Answered step by step

Verified Expert Solution

Question

1 Approved Answer

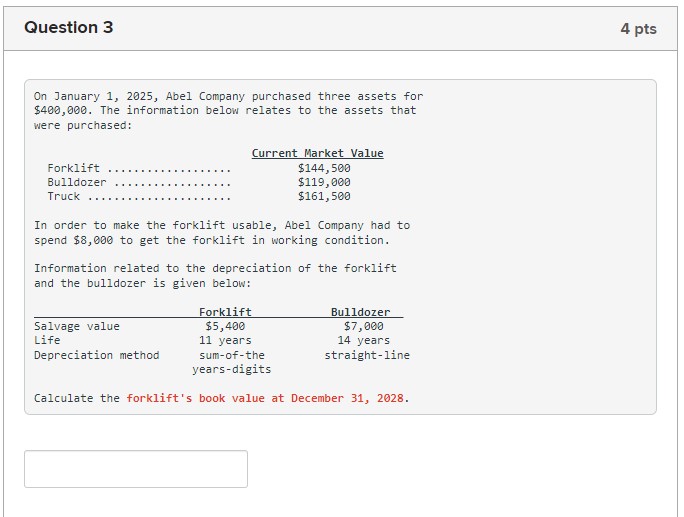

Question 3 On January 1, 2025, Abel Company purchased three assets for $400,000. The information below relates to the assets that were purchased: Forklift

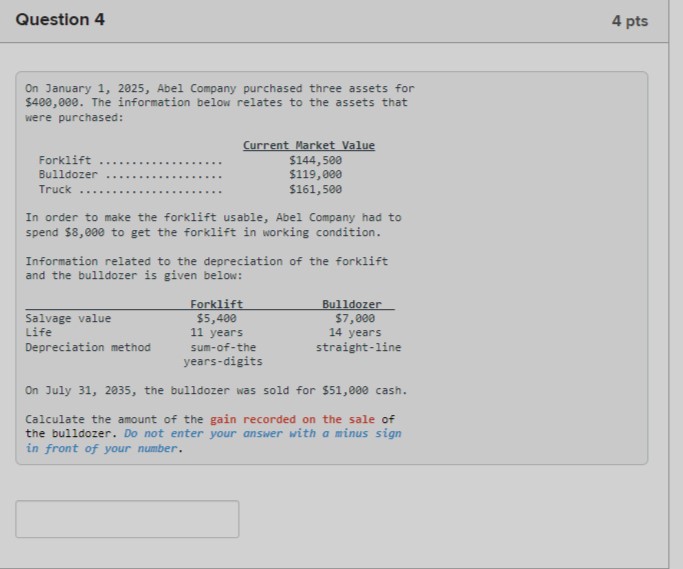

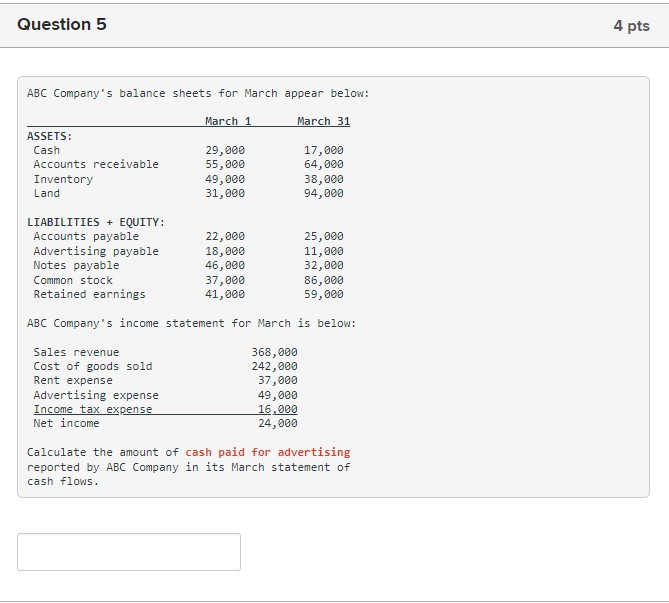

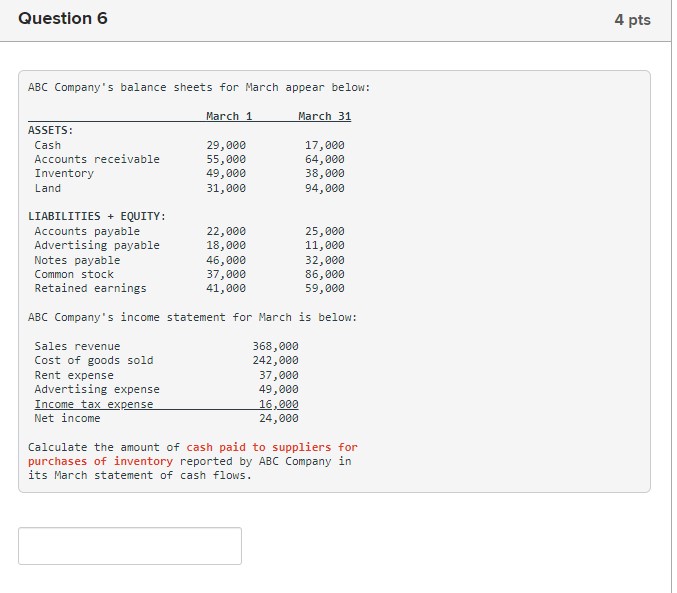

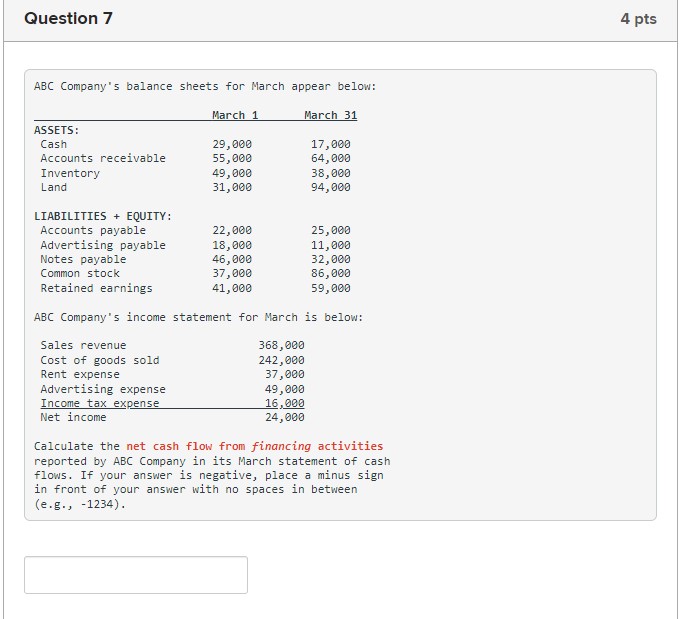

Question 3 On January 1, 2025, Abel Company purchased three assets for $400,000. The information below relates to the assets that were purchased: Forklift Bulldozer Truck Current Market Value $144,500 $119,000 $161,500 In order to make the forklift usable, Abel Company had to spend $8,000 to get the forklift in working condition. Information related to the depreciation of the forklift and the bulldozer is given below: Forklift Bulldozer Salvage value $5,400 Life 11 years Depreciation method $7,000 14 years straight-line sum-of-the years-digits Calculate the forklift's book value at December 31, 2028. 4 pts Question 4 On January 1, 2025, Abel Company purchased three assets for $400,000. The information below relates to the assets that were purchased: Forklift Bulldozer Truck Current Market Value $144,500 $119,000 $161,500 In order to make the forklift usable, Abel Company had to spend $8,000 to get the forklift in working condition. Information related to the depreciation of the forklift and the bulldozer is given below: Forklift Bulldozer Salvage value Life $5,400 11 years Depreciation method $7,000 14 years straight-line sum-of-the years-digits On July 31, 2035, the bulldozer was sold for $51,000 cash. Calculate the amount of the gain recorded on the sale of the bulldozer. Do not enter your answer with a minus sign in front of your number. 4 pts Question 5 ABC Company's balance sheets for March appear below: March 1 March 31 ASSETS: Cash 29,000 17,000 Accounts receivable 55,000 64,000 Inventory 49,000 38,000 Land 31,000 94,000 LIABILITIES + EQUITY: Accounts payable 22,000 25,000 Advertising payable 18,000 11,000 Notes payable 46,000 32,000 Common stock 37,000 86,000 Retained earnings 41,000 59,000 ABC Company's income statement for March is below: Sales revenue Cost of goods sold Rent expense Advertising expense Income tax expense Net income 368,000 242,000 37,000 49,000 16,000 24,000 Calculate the amount of cash paid for advertising reported by ABC Company in its March statement of cash flows. 4 pts Question 6 ABC Company's balance sheets for March appear below: March 1 March 31 ASSETS: Cash 29,000 17,000 Accounts receivable 55,000 64,000 Inventory 49,000 38,000 Land 31,000 94,000 LIABILITIES + EQUITY: Accounts payable 22,000 25,000 Advertising payable 18,000 11,000 Notes payable 46,000 32,000 Common stock 37,000 86,000 Retained earnings 41,000 59,000 ABC Company's income statement for March is below: Sales revenue Cost of goods sold Rent expense Advertising expense Income tax expense Net income 368,000 242,000 37,000 49,000 16,000 24,000 Calculate the amount of cash paid to suppliers for purchases of inventory reported by ABC Company in its March statement of cash flows. 4 pts Question 7 ABC Company's balance sheets for March appear below: March 1 March 31 ASSETS: Cash 29,000 17,000 Accounts receivable 55,000 64,000 Inventory 49,000 38,000 Land 31,000 94,000 LIABILITIES + EQUITY: Accounts payable 22,000 25,000 Advertising payable. 18,000 11,000 Notes payable 46,000 32,000 Common stock 37,000 86,000 Retained earnings 41,000 59,000 ABC Company's income statement for March is below: Sales revenue Cost of goods sold Rent expense Advertising expense Income tax expense Net income 368,000 242,000 37,000 49,000 16,000 24,000 Calculate the net cash flow from financing activities reported by ABC Company in its March statement of cash flows. If your answer is negative, place a minus sign in front of your answer with no spaces in between (e.g., -1234). 4 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started