Question

Question 3 Part 1 is based on B124 Book 2 Chapters 1, 2 and 3. (Completing Activity 2.1 in Chapter 2 of Book 2 and

Question 3 Part 1 is based on B124 Book 2 Chapters 1, 2 and 3. (Completing Activity 2.1 in Chapter 2 of Book 2 and the Self-assessed Question 1 (SAQ 1) at the end of Book 2 would be excellent preparation for this question.)

a.Frank owns and manages a small business, which sells doughnuts to various cafs. Frank manages all aspects of the business, including delivery and collection of the products. The business accounts are balanced at the end of each month.

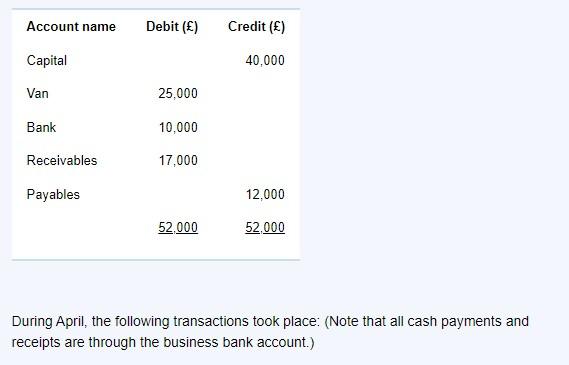

On 1 April the balances on his business accounts were as follows:

Required:

i.Set out Franks general ledger accounts at 1 April.

(5 marks)

ii.Continuing on, post to the relevant accounts the ten transactions that took place in April.

(10 marks)

iii.Balance off the general ledger accounts.

(5 marks)

iv.Present the trial balance at 1 May.

(5 marks)

v.Frank has not accounted for depreciation. Using your knowledge of accrual accounting, explain why a business should depreciate non-current assets.

(5 marks)

(30 marks in total)

b.Set out briefly how you have approached preparing for TMA 01, and explain what you plan to do differently when preparing for TMA 02, and why this is so. Use 180 words or fewer for your answer to this question.

(5 marks in total)

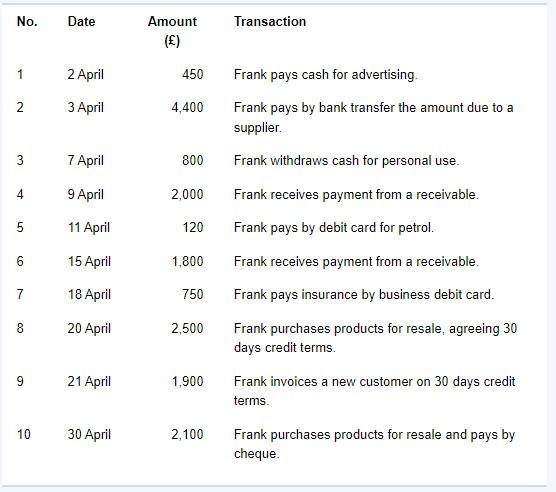

During April, the following transactions took place: (Note that all cash payments and receipts are through the business bank account.) No. Date Amount Transaction (E) days credit terms. 921 April 1,900 Frank invoices a new customer on 30 days credit terms. 10 30 April 2,100 Frank purchases products for resale and pays by chequeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started