b) During the 2020-21 year, PKP Ltd had sold inventory to MCO Ltd for $28,900. The mark- up on sales was 20% on cost. At 30 June 2021, MCo Ltd still had some of this inventory on hand, amounting to items acquired from PKP Ltd for $2,400. (c) On 29 June 2021, PKP Ltd sold plant to MCO Ltd for a before-tax profit of $2,000. This plant was carried at $3,000 (original cost $20,000) in the records of PKP Ltd at time of sale. (d) The goodwill arising from the acquisition was impaired by $200 in the year ending 30 June 2020. (e) Financial information provided by PKP Ltd concerning events affecting it during the 2020-21 year was as follows: Net Profit After Tax for the year $27,500 Retained earnings at 1 July 2020 50,000 77,500 Dividend paid (10,000) Dividend declared (3,000) Transfer to general reserve (1,500) 14,500 Retained earnings at 30 June 2021 $63,000 MCO Ltd and PKP Ltd depreciate their items of property, Plant & Equipment using 20% p.a. straight-line method. Tax rate is 30%. (1) (g) Required Prepare the consolidation worksheet entries for the preparation of the consolidated financial statements of MCO Ltd at 30 June 2021 in accordance to IFRS 10/AASB 10 Consolidated Financial Statements and IFRS 3/ AASB 3 Business Combinations. Workings and narrations are required. 23 marks