Question

Question 3 Prodon Company (PRO) is considering the acquisition of Toyata Corporation (TOY) with common stock. Relevant financial information is as follows: PRO RM11,340

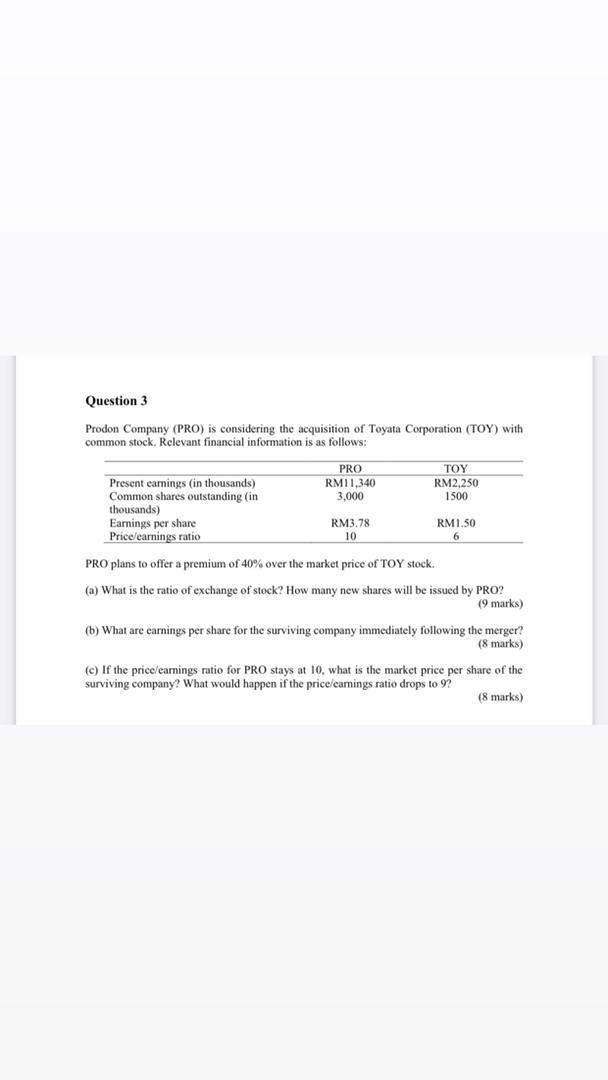

Question 3 Prodon Company (PRO) is considering the acquisition of Toyata Corporation (TOY) with common stock. Relevant financial information is as follows: PRO RM11,340 3,000 RM2,250 1500 Present earnings (in thousands) Common shares outstanding (in thousands) Earnings per share Price/earnings ratio PRO plans to offer a premium of 40% over the market price of TOY stock. (a) What is the ratio of exchange of stock? How many new shares will be issued by PRO? (9 marks) RM3.78 10 RM1.50 6 (b) What are earnings per share for the surviving company immediately following the merger? (8 marks) (c) If the price/earnings ratio for PRO stays at 10, what is the market price per share of the surviving company? What would happen if the price/earnings ratio drops to 9? (8 marks)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ

6th Canadian edition

978-0132893534, 9780133389401, 132893533, 133389405, 978-0133392883

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App