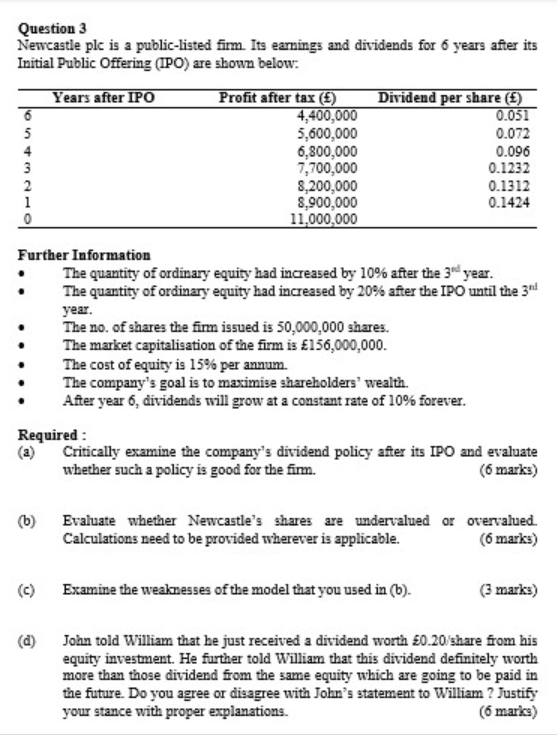

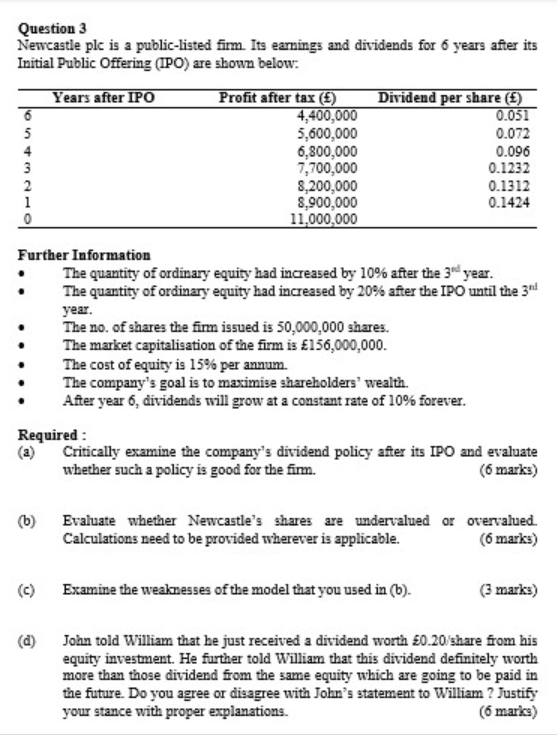

Question 3 Newcastle plc is a public-listed fim. Its earnings and dividends for 6 years after its Initial Public Offering (IPO) are shown below: Years after IPO Profit after tax (4) Dividend per share () 6 4,400,000 0.051 5 5,600,000 0.072 4 6,800,000 0.096 3 7,700,000 0.1232 2 8,200,000 0.1312 1 8,900,000 0.1424 0 11,000,000 Further Information The quantity of ordinary equity had increased by 10% after the 30 year. The quantity of ordinary equity had increased by 20% after the IPO until the 34 year. The no. of shares the fimm issued is 50,000,000 shares. The market capitalisation of the firm is 156,000,000 The cost of equity is 15% per annum. The company's goal is to maximise shareholders' wealth. After year 6, dividends will grow at a constant rate of 10% forever. Required: Critically examine the company's dividend policy after its IPO and evaluate whether such a policy is good for the fim. (6 marks) (6) Evaluate whether Newcastle's shares are undervalued or overvalued. Calculations need to be provided wherever is applicable. (6 marks) Examine the weaknesses of the model that you used in (b). (3 marks) John told William that he just received a dividend worth 0.20/share from his equity investment. He further told William that this dividend definitely worth more than those dividend from the same equity which are going to be paid in the future. Do you agree or disagree with John's statement to William ? Justify your stance with proper explanations. (6 marks) Robert told Peter that dividend is not relevant to investors as the latter can sell their equity anytime to eam returns. Discuss critically why the "Dividend Irrelevance Theorem" as suggested by Robert is not realistic in the real world. (4 marks) Question 3 Newcastle plc is a public-listed fim. Its earnings and dividends for 6 years after its Initial Public Offering (IPO) are shown below: Years after IPO Profit after tax (4) Dividend per share () 6 4,400,000 0.051 5 5,600,000 0.072 4 6,800,000 0.096 3 7,700,000 0.1232 2 8,200,000 0.1312 1 8,900,000 0.1424 0 11,000,000 Further Information The quantity of ordinary equity had increased by 10% after the 30 year. The quantity of ordinary equity had increased by 20% after the IPO until the 34 year. The no. of shares the fimm issued is 50,000,000 shares. The market capitalisation of the firm is 156,000,000 The cost of equity is 15% per annum. The company's goal is to maximise shareholders' wealth. After year 6, dividends will grow at a constant rate of 10% forever. Required: Critically examine the company's dividend policy after its IPO and evaluate whether such a policy is good for the fim. (6 marks) (6) Evaluate whether Newcastle's shares are undervalued or overvalued. Calculations need to be provided wherever is applicable. (6 marks) Examine the weaknesses of the model that you used in (b). (3 marks) John told William that he just received a dividend worth 0.20/share from his equity investment. He further told William that this dividend definitely worth more than those dividend from the same equity which are going to be paid in the future. Do you agree or disagree with John's statement to William ? Justify your stance with proper explanations. (6 marks) Robert told Peter that dividend is not relevant to investors as the latter can sell their equity anytime to eam returns. Discuss critically why the "Dividend Irrelevance Theorem" as suggested by Robert is not realistic in the real world. (4 marks)