Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: On 1 January 2003, JCR Ltd bought a machine for $220,000 which has an estimated useful life of 10 years and $20,000

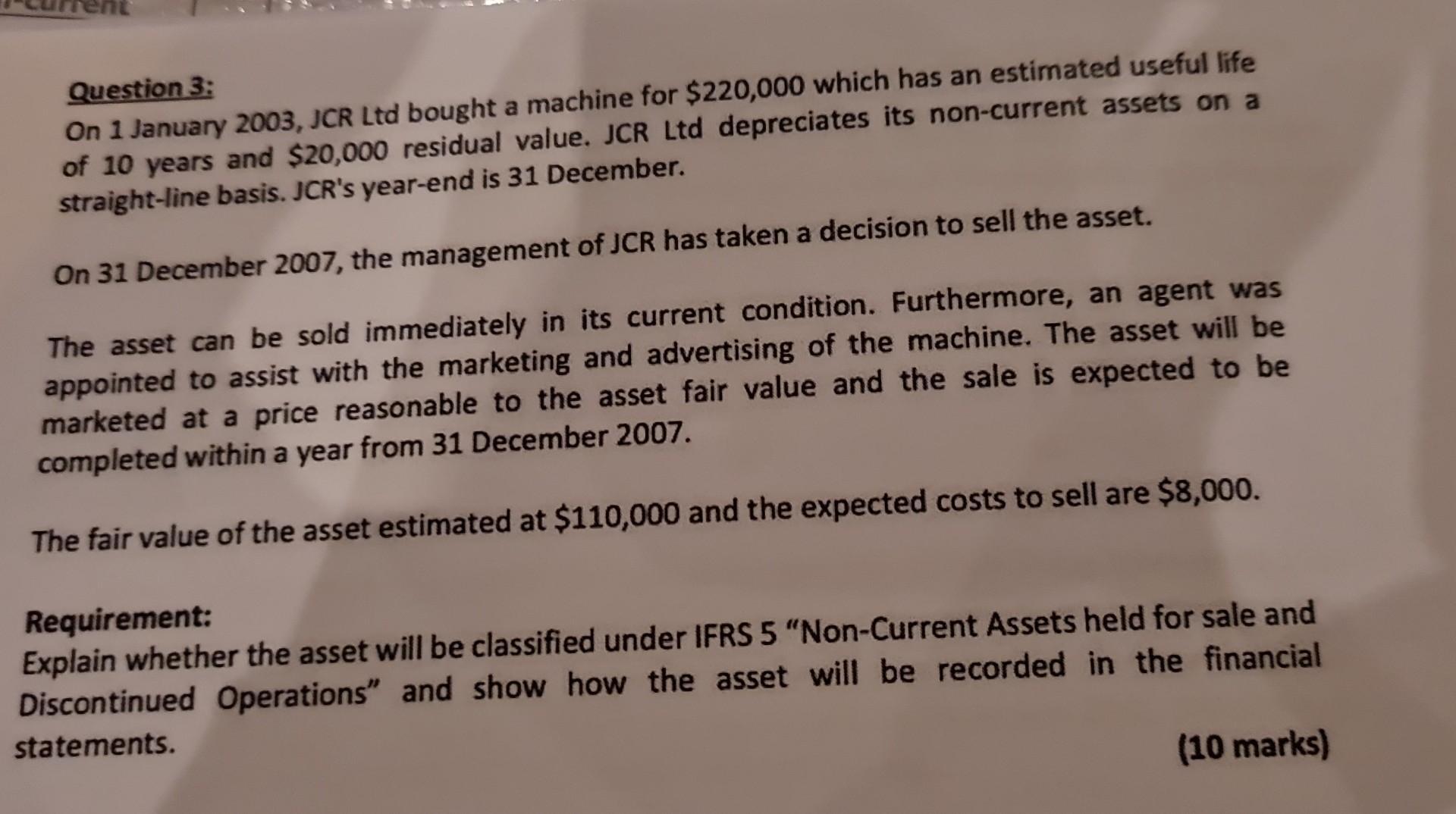

Question 3: On 1 January 2003, JCR Ltd bought a machine for $220,000 which has an estimated useful life of 10 years and $20,000 residual value. JCR Ltd depreciates its non-current assets on a straight-line basis. JCR's year-end is 31 December. On 31 December 2007, the management of JCR has taken a decision to sell the asset. The asset can be sold immediately in its current condition. Furthermore, an agent was appointed to assist with the marketing and advertising of the machine. The asset will be marketed at a price reasonable to the asset fair value and the sale is expected to be completed within a year from 31 December 2007. The fair value of the asset estimated at $110,000 and the expected costs to sell are $8,000. Requirement: Explain whether the asset will be classified under IFRS 5 "Non-Current Assets held for sale and Discontinued Operations" and show how the asset will be recorded in the financial statements. (10 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The asset held for sale should be carried on the books at the lower of its carrying value or its est...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started