Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Not yet answered Question 3 (20 marks) Your company has two divisions. One division sells software and the other division sells computers. You

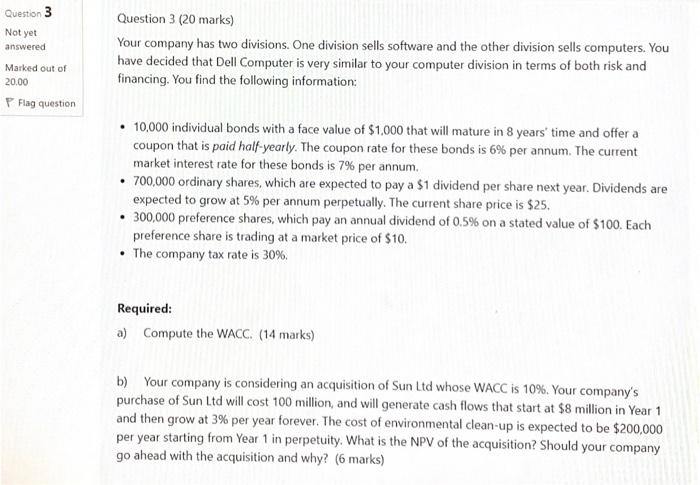

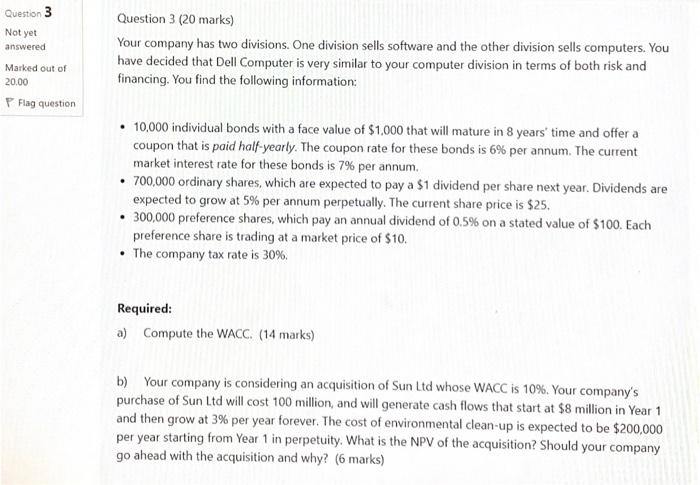

Question 3 Not yet answered Question 3 (20 marks) Your company has two divisions. One division sells software and the other division sells computers. You have decided that Dell Computer is very similar to your computer division in terms of both risk and financing. You find the following information: Marked out of 20.00 P Flag question 10,000 individual bonds with a face value of $1,000 that will mature in 8 years' time and offer a coupon that is paid half-yearly. The coupon rate for these bonds is 6% per annum. The current market interest rate for these bonds is 7% per annum 700,000 ordinary shares, which are expected to pay a $1 dividend per share next year. Dividends are expected to grow at 5% per annum perpetually. The current share price is $25. 300,000 preference shares, which pay an annual dividend of 0.5% on a stated value of $100. Each preference share is trading at a market price of $10. The company tax rate is 30%, Required: a) Compute the WACC. (14 marks) b) Your company is considering an acquisition of Sun Ltd whose WACC is 10%. Your company's purchase of Sun Ltd will cost 100 million, and will generate cash flows that start at $8 million in Year 1 and then grow at 3% per year forever. The cost of environmental clean-up is expected to be $200,000 per year starting from Year 1 in perpetuity. What is the NPV of the acquisition? Should your company go ahead with the acquisition and why? (6 marks)

Question 3 Not yet answered Question 3 (20 marks) Your company has two divisions. One division sells software and the other division sells computers. You have decided that Dell Computer is very similar to your computer division in terms of both risk and financing. You find the following information: Marked out of 20.00 P Flag question 10,000 individual bonds with a face value of $1,000 that will mature in 8 years' time and offer a coupon that is paid half-yearly. The coupon rate for these bonds is 6% per annum. The current market interest rate for these bonds is 7% per annum 700,000 ordinary shares, which are expected to pay a $1 dividend per share next year. Dividends are expected to grow at 5% per annum perpetually. The current share price is $25. 300,000 preference shares, which pay an annual dividend of 0.5% on a stated value of $100. Each preference share is trading at a market price of $10. The company tax rate is 30%, Required: a) Compute the WACC. (14 marks) b) Your company is considering an acquisition of Sun Ltd whose WACC is 10%. Your company's purchase of Sun Ltd will cost 100 million, and will generate cash flows that start at $8 million in Year 1 and then grow at 3% per year forever. The cost of environmental clean-up is expected to be $200,000 per year starting from Year 1 in perpetuity. What is the NPV of the acquisition? Should your company go ahead with the acquisition and why? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started