Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 of 9 View Policies Current Attempt in Progress Ayayai Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable

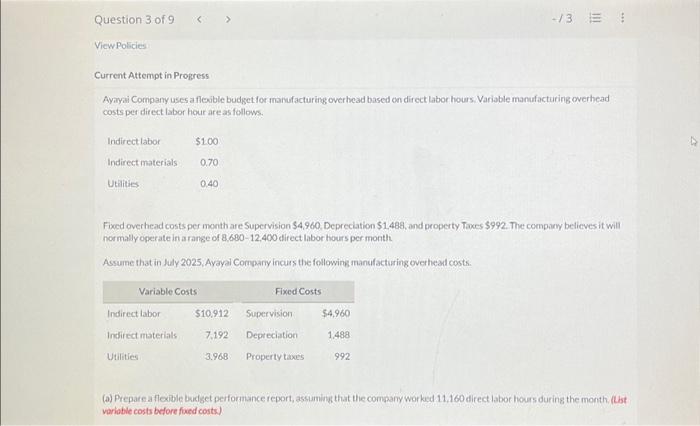

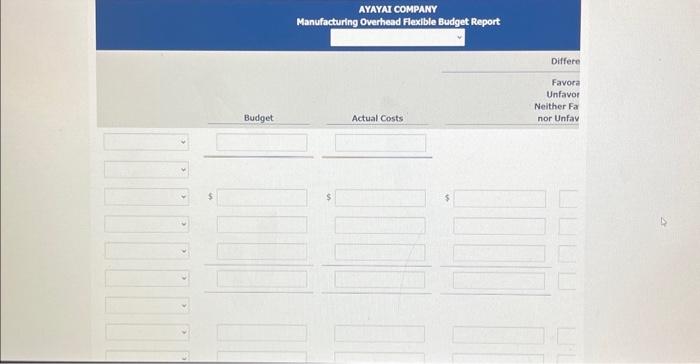

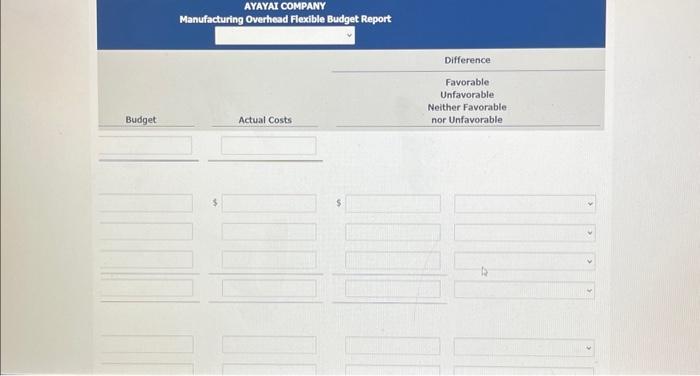

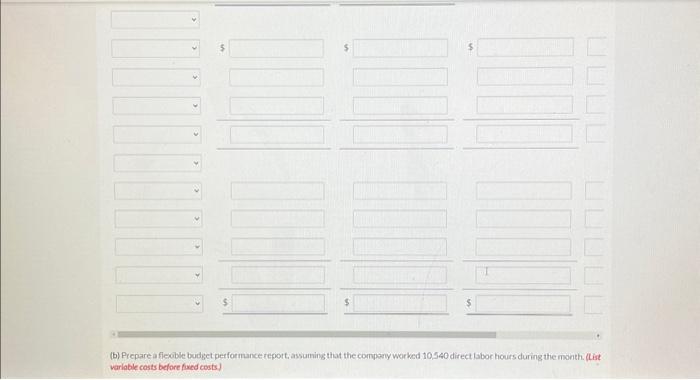

Question 3 of 9 View Policies Current Attempt in Progress Ayayai Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. Indirect labor Indirect materials Utilities Indirect labor $1.00 Variable Costs Indirect materials Utilities Fixed overhead costs per month are Supervision $4,960, Depreciation $1,488, and property Taxes $992. The company believes it will normally operate in a range of 8,680-12,400 direct labor hours per month. Assume that in July 2025, Ayayai Company incurs the following manufacturing overhead costs. 0.70 0.40 $10,912 7,192 3,968 Fixed Costs Supervision Depreciation Property taxes $4,960 -/3 : 1,488 992 (a) Prepare a flexible budget performance report, assuming that the company worked 11,160 direct labor hours during the month. (List variable costs before fixed costs.) K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started