Answered step by step

Verified Expert Solution

Question

1 Approved Answer

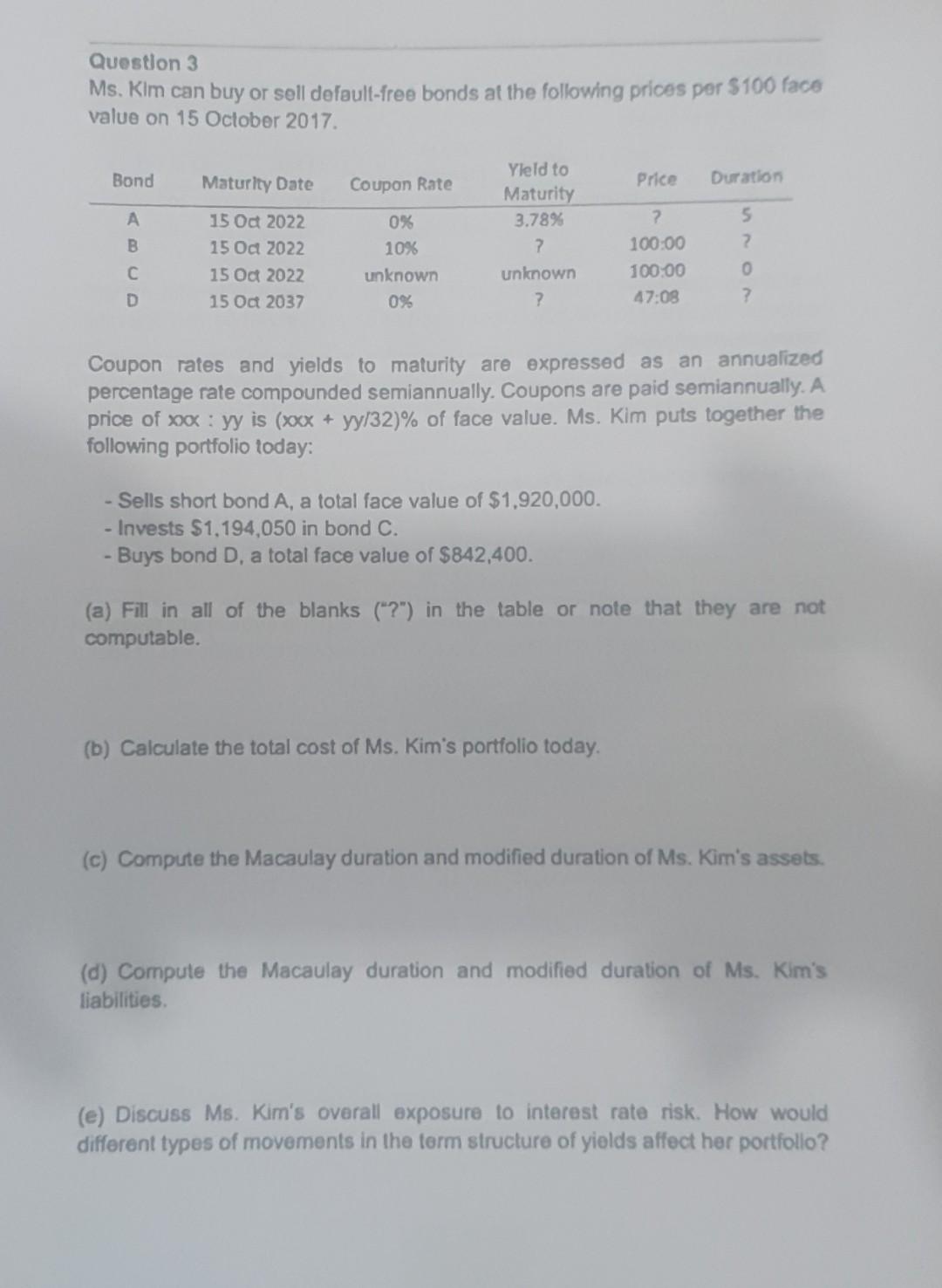

Question 3 Ms. Kim can buy or sell defaull-free bonds at the following prices per $100 face value on 15 Oclober 2017 Coupon rates and

Question 3 Ms. Kim can buy or sell defaull-free bonds at the following prices per $100 face value on 15 Oclober 2017 Coupon rates and yields to maturity are expressed as an annualized percentage rate compounded semiannually. Coupons are paid semiannually. A price of xox:yy is (xxx+yy/32)% of face value. Ms. Kim puts together the following portfolio today: - Sells short bond A, a total face value of $1,920,000. - Invests $1,194,050 in bond C. - Buys bond D, a total face value of $842,400. (a) Fill in all of the blanks ("?") in the table or note that they are not computable. (b) Calculate the total cost of Ms. Kim's portfolio today. (c) Compute the Macaulay duration and modified duration of Ms. Kim's assets. (d) Compute the Macaulay duration and modified duration of Ms. Kim's liabilities. (e) Discuss Ms. Kim's overall exposure to interest rate risk. How would different types of movements in the term structure of yields affect her portfollo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started