Answered step by step

Verified Expert Solution

Question

1 Approved Answer

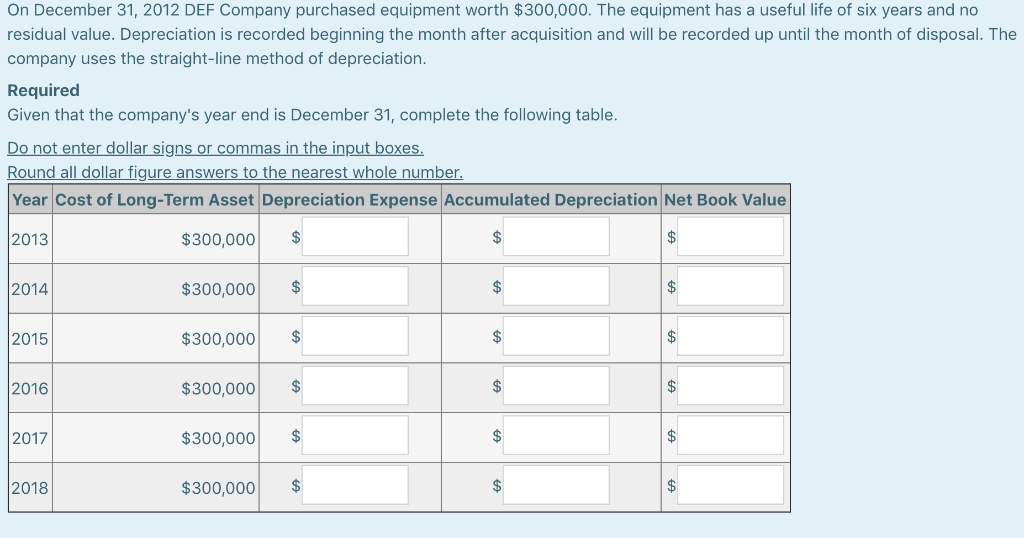

Question 3 :) On December 31, 2012 DEF Company purchased equipment worth $300,000. The equipment has a useful life of six years and no residual

Question 3 :)

On December 31, 2012 DEF Company purchased equipment worth $300,000. The equipment has a useful life of six years and no residual value. Depreciation is recorded beginning the month after acquisition and will be recorded up until the month of disposal. The company uses the straight-line method of depreciation. Required Given that the company's year end is December 31, complete the following table. Do not enter dollar signs or commas in the input boxes. Round all dollar figure answers to the nearest whole number. Year Cost of Long-Term Asset Depreciation Expense Accumulated Depreciation Net Book Value 2013 $300,000 A 2014 $300,000 2015 $300,000 A 2016 $300,000 A 2017 $300,000 2018 $300,000 A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started