Answered step by step

Verified Expert Solution

Question

1 Approved Answer

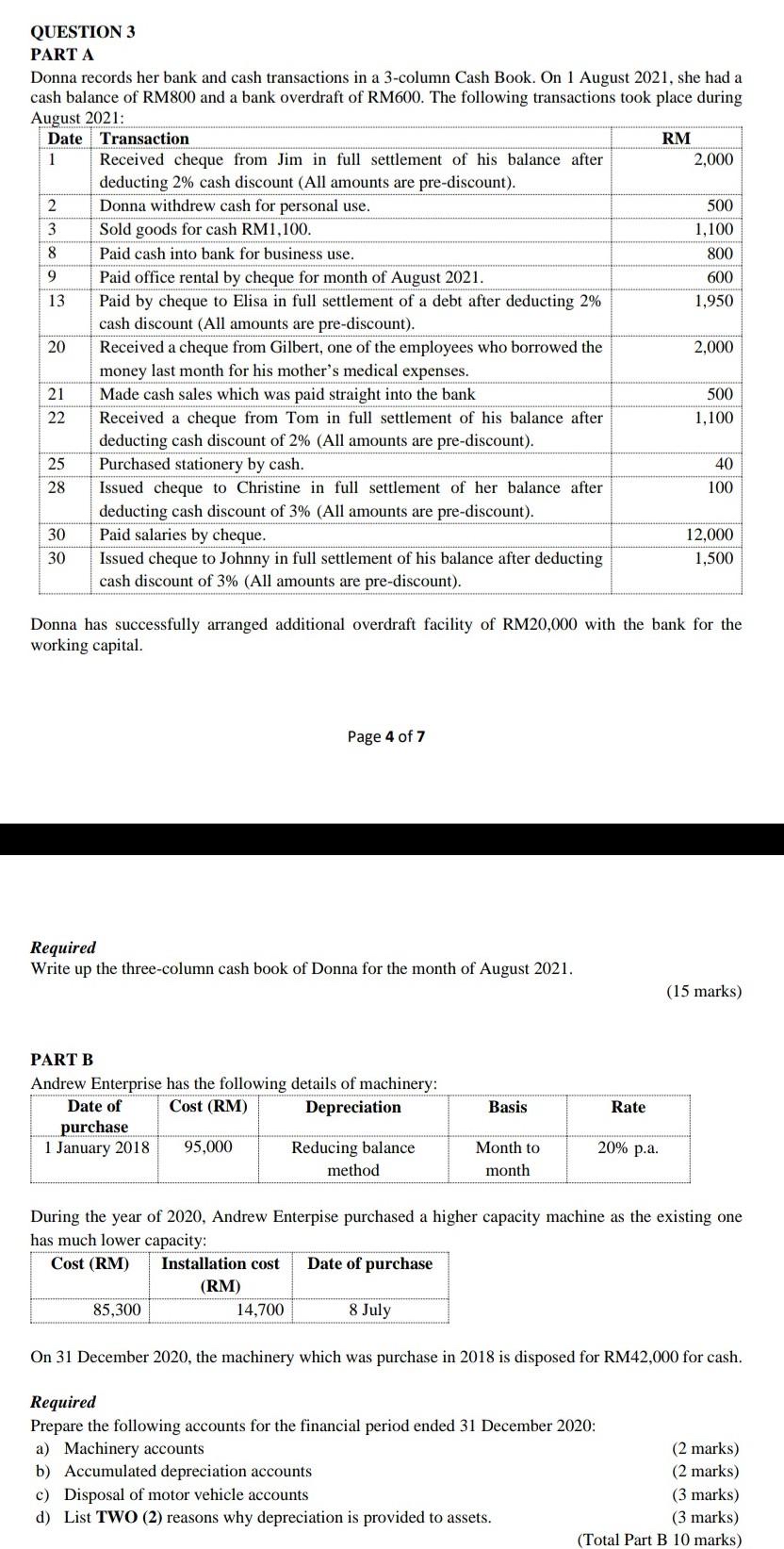

QUESTION 3 PART A Donna records her bank and cash transactions in a 3 - column Cash Book. On 1 August 2 0 2 1

QUESTION

PART A

Donna records her bank and cash transactions in a column Cash Book. On August she had a cash balance of RM and a bank overdraft of RM The following transactions took place during August :

tableDateTransaction,RMtableReceived cheque from Jim in full settlement of his balance afterdeducting cash discount All amounts are prediscountDonna withdrew cash for personal use.,Sold goods for cash RMPaid cash into bank for business use.,Paid office rental by cheque for month of August tablePaid by cheque to Elisa in full settlement of a debt after deducting cash discount All amounts are prediscounttableReceived a cheque from Gilbert, one of the employees who borrowed themoney last month for his mother's medical expenses.Made cash sales which was paid straight into the bank,tableReceived a cheque from Tom in full settlement of his balance afterdeducting cash discount of All amounts are prediscountPurchased stationery by cash.,tableIssued cheque to Christine in full settlement of her balance afterdeducting cash discount of All amounts are prediscountPaid salaries by cheque.,tableIssued cheque to Johnny in full settlement of his balance after deductingcash discount of All amounts are prediscount

Donna has successfully arranged additional overdraft facility of RM with the bank for the working capital.

Page of

Required

Write up the threecolumn cash book of Donna for the month of August

marks

PART B

Andrew Enterprise has the following details of machinery:

tabletableDate ofpurchaseCost RMDepreciation,Basis,Rate January tableReducing balancemethodtableMonth tomonth pa

During the year of Andrew Enterpise purchased a higher capacity machine as the existing one has much lower capacity:

tableCost RMtableInstallation costRMDate of purchase July

On December the machinery which was purchase in is disposed for RM for cash.

Required

Prepare the following accounts for the financial period ended December :

a Machinery accounts

marks

b Accumulated depreciation accounts

marks

c Disposal of motor vehicle accounts

marks

d List TWO reasons why depreciation is provided to assets.

marks

Total Part B marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started