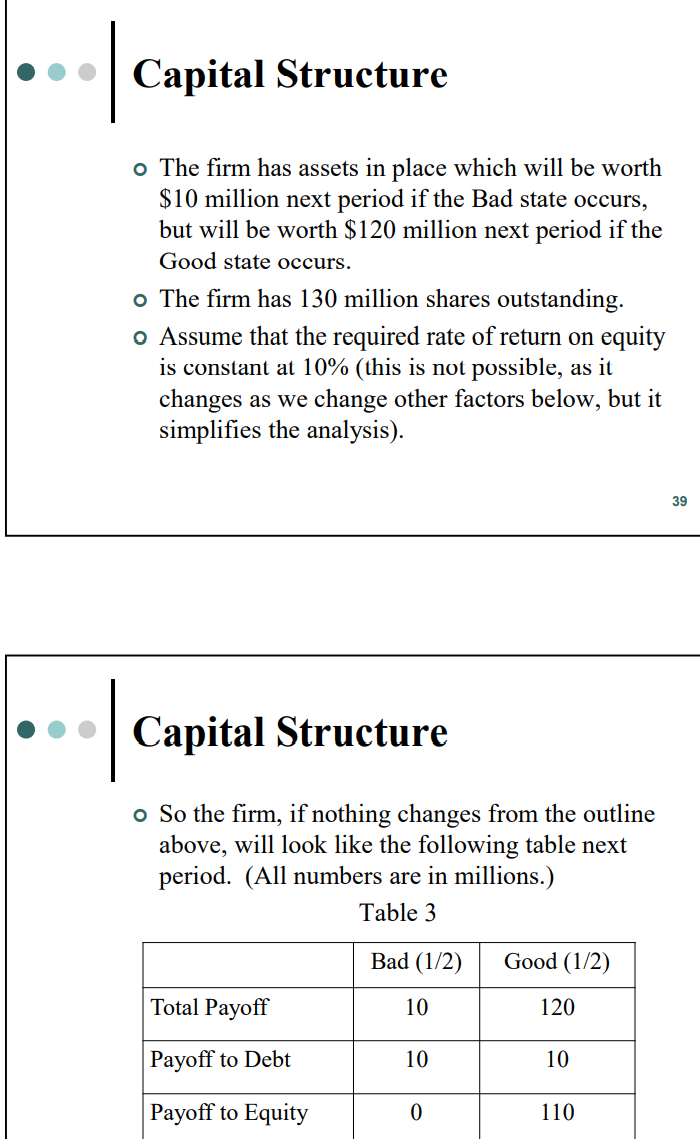

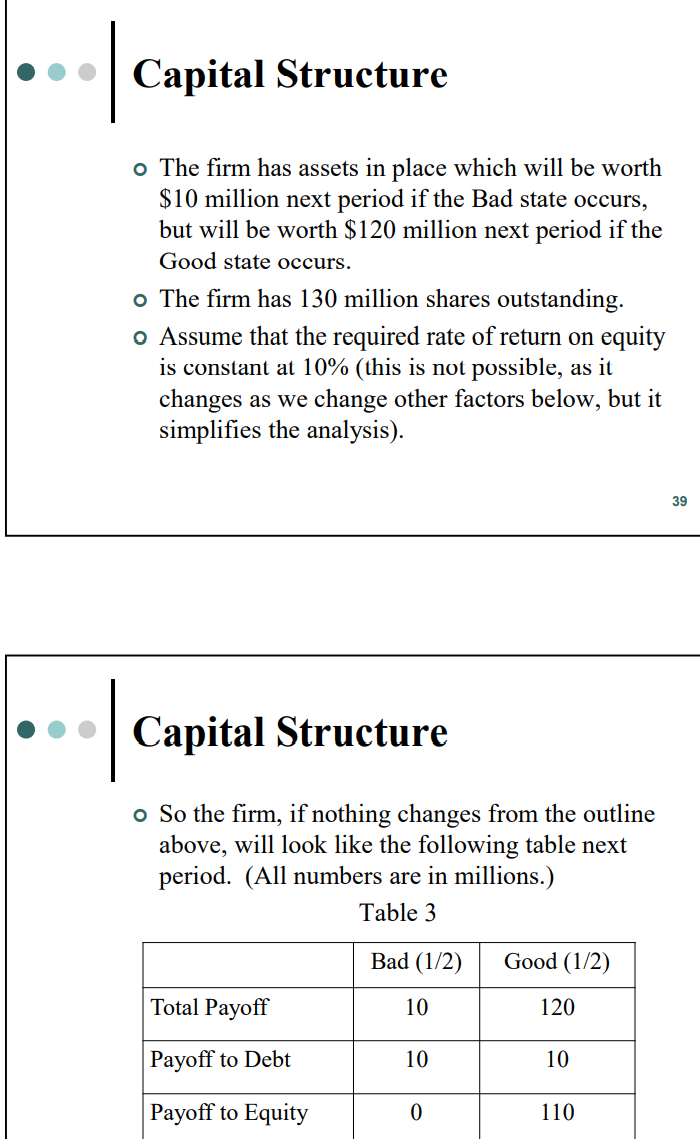

Question 3: Project Decision under Asymmetric Information In the lecture note part I, now suppose the firm has an opportunity to do a project which costs $100 M, and has payoffs of: $99 M next period if Bad state occurs, and $184 M next period if Good state occurs. (f) What is the difference between this example and the one in the lecture notes? The following questions illustrate some possible conflicts between equity holders and debt holders. Capital Structure o The firm has assets in place which will be worth $10 million next period if the Bad state occurs, but will be worth $120 million next period if the Good state occurs. o The firm has 130 million shares outstanding. o Assume that the required rate of return on equity is constant at 10% (this is not possible, as it changes as we change other factors below, but it simplifies the analysis). 39 . Capital Structure o So the firm, if nothing changes from the outline above, will look like the following table next period. (All numbers are in millions.) Table 3 Bad (1/2) Good (1/2) Total Payoff 10 120 Payoff to Debt 10 10 Payoff to Equity 0 110 Question 3: Project Decision under Asymmetric Information In the lecture note part I, now suppose the firm has an opportunity to do a project which costs $100 M, and has payoffs of: $99 M next period if Bad state occurs, and $184 M next period if Good state occurs. (f) What is the difference between this example and the one in the lecture notes? The following questions illustrate some possible conflicts between equity holders and debt holders. Capital Structure o The firm has assets in place which will be worth $10 million next period if the Bad state occurs, but will be worth $120 million next period if the Good state occurs. o The firm has 130 million shares outstanding. o Assume that the required rate of return on equity is constant at 10% (this is not possible, as it changes as we change other factors below, but it simplifies the analysis). 39 . Capital Structure o So the firm, if nothing changes from the outline above, will look like the following table next period. (All numbers are in millions.) Table 3 Bad (1/2) Good (1/2) Total Payoff 10 120 Payoff to Debt 10 10 Payoff to Equity 0 110