Question 3 Not checked Marked out of 3.00 Flag question Take me to the text Adrian's Restaurant is a 69-seat restaurant open every day

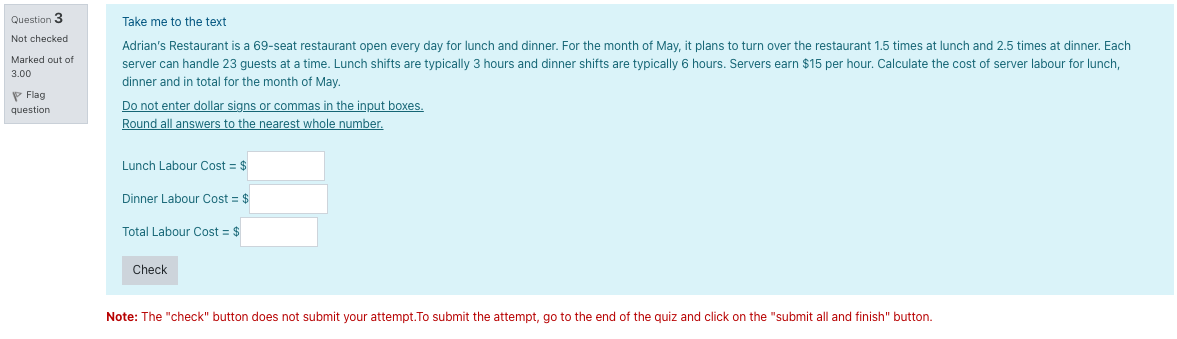

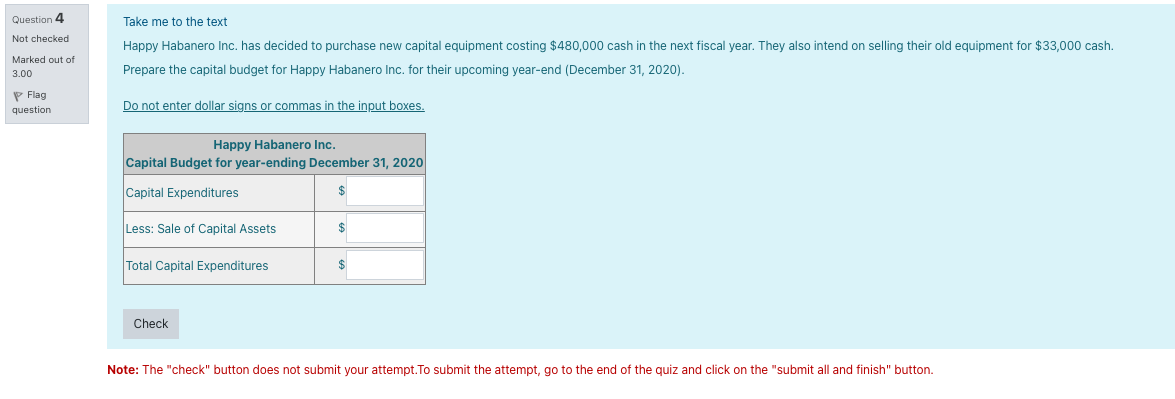

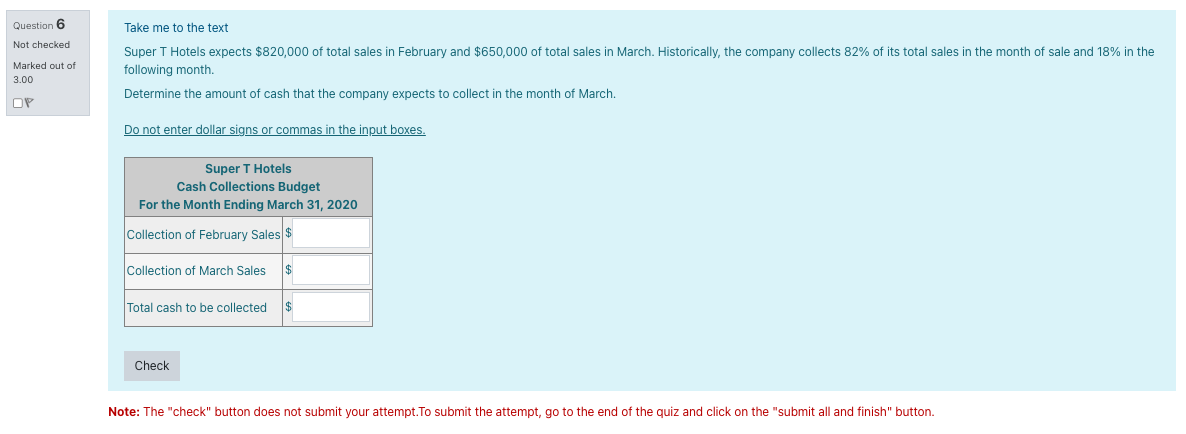

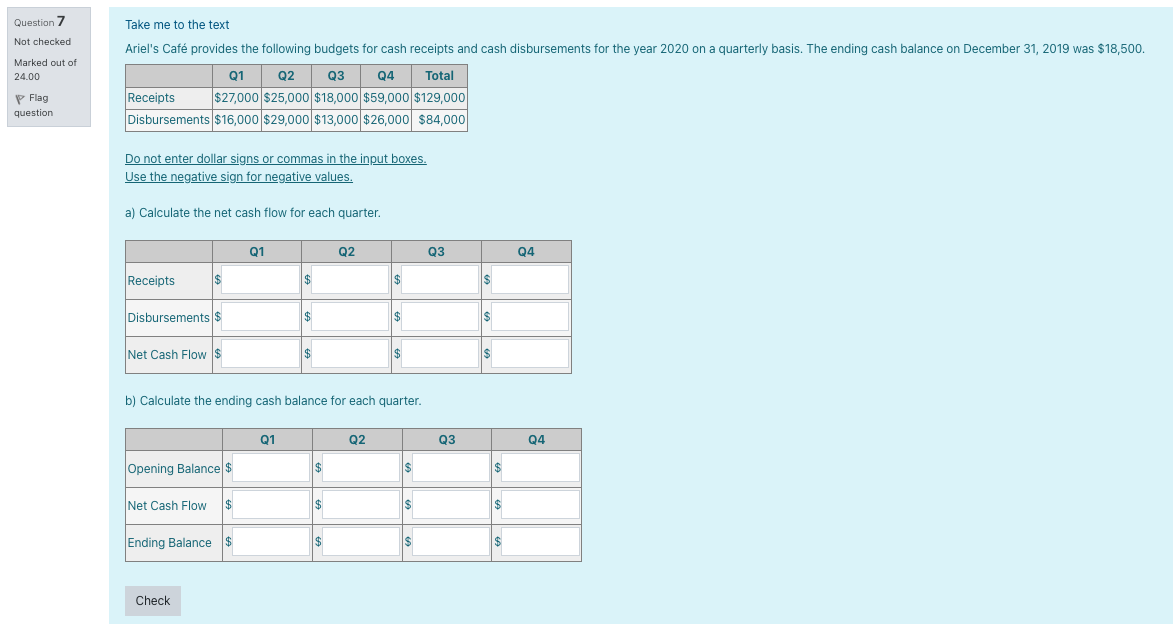

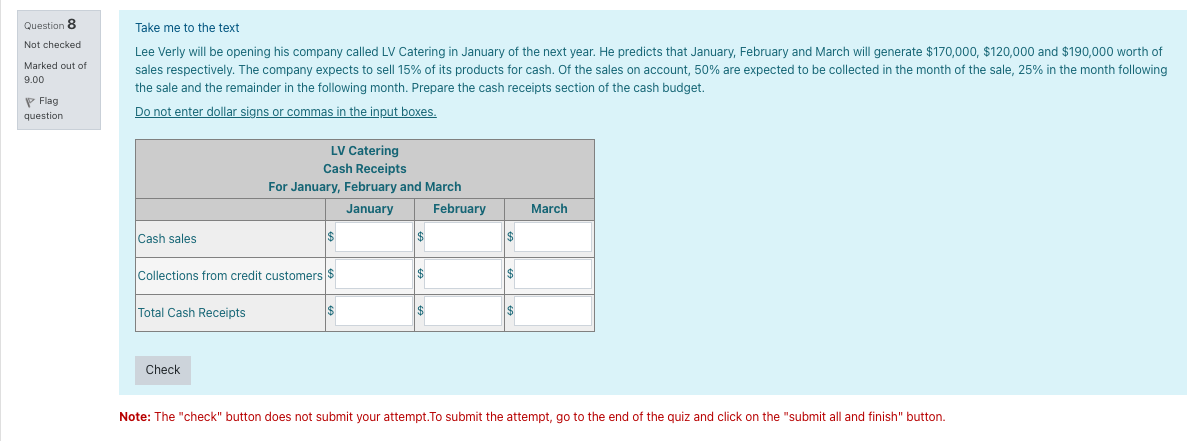

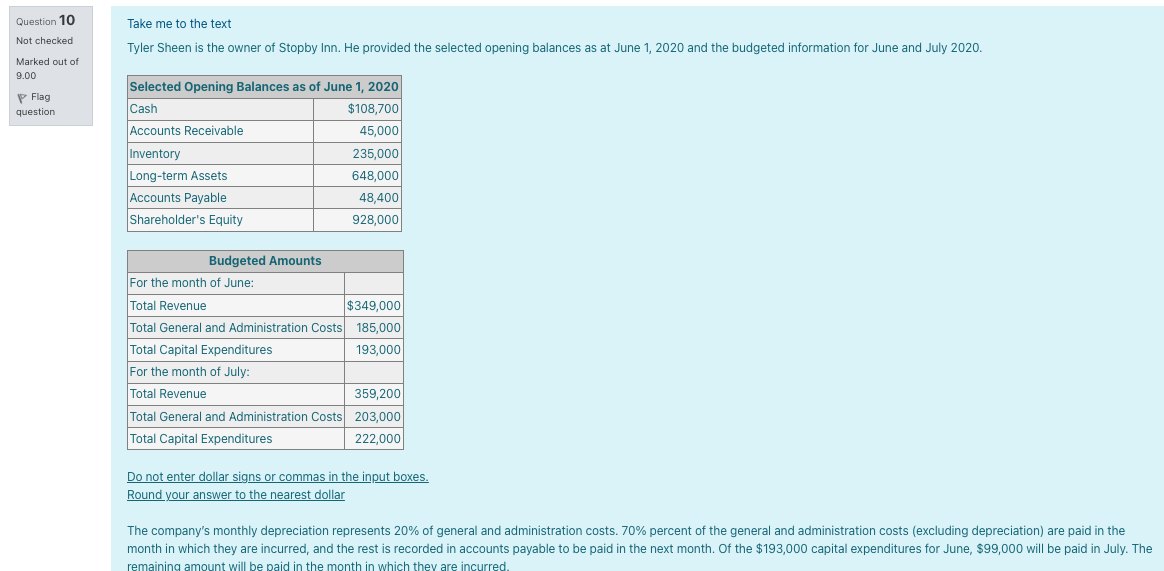

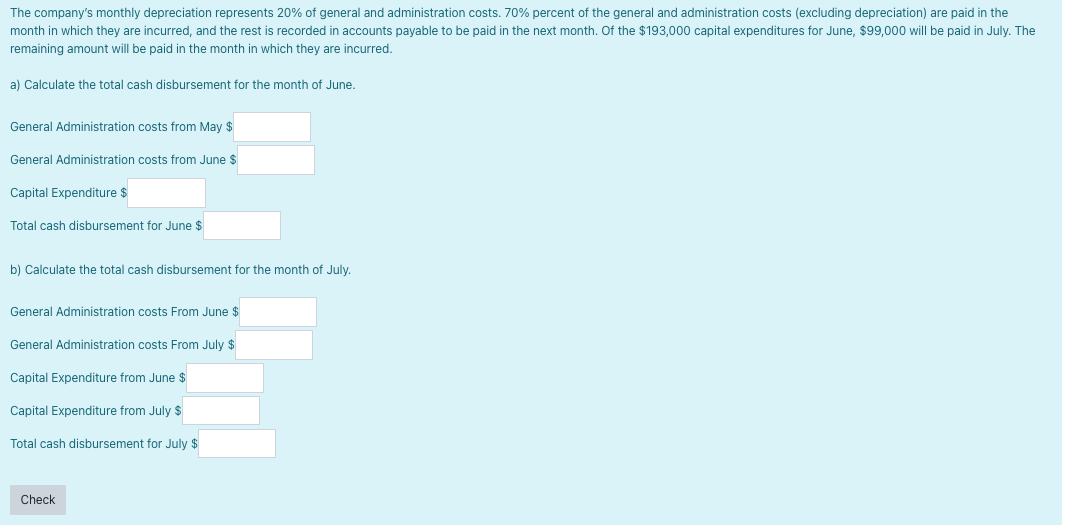

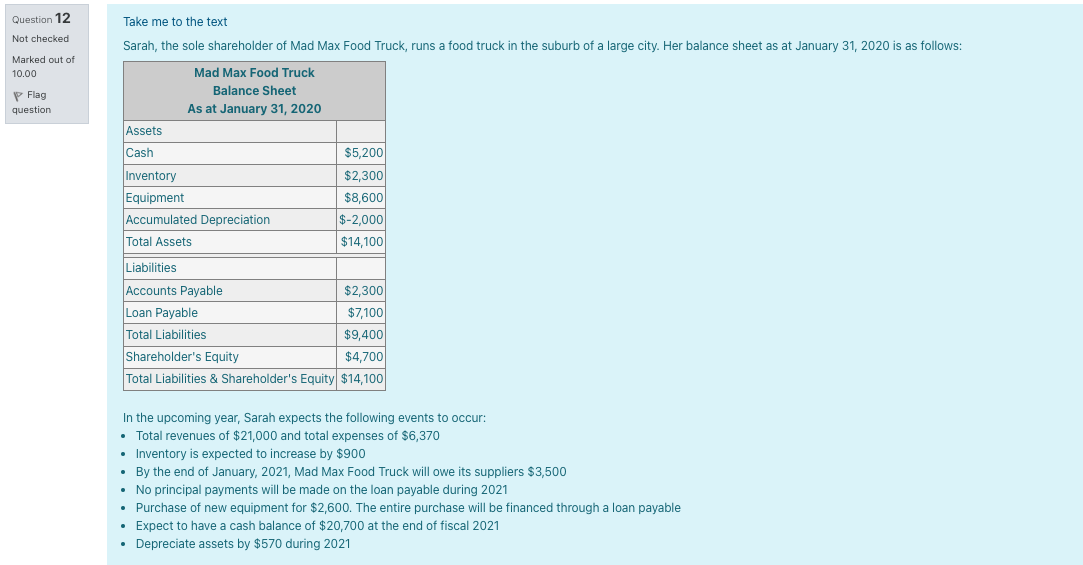

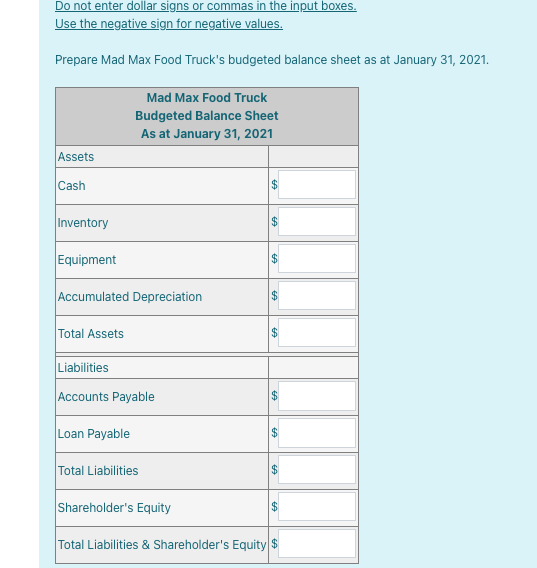

Question 3 Not checked Marked out of 3.00 Flag question Take me to the text Adrian's Restaurant is a 69-seat restaurant open every day for lunch and dinner. For the month of May, it plans to turn over the restaurant 1.5 times at lunch and 2.5 times at dinner. Each server can handle 23 guests at a time. Lunch shifts are typically 3 hours and dinner shifts are typically 6 hours. Servers earn $15 per hour. Calculate the cost of server labour for lunch, dinner and in total for the month of May. Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. Lunch Labour Cost = $ Dinner Labour Cost = $ Total Labour Cost = $ Check Note: The "check" button does not submit your attempt.To submit the attempt, go to the end of the quiz and click on the "submit all and finish" button. Question 4 Not checked Marked out of 3.00 Flag question Take me to the text Happy Habanero Inc. has decided to purchase new capital equipment costing $480,000 cash in the next fiscal year. They also intend on selling their old equipment for $33,000 cash. Prepare the capital budget for Happy Habanero Inc. for their upcoming year-end (December 31, 2020). Do not enter dollar signs or commas in the input boxes. Happy Habanero Inc. Capital Budget for year-ending December 31, 2020 Capital Expenditures Less: Sale of Capital Assets $ Total Capital Expenditures $ Check Note: The "check" button does not submit your attempt.To submit the attempt, go to the end of the quiz and click on the "submit all and finish" button. Question 6 Not checked Marked out of 3.00 Take me to the text Super T Hotels expects $820,000 of total sales in February and $650,000 of total sales in March. Historically, the company collects 82% of its total sales in the month of sale and 18% in the following month. Determine the amount of cash that the company expects to collect in the month of March. Do not enter dollar signs or commas in the input boxes. Super T Hotels Cash Collections Budget For the Month Ending March 31, 2020 Collection of February Sales $ Collection of March Sales Total cash to be collected $ Check Note: The "check" button does not submit your attempt.To submit the attempt, go to the end of the quiz and click on the "submit all and finish" button. Question 7 Take me to the text Not checked Marked out of 24.00 Flag question Ariel's Caf provides the following budgets for cash receipts and cash disbursements for the year 2020 on a quarterly basis. The ending cash balance on December 31, 2019 was $18,500. Q1 Q2 Q3 Q4 Total $27,000 $25,000 $18,000 $59,000 $129,000 Receipts Disbursements $16,000 $29,000 $13,000 $26,000 $84,000 Do not enter dollar signs or commas in the input boxes. Use the negative sign for negative values. a) Calculate the net cash flow for each quarter. Q1 Q2 Q3 Q4 Receipts Disbursements $ Net Cash Flow $ b) Calculate the ending cash balance for each quarter. Opening Balance $ Net Cash Flow Ending Balance $ Check Q1 Q2 $ Q3 Q4 Question 8 Not checked Marked out of 9.00 Flag question Take me to the text Lee Verly will be opening his company called LV Catering in January of the next year. He predicts that January, February and March will generate $170,000, $120,000 and $190,000 worth of sales respectively. The company expects to sell 15% of its products for cash. Of the sales on account, 50% are expected to be collected in the month of the sale, 25% in the month following the sale and the remainder in the following month. Prepare the cash receipts section of the cash budget. Do not enter dollar signs or commas in the input boxes. LV Catering Cash Receipts For January, February and March Cash sales Collections from credit customers $ Total Cash Receipts Check January February March $ Note: The "check" button does not submit your attempt.To submit the attempt, go to the end of the quiz and click on the "submit all and finish" button. Question 10 Not checked Marked out of 9.00 Flag question Take me to the text Tyler Sheen is the owner of Stopby Inn. He provided the selected opening balances as at June 1, 2020 and the budgeted information for June and July 2020. Selected Opening Balances as of June 1, 2020 Cash $108,700 Accounts Receivable 45,000 Inventory 235,000 Long-term Assets 648,000 Accounts Payable 48,400 Shareholder's Equity 928,000 Budgeted Amounts For the month of June: Total Revenue $349,000 Total General and Administration Costs 185,000 Total Capital Expenditures For the month of July: Total Revenue 193,000 359,200 Total General and Administration Costs 203,000 Total Capital Expenditures 222,000 Do not enter dollar signs or commas in the input boxes. Round your answer to the nearest dollar The company's monthly depreciation represents 20% of general and administration costs. 70% percent of the general and administration costs (excluding depreciation) are paid in the month in which they are incurred, and the rest is recorded in accounts payable to be paid in the next month. Of the $193,000 capital expenditures for June, $99,000 will be paid in July. The remaining amount will be paid in the month in which they are incurred. The company's monthly depreciation represents 20% of general and administration costs. 70% percent of the general and administration costs (excluding depreciation) are paid in the month in which they are incurred, and the rest is recorded in accounts payable to be paid in the next month. Of the $193,000 capital expenditures for June, $99,000 will be paid in July. The remaining amount will be paid in the month in which they are incurred. a) Calculate the total cash disbursement for the month of June. General Administration costs from May $ General Administration costs from June $ Capital Expenditure $ Total cash disbursement for June $ b) Calculate the total cash disbursement for the month of July. General Administration costs From June $ General Administration costs From July $ Capital Expenditure from June $ Capital Expenditure from July $ Total cash disbursement for July $ Check Question 12 Not checked Marked out of 10.00 Flag question Take me to the text Sarah, the sole shareholder of Mad Max Food Truck, runs a food truck in the suburb of a large city. Her balance sheet as at January 31, 2020 is as follows: Assets Mad Max Food Truck Balance Sheet As at January 31, 2020 Cash $5,200 Inventory $2,300 Equipment $8,600 Accumulated Depreciation $-2,000 Total Assets $14,100 Liabilities Accounts Payable $2,300 Loan Payable $7,100 Total Liabilities $9,400 Shareholder's Equity $4,700 Total Liabilities & Shareholder's Equity $14,100 In the upcoming year, Sarah expects the following events to occur: Total revenues of $21,000 and total expenses of $6,370 Inventory is expected to increase by $900 By the end of January, 2021, Mad Max Food Truck will owe its suppliers $3,500 No principal payments will be made on the loan payable during 2021 Purchase of new equipment for $2,600. The entire purchase will be financed through a loan payable Expect to have a cash balance of $20,700 at the end of fiscal 2021 Depreciate assets by $570 during 2021 Do not enter dollar signs or commas in the input boxes. Use the negative sign for negative values. Prepare Mad Max Food Truck's budgeted balance sheet as at January 31, 2021. Assets Cash Inventory Mad Max Food Truck Budgeted Balance Sheet As at January 31, 2021 Equipment Accumulated Depreciation Total Assets Liabilities Accounts Payable Loan Payable Total Liabilities Shareholder's Equity FA FA FA EA FA Total Liabilities & Shareholder's Equity $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started