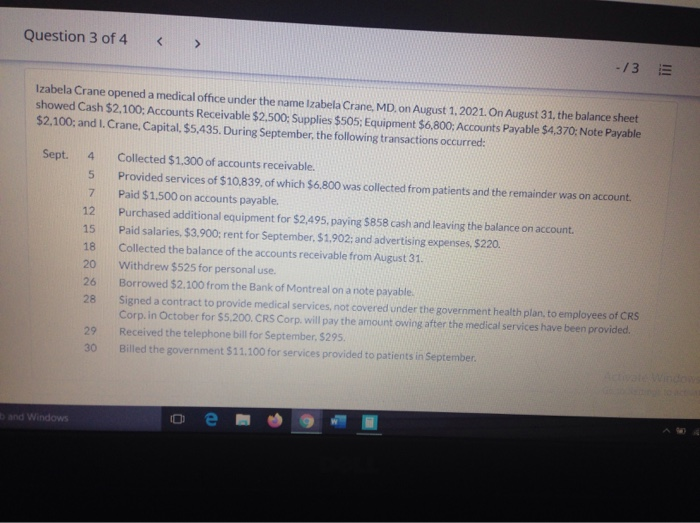

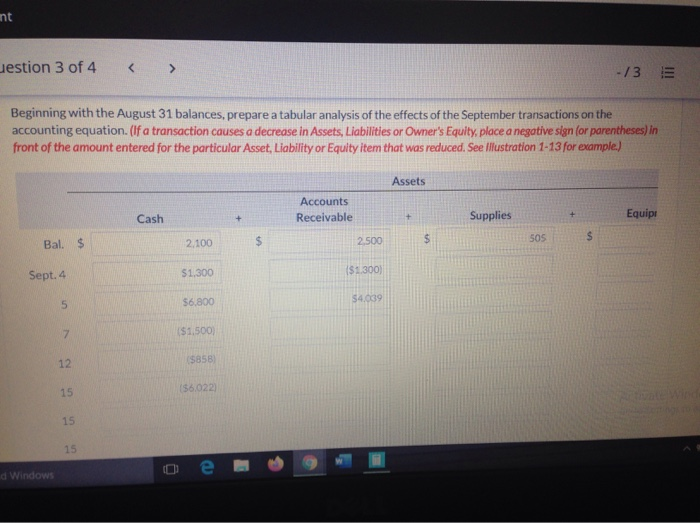

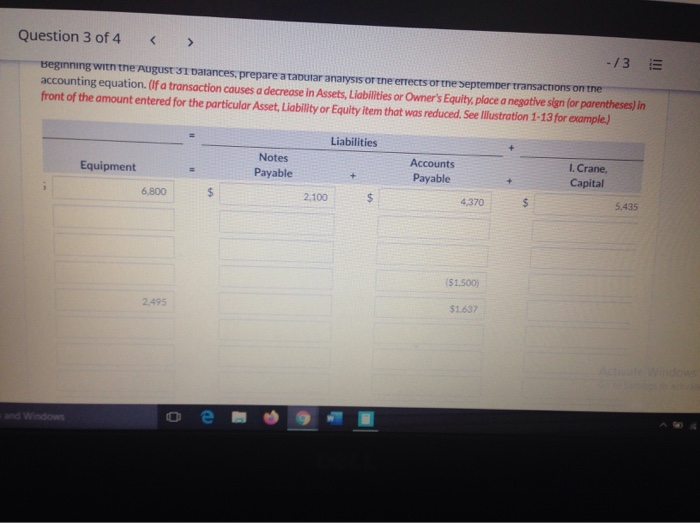

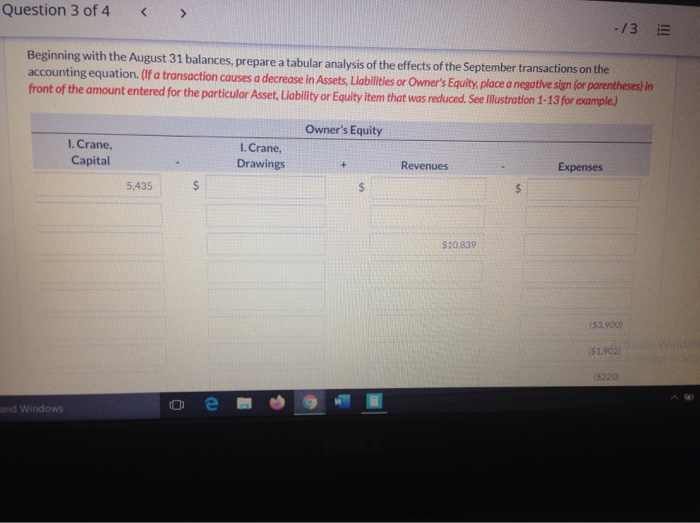

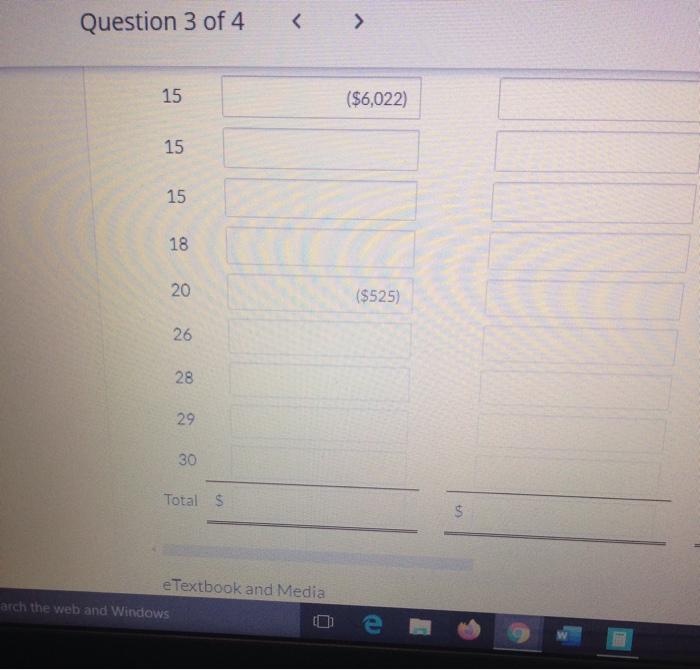

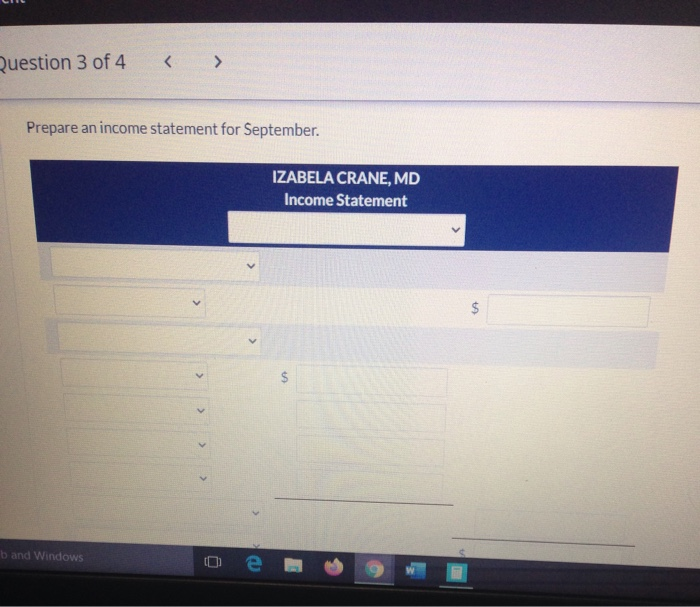

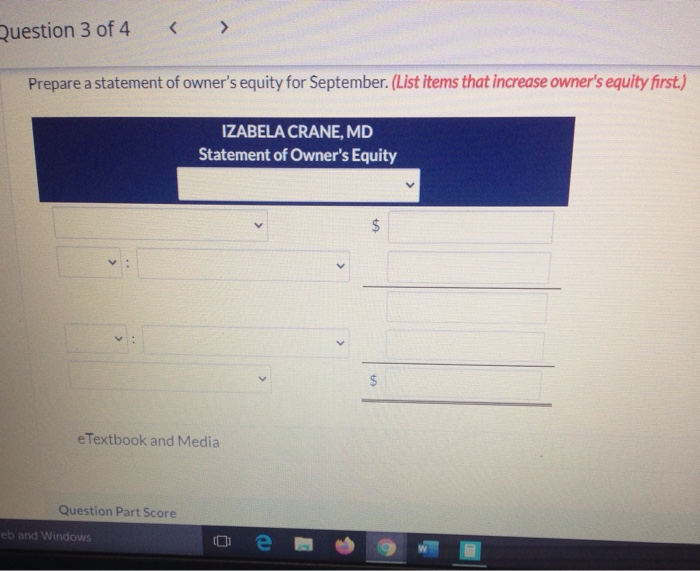

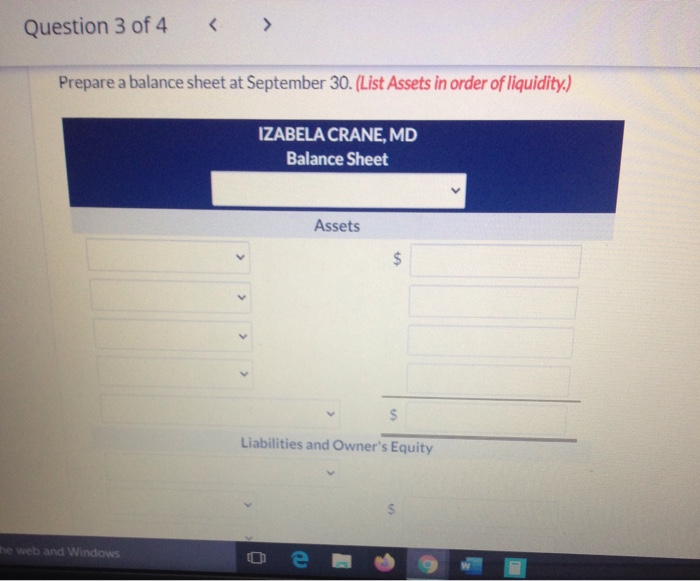

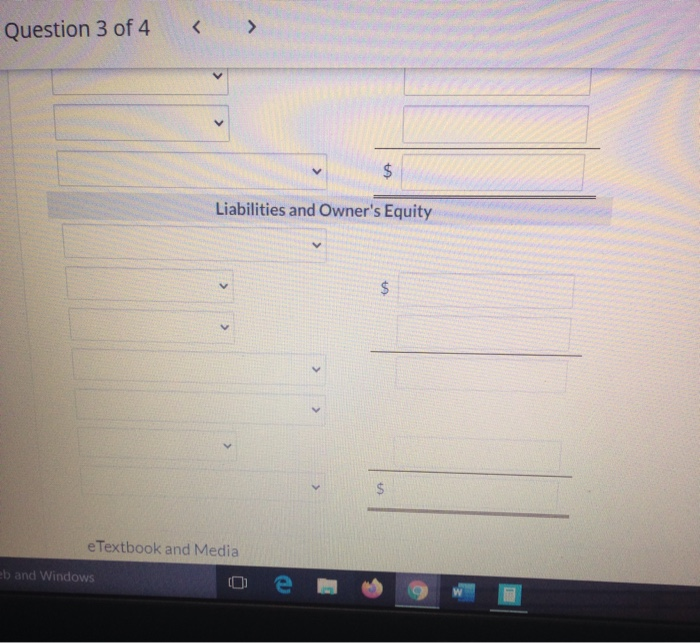

Question 3 of 4 -/3 Izabela Crane opened a medical office under the name Izabela Crane, MD. on August 1, 2021. On August 31, the balance sheet showed Cash $2,100; Accounts Receivable $2,500, Supplies $505; Equipment $6,800; Accounts Payable $4,370; Note Payable $2,100; and I. Crane, Capital, $5,435. During September, the following transactions occurred: Sept. 4 5 7 12 15 18 20 26 28 Collected $1,300 of accounts receivable. Provided services of $10,839, of which $6.800 was collected from patients and the remainder was on account Paid $1,500 on accounts payable. Purchased additional equipment for $2.495. paying $858 cash and leaving the balance on account. Paid salaries, $3,900; rent for September. 51,902; and advertising expenses. $220. Collected the balance of the accounts receivable from August 31. Withdrew $525 for personal use. Borrowed $2.100 from the Bank of Montreal on a note payable Signed a contract to provide medical services, not covered under the government health plan, to employees of CRS Corp. in October for $5,200. CRS Corp. will pay the amount owing after the medical services have been provided. Received the telephone bill for September. $295. Billed the government $11.100 for services provided to patients in September 29 30 and Windows 0 e ant uestion 3 of 4 -/3 Beginning with the August 31 balances, prepare a tabular analysis of the effects of the September transactions on the accounting equation. (If a transaction causes a decrease in Assets, Liabilities or Owner's Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See Illustration 1-13 for example.) Assets Accounts Receivable Cash Supplies Equipe 2.100 2.500 505 $ Bal. $ Sept. 4 $1.300 ($1.300) 5 $6.800 $4.0339 7 ($1.500 12 $858 15 (56,022 15 15 e d Windows Question 3 of 4 -/3 Beginning with the August 31 balances, prepare a tabular analysis of the erects or the september transactions on the accounting equation. (If a transaction causes a decrease in Assets, Liabilities or Owner's Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See lillustration 1-13 for example.) Liabilities Equipment Notes Payable Accounts Payable 1. Crane Capital 6,800 $ 2.100 $ 4,370 $ 5,435 (51.500 2.495 $1.637 Question 3 of 4 -13 Beginning with the August 31 balances, prepare a tabular analysis of the effects of the September transactions on the accounting equation. (If a transaction causes a decrease in Assets, Liabilities or Owner's Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset Liability or Equity item that was reduced. See Illustration 1-13 for example.) Owner's Equity 1.Crane, Capital 1. Crane, Drawings Revenues Expenses 5,435 $ $ $ $10.839 1$3,900) ($1.902 ($220 e and Windows Question 3 of 4 15 ($6,022) 15 15 18 20 ($525) 26 28 29 30 Total $ $ e Textbook and Media arch the web and Windows Question 3 of 4 Prepare an income statement for September. IZABELA CRANE, MD Income Statement $ $ > band Windows e Question 3 of 4 Prepare a statement of owner's equity for September. (List items that increase owner's equity first.) IZABELA CRANE, MD Statement of Owner's Equity $ $ e Textbook and Media Question Part Score eb and Windows Question 3 of 4 Prepare a balance sheet at September 30. (List Assets in order of liquidity.) IZABELA CRANE, MD Balance Sheet Assets $ > $ Liabilities and Owner's Equity he web and Windows Question 3 of 4 $ Liabilities and Owner's Equity $ $ e Textbook and Media eb and Windows e