Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: Part 1: On 1 Jan 2021 Co A acquires equipment for its manufacturing plant and receives a government grant of 200,000 towards

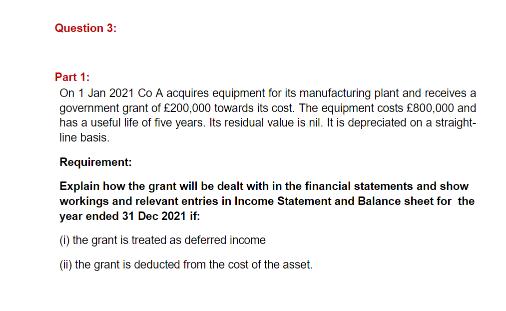

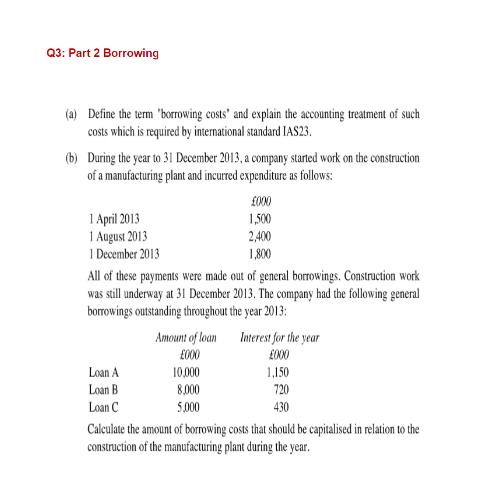

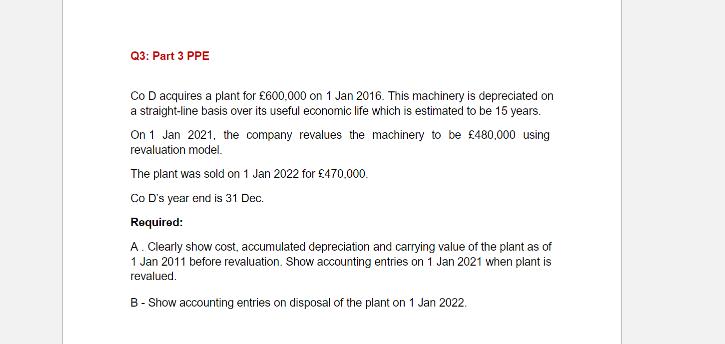

Question 3: Part 1: On 1 Jan 2021 Co A acquires equipment for its manufacturing plant and receives a government grant of 200,000 towards its cost. The equipment costs 800,000 and has a useful life of five years. Its residual value is nil. It is depreciated on a straight- line basis. Requirement: Explain how the grant will be dealt with in the financial statements and show workings and relevant entries in Income Statement and Balance sheet for the year ended 31 Dec 2021 if: (i) the grant is treated as deferred income (ii) the grant is deducted from the cost of the asset. Q3: Part 2 Borrowing (a) Define the term "borrowing costs' and explain the accounting treatment of such costs which is required by international standard IAS23. (b) During the year to 31 December 2013, a company started work on the construction of a manufacturing plant and incurred expenditure as follows: 1 April 2013 1 August 2013 1 December 2013 All of these payments were made out of general borrowings. Construction work was still underway at 31 December 2013. The company had the following general borrowings outstanding throughout the year 2013: Loan A Loan B Loan C Amount of loan 000 000 1,500 2,400 1,800 10,000 8,000 5,000 Interest for the year 000 1,150 720 430 Calculate the amount of borrowing costs that should be capitalised in relation to the construction of the manufacturing plant during the year. Q3: Part 2 Borrowing (a) Define the term "borrowing costs' and explain the accounting treatment of such costs which is required by international standard IAS23. (b) During the year to 31 December 2013, a company started work on the construction of a manufacturing plant and incurred expenditure as follows: 1 April 2013 1 August 2013 1 December 2013 All of these payments were made out of general borrowings. Construction work was still underway at 31 December 2013. The company had the following general borrowings outstanding throughout the year 2013: Loan A Loan B Loan C Amount of loan 000 000 1,500 2,400 1,800 10,000 8,000 5,000 Interest for the year 000 1,150 720 430 Calculate the amount of borrowing costs that should be capitalised in relation to the construction of the manufacturing plant during the year. Q3: Part 3 PPE Co D acquires a plant for 600,000 on 1 Jan 2016. This machinery is depreciated on a straight-line basis over its useful economic life which is estimated to be 15 years. On 1 Jan 2021, the company revalues the machinery to be 480,000 using revaluation model. The plant was sold on 1 Jan 2022 for 470,000. Co D's year end is 31 Dec. Required: A. Clearly show cost, accumulated depreciation and carrying value of the plant as of 1 Jan 2011 before revaluation. Show accounting entries on 1 Jan 2021 when plant is revalued. B - Show accounting entries on disposal of the plant on 1 Jan 2022.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started