Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3. Poppy had the following capital transactions during the tax year 2021/2022. On 3 July 2021 she sold a Daimler motor car for 20,000.

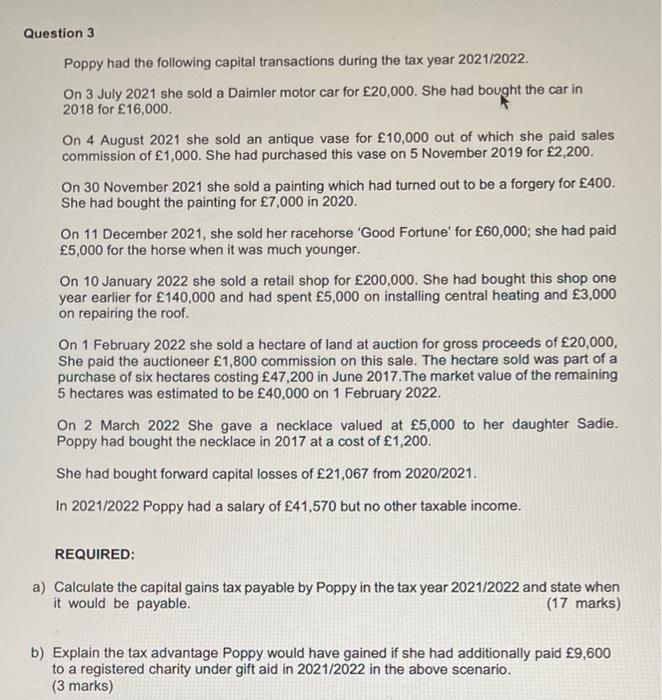

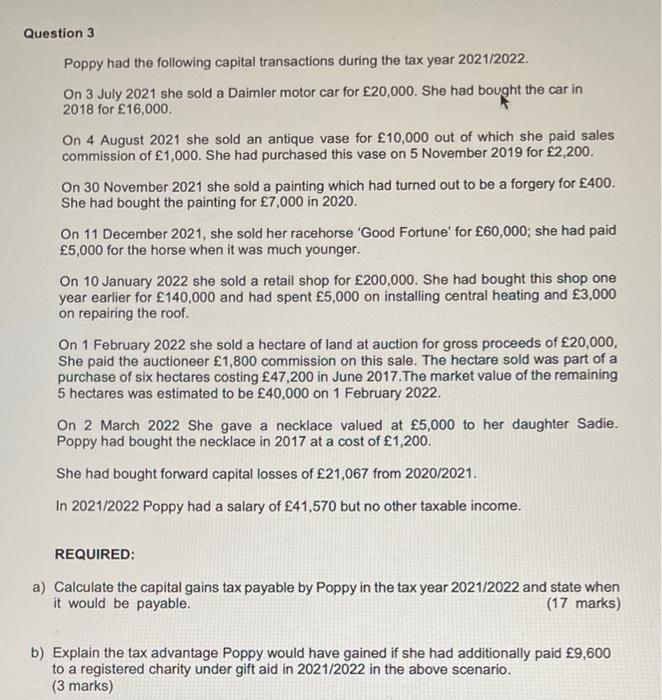

Question 3. Poppy had the following capital transactions during the tax year 2021/2022. On 3 July 2021 she sold a Daimler motor car for 20,000. She had bought the car in 2018 for 16,000. On 4 August 2021 she sold an antique vase for 10,000 out of which she paid sales commission of 1,000. She had purchased this vase on 5 November 2019 for 2,200. On 30 November 2021 she sold a painting which had turned out to be a forgery for 400. She had bought the painting for 7,000 in 2020. On 11 December 2021, she sold her racehorse 'Good Fortune' for 60,000; she had paid 5,000 for the horse when it was much younger. On 10 January 2022 she sold a retail shop for 200,000. She had bought this shop one year earlier for 140,000 and had spent 5,000 on installing central heating and 3,000 on repairing the roof. On 1 February 2022 she sold a hectare of land at auction for gross proceeds of 20,000, She paid the auctioneer 1,800 commission on this sale. The hectare sold was part of a purchase of six hectares costing 47,200 in June 2017. The market value of the remaining 5 hectares was estimated to be 40,000 on 1 February 2022. On 2 March 2022 She gave a necklace valued at 5,000 to her daughter Sadie. Poppy had bought the necklace in 2017 at a cost of 1,200. She had bought forward capital losses of 21,067 from 2020/2021. In 2021/2022 Poppy had a salary of 41,570 but no other taxable income. REQUIRED: a) Calculate the capital gains tax payable by Poppy in the tax year 2021/2022 and state when it would be payable. (17 marks) b) Explain the tax advantage Poppy would have gained if she had additionally paid 9,600 to a registered charity under gift aid in 2021/2022 in the above scenario. (3 marks) Question 3. Poppy had the following capital transactions during the tax year 2021/2022. On 3 July 2021 she sold a Daimler motor car for 20,000. She had bought the car in 2018 for 16,000. On 4 August 2021 she sold an antique vase for 10,000 out of which she paid sales commission of 1,000. She had purchased this vase on 5 November 2019 for 2,200. On 30 November 2021 she sold a painting which had turned out to be a forgery for 400. She had bought the painting for 7,000 in 2020. On 11 December 2021, she sold her racehorse 'Good Fortune' for 60,000; she had paid 5,000 for the horse when it was much younger. On 10 January 2022 she sold a retail shop for 200,000. She had bought this shop one year earlier for 140,000 and had spent 5,000 on installing central heating and 3,000 on repairing the roof. On 1 February 2022 she sold a hectare of land at auction for gross proceeds of 20,000, She paid the auctioneer 1,800 commission on this sale. The hectare sold was part of a purchase of six hectares costing 47,200 in June 2017. The market value of the remaining 5 hectares was estimated to be 40,000 on 1 February 2022. On 2 March 2022 She gave a necklace valued at 5,000 to her daughter Sadie. Poppy had bought the necklace in 2017 at a cost of 1,200. She had bought forward capital losses of 21,067 from 2020/2021. In 2021/2022 Poppy had a salary of 41,570 but no other taxable income. REQUIRED: a) Calculate the capital gains tax payable by Poppy in the tax year 2021/2022 and state when it would be payable. (17 marks) b) Explain the tax advantage Poppy would have gained if she had additionally paid 9,600 to a registered charity under gift aid in 2021/2022 in the above scenario

Question 3. Poppy had the following capital transactions during the tax year 2021/2022. On 3 July 2021 she sold a Daimler motor car for 20,000. She had bought the car in 2018 for 16,000. On 4 August 2021 she sold an antique vase for 10,000 out of which she paid sales commission of 1,000. She had purchased this vase on 5 November 2019 for 2,200. On 30 November 2021 she sold a painting which had turned out to be a forgery for 400. She had bought the painting for 7,000 in 2020. On 11 December 2021, she sold her racehorse 'Good Fortune' for 60,000; she had paid 5,000 for the horse when it was much younger. On 10 January 2022 she sold a retail shop for 200,000. She had bought this shop one year earlier for 140,000 and had spent 5,000 on installing central heating and 3,000 on repairing the roof. On 1 February 2022 she sold a hectare of land at auction for gross proceeds of 20,000, She paid the auctioneer 1,800 commission on this sale. The hectare sold was part of a purchase of six hectares costing 47,200 in June 2017. The market value of the remaining 5 hectares was estimated to be 40,000 on 1 February 2022. On 2 March 2022 She gave a necklace valued at 5,000 to her daughter Sadie. Poppy had bought the necklace in 2017 at a cost of 1,200. She had bought forward capital losses of 21,067 from 2020/2021. In 2021/2022 Poppy had a salary of 41,570 but no other taxable income. REQUIRED: a) Calculate the capital gains tax payable by Poppy in the tax year 2021/2022 and state when it would be payable. (17 marks) b) Explain the tax advantage Poppy would have gained if she had additionally paid 9,600 to a registered charity under gift aid in 2021/2022 in the above scenario. (3 marks) Question 3. Poppy had the following capital transactions during the tax year 2021/2022. On 3 July 2021 she sold a Daimler motor car for 20,000. She had bought the car in 2018 for 16,000. On 4 August 2021 she sold an antique vase for 10,000 out of which she paid sales commission of 1,000. She had purchased this vase on 5 November 2019 for 2,200. On 30 November 2021 she sold a painting which had turned out to be a forgery for 400. She had bought the painting for 7,000 in 2020. On 11 December 2021, she sold her racehorse 'Good Fortune' for 60,000; she had paid 5,000 for the horse when it was much younger. On 10 January 2022 she sold a retail shop for 200,000. She had bought this shop one year earlier for 140,000 and had spent 5,000 on installing central heating and 3,000 on repairing the roof. On 1 February 2022 she sold a hectare of land at auction for gross proceeds of 20,000, She paid the auctioneer 1,800 commission on this sale. The hectare sold was part of a purchase of six hectares costing 47,200 in June 2017. The market value of the remaining 5 hectares was estimated to be 40,000 on 1 February 2022. On 2 March 2022 She gave a necklace valued at 5,000 to her daughter Sadie. Poppy had bought the necklace in 2017 at a cost of 1,200. She had bought forward capital losses of 21,067 from 2020/2021. In 2021/2022 Poppy had a salary of 41,570 but no other taxable income. REQUIRED: a) Calculate the capital gains tax payable by Poppy in the tax year 2021/2022 and state when it would be payable. (17 marks) b) Explain the tax advantage Poppy would have gained if she had additionally paid 9,600 to a registered charity under gift aid in 2021/2022 in the above scenario

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started