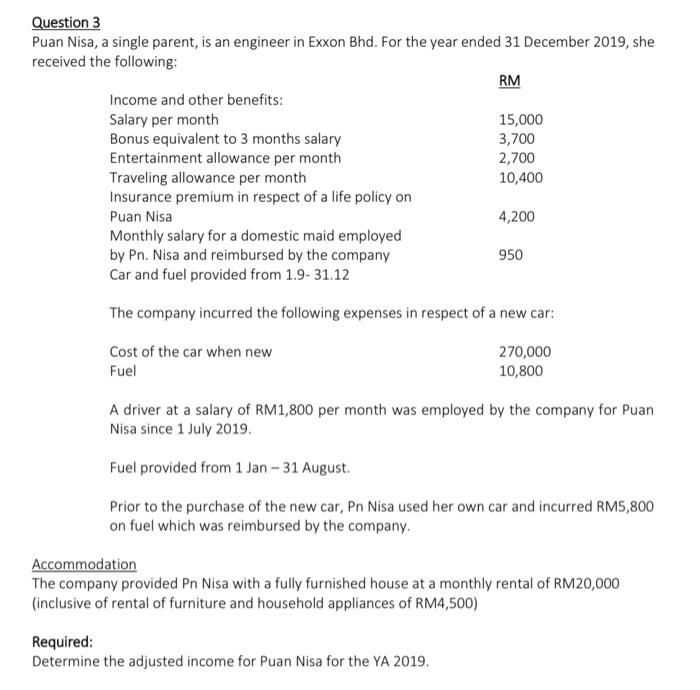

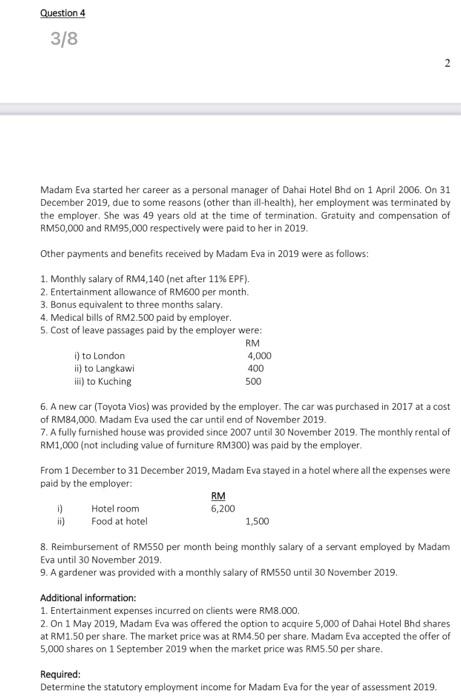

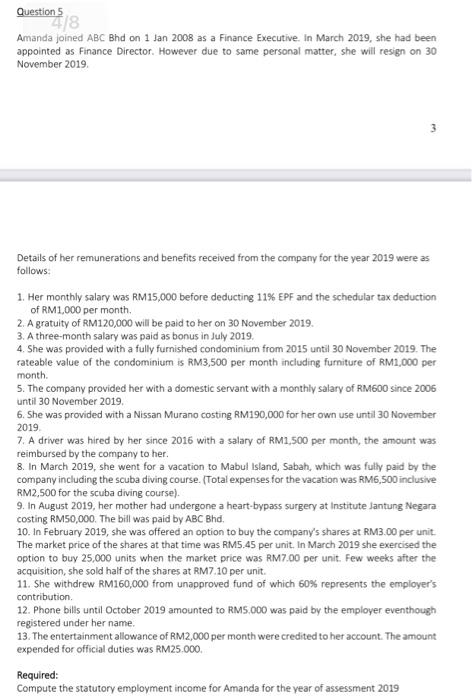

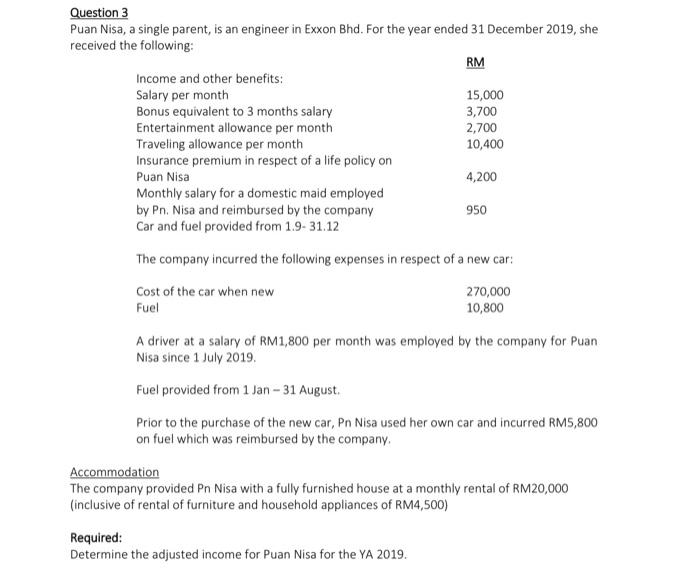

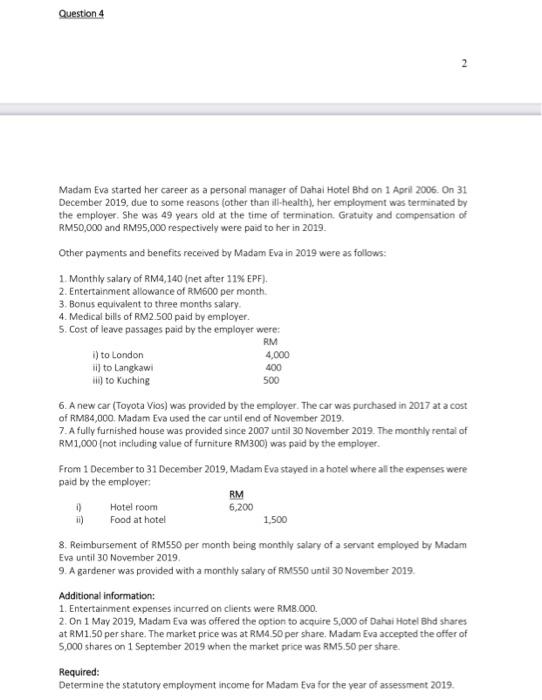

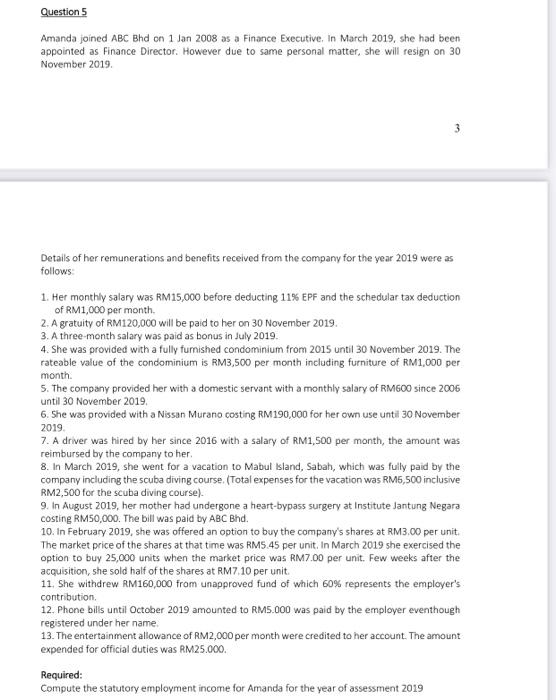

Question 3 Puan Nisa, a single parent, is an engineer in Exxon Bhd. For the year ended 31 December 2019, she received the following: RM Income and other benefits: Salary per month 15,000 Bonus equivalent to 3 months salary 3,700 Entertainment allowance per month 2,700 Traveling allowance per month 10,400 Insurance premium in respect of a life policy on Puan Nisa 4,200 Monthly salary for a domestic maid employed by Pn. Nisa and reimbursed by the company 950 Car and fuel provided from 1.9- 31.12 The company incurred the following expenses in respect of a new car: Cost of the car when new Fuel 270,000 10,800 A driver at a salary of RM1,800 per month was employed by the company for Puan Nisa since 1 July 2019 Fuel provided from 1 Jan - 31 August. Prior to the purchase of the new car, Pn Nisa used her own car and incurred RM5,800 on fuel which was reimbursed by the company. Accommodation The company provided Pn Nisa with a fully furnished house at a monthly rental of RM20,000 (inclusive of rental of furniture and household appliances of RM4,500) Required: Determine the adjusted income for Puan Nisa for the YA 2019. Question 4 3/8 2 Madam Eva started her career as a personal manager of Dahai Hotel Bhd on 1 April 2006. On 31 December 2019, due to some reasons (other than ill-health), her employment was terminated by the employer. She was 49 years old at the time of termination Gratuity and compensation of RM50,000 and RM95,000 respectively were paid to her in 2019. Other payments and benefits received by Madam Eva in 2019 were as follows: 1. Monthly salary of RM4,140 (net after 11% EPF). 2. Entertainment allowance of RM600 per month. 3. Bonus equivalent to three months salary 4. Medical bills of RM2.500 paid by employer. 5. Cost of leave passages paid by the employer were: RM ) to London 4,000 ii) to Langkawi 400 liti) to Kuching 500 6. A new car (Toyota Vios) was provided by the employer. The car was purchased in 2017 at a cost of RM84,000. Madam Eva used the car until end of November 2019. 7. A fully furnished house was provided since 2007 until 30 November 2019. The monthly rental of RM1,000 (not including value of furniture RM300) was paid by the employer From 1 December to 31 December 2019, Madam Eva stayed in a hotel where all the expenses were paid by the employer: RM o) Hotel room 6,200 Food at hotel 1.500 8. Reimbursement of RM550 per month being monthly salary of a servant employed by Madam Eva until 30 November 2019. 9. A gardener was provided with a monthly salary of RM550 until 30 November 2019. Additional information: 1. Entertainment expenses incurred on clients were RM8.000. 2. On 1 May 2019, Madam Eva was offered the option to acquire 5,000 of Dahai Hotel Bhd shares at RM1.50 per share. The market price was at RM4.50 per share. Madam Eva accepted the offer of 5,000 shares on 1 September 2019 when the market price was RM5.50 per share. Required: Determine the statutory employment income for Madam Eva for the year of assessment 2019. Questions Amanda joined ABC Bhd on 1 Jan 2008 as a Finance Executive. In March 2019, she had been appointed as Finance Director. However due to same personal matter, she will resign on 30 November 2019 3 Details of her remunerations and benefits received from the company for the year 2019 were as follows: 1. Her monthly salary was RM 15,000 before deducting 11% EPF and the schedular tax deduction of RM1,000 per month 2. A gratuity of RM120,000 will be paid to her on 30 November 2019. 3. A three-month salary was paid as bonus in July 2019. 4. She was provided with a fully furnished condominium from 2015 until 30 November 2019. The rateable value of the condominium is RM3,500 per month including furniture of RM1,000 per month. 5. The company provided her with a domestic servant with a monthly salary of RM600 since 2006 until 30 November 2019. 6. She was provided with a Nissan Murano costing RM190,000 for her own use until 30 November 2019 7. A driver was hired by her since 2016 with a salary of RM1,500 per month, the amount was reimbursed by the company to her. 8. In March 2019, she went for a vacation to Mabul Island, Sabah, which was fully paid by the company including the scuba diving course. (Total expenses for the vacation was RM5,500 inclusive RM2,500 for the scuba diving course). 9. In August 2019, her mother had undergone a heart-bypass surgery at Institute Jantung Negara costing RM50,000. The bill was paid by ABC Bhd, 10. In February 2019, she was offered an option to buy the company's shares at RM3.00 per unit The market price of the shares at that time was RM5.45 per unit. In March 2019 she exercised the option to buy 25,000 units when the market price was RM7.00 per unit. Few weeks after the acquisition, she sold half of the shares at RM7.10 per unit. 11. She withdrew RM160,000 from unapproved fund of which 60% represents the employer's contribution. 12. Phone bills until October 2019 amounted to RM5.000 was paid by the employer eventhough registered under her name. 13. The entertainment allowance of RM2,000 per month were credited to her account. The an amount expended for official duties was RM25.000 Required: Compute the statutory employment income for Amanda for the year of assessment 2019 Question 3 Puan Nisa, a single parent, is an engineer in Exxon Bhd. For the year ended 31 December 2019, she received the following: RM Income and other benefits: Salary per month 15,000 Bonus equivalent to 3 months salary 3,700 Entertainment allowance per month 2,700 Traveling allowance per month 10,400 Insurance premium in respect of a life policy on Puan Nisa 4,200 Monthly salary for a domestic maid employed by Pn. Nisa and reimbursed by the company Car and fuel provided from 1.9-31.12 The company incurred the following expenses in respect of a new car: Cost of the car when new 270,000 Fuel 10,800 950 A driver at a salary of RM 1,800 per month was employed by the company for Puan Nisa since 1 July 2019. Fuel provided from 1 Jan - 31 August Prior to the purchase of the new car, Pn Nisa used her own car and incurred RM5,800 on fuel which was reimbursed by the company, Accommodation The company provided Pn Nisa with a fully furnished house at a monthly rental of RM20,000 (inclusive of rental of furniture and household appliances of RM4,500) Required: Determine the adjusted income for Puan Nisa for the YA 2019. Question 5 Amanda joined ABC Bhd on 1 Jan 2008 as a Finance Executive, in March 2019, she had been appointed as Finance Director. However due to same personal matter, she will resign on 30 November 2019 3 month Details of her remunerations and benefits received from the company for the year 2019 were as follows 1. Her monthly salary was RM15,000 before deducting 11% EPF and the schedular tax deduction of RM1,000 per month 2. A gratuity of RM120,000 will be paid to her on 30 November 2019. 3. A three month salary was paid as bonus in July 2019. 4. She was provided with a fully furnished condominium from 2015 until 30 November 2019. The rateable value of the condominium is RM3,500 per month including furniture of RM1,000 per 5. The company provided her with a domestic servant with a monthly salary of RMGOO since 2006 until 30 November 2019 6. She was provided with a Nissan Murano costing RM 190,000 for her own use until 30 November 2019 7. A driver was hired by her since 2016 with a salary of RM1,500 per month, the amount was reimbursed by the company to her 8. In March 2019, she went for a vacation to Mabul Island, Sabah, which was fully paid by the company including the scuba diving course. (Total expenses for the vacation was RM5,500 inclusive RM2,500 for the scuba diving course). 9. In August 2019, her mother had undergone a heart-bypass surgery at Institute Jantung Negara costing RM50,000. The bill was paid by ABC Bhd. 10. In February 2019, she was offered an option to buy the company's shares at RM3.00 per unit The market price of the shares at that time was RM5.45 per unit. In March 2019 she exercised the option to buy 25,000 units when the market price was RM7.00 per unit. Few weeks after the acquisition, she sold half of the shares at RM 7.10 per unit 11. She withdrew RM160,000 from unapproved fund of which 60% represents the employer's contribution 12. Phone bills until October 2019 amounted to RM5.000 was paid by the employer eventhough registered under her name 13. The entertainment allowance of RM2,000 per month were credited to her account. The amount expended for official duties was RM25.000. Required: Compute the statutory employment income for Amanda for the year of assessment 2019 Question 3 Puan Nisa, a single parent, is an engineer in Exxon Bhd. For the year ended 31 December 2019, she received the following: RM Income and other benefits: Salary per month 15,000 Bonus equivalent to 3 months salary 3,700 Entertainment allowance per month 2,700 Traveling allowance per month 10,400 Insurance premium in respect of a life policy on Puan Nisa 4,200 Monthly salary for a domestic maid employed by Pn. Nisa and reimbursed by the company 950 Car and fuel provided from 1.9- 31.12 The company incurred the following expenses in respect of a new car: Cost of the car when new Fuel 270,000 10,800 A driver at a salary of RM1,800 per month was employed by the company for Puan Nisa since 1 July 2019 Fuel provided from 1 Jan - 31 August. Prior to the purchase of the new car, Pn Nisa used her own car and incurred RM5,800 on fuel which was reimbursed by the company. Accommodation The company provided Pn Nisa with a fully furnished house at a monthly rental of RM20,000 (inclusive of rental of furniture and household appliances of RM4,500) Required: Determine the adjusted income for Puan Nisa for the YA 2019. Question 4 3/8 2 Madam Eva started her career as a personal manager of Dahai Hotel Bhd on 1 April 2006. On 31 December 2019, due to some reasons (other than ill-health), her employment was terminated by the employer. She was 49 years old at the time of termination Gratuity and compensation of RM50,000 and RM95,000 respectively were paid to her in 2019. Other payments and benefits received by Madam Eva in 2019 were as follows: 1. Monthly salary of RM4,140 (net after 11% EPF). 2. Entertainment allowance of RM600 per month. 3. Bonus equivalent to three months salary 4. Medical bills of RM2.500 paid by employer. 5. Cost of leave passages paid by the employer were: RM ) to London 4,000 ii) to Langkawi 400 liti) to Kuching 500 6. A new car (Toyota Vios) was provided by the employer. The car was purchased in 2017 at a cost of RM84,000. Madam Eva used the car until end of November 2019. 7. A fully furnished house was provided since 2007 until 30 November 2019. The monthly rental of RM1,000 (not including value of furniture RM300) was paid by the employer From 1 December to 31 December 2019, Madam Eva stayed in a hotel where all the expenses were paid by the employer: RM o) Hotel room 6,200 Food at hotel 1.500 8. Reimbursement of RM550 per month being monthly salary of a servant employed by Madam Eva until 30 November 2019. 9. A gardener was provided with a monthly salary of RM550 until 30 November 2019. Additional information: 1. Entertainment expenses incurred on clients were RM8.000. 2. On 1 May 2019, Madam Eva was offered the option to acquire 5,000 of Dahai Hotel Bhd shares at RM1.50 per share. The market price was at RM4.50 per share. Madam Eva accepted the offer of 5,000 shares on 1 September 2019 when the market price was RM5.50 per share. Required: Determine the statutory employment income for Madam Eva for the year of assessment 2019. Questions Amanda joined ABC Bhd on 1 Jan 2008 as a Finance Executive. In March 2019, she had been appointed as Finance Director. However due to same personal matter, she will resign on 30 November 2019 3 Details of her remunerations and benefits received from the company for the year 2019 were as follows: 1. Her monthly salary was RM 15,000 before deducting 11% EPF and the schedular tax deduction of RM1,000 per month 2. A gratuity of RM120,000 will be paid to her on 30 November 2019. 3. A three-month salary was paid as bonus in July 2019. 4. She was provided with a fully furnished condominium from 2015 until 30 November 2019. The rateable value of the condominium is RM3,500 per month including furniture of RM1,000 per month. 5. The company provided her with a domestic servant with a monthly salary of RM600 since 2006 until 30 November 2019. 6. She was provided with a Nissan Murano costing RM190,000 for her own use until 30 November 2019 7. A driver was hired by her since 2016 with a salary of RM1,500 per month, the amount was reimbursed by the company to her. 8. In March 2019, she went for a vacation to Mabul Island, Sabah, which was fully paid by the company including the scuba diving course. (Total expenses for the vacation was RM5,500 inclusive RM2,500 for the scuba diving course). 9. In August 2019, her mother had undergone a heart-bypass surgery at Institute Jantung Negara costing RM50,000. The bill was paid by ABC Bhd, 10. In February 2019, she was offered an option to buy the company's shares at RM3.00 per unit The market price of the shares at that time was RM5.45 per unit. In March 2019 she exercised the option to buy 25,000 units when the market price was RM7.00 per unit. Few weeks after the acquisition, she sold half of the shares at RM7.10 per unit. 11. She withdrew RM160,000 from unapproved fund of which 60% represents the employer's contribution. 12. Phone bills until October 2019 amounted to RM5.000 was paid by the employer eventhough registered under her name. 13. The entertainment allowance of RM2,000 per month were credited to her account. The an amount expended for official duties was RM25.000 Required: Compute the statutory employment income for Amanda for the year of assessment 2019 Question 3 Puan Nisa, a single parent, is an engineer in Exxon Bhd. For the year ended 31 December 2019, she received the following: RM Income and other benefits: Salary per month 15,000 Bonus equivalent to 3 months salary 3,700 Entertainment allowance per month 2,700 Traveling allowance per month 10,400 Insurance premium in respect of a life policy on Puan Nisa 4,200 Monthly salary for a domestic maid employed by Pn. Nisa and reimbursed by the company Car and fuel provided from 1.9-31.12 The company incurred the following expenses in respect of a new car: Cost of the car when new 270,000 Fuel 10,800 950 A driver at a salary of RM 1,800 per month was employed by the company for Puan Nisa since 1 July 2019. Fuel provided from 1 Jan - 31 August Prior to the purchase of the new car, Pn Nisa used her own car and incurred RM5,800 on fuel which was reimbursed by the company, Accommodation The company provided Pn Nisa with a fully furnished house at a monthly rental of RM20,000 (inclusive of rental of furniture and household appliances of RM4,500) Required: Determine the adjusted income for Puan Nisa for the YA 2019. Question 5 Amanda joined ABC Bhd on 1 Jan 2008 as a Finance Executive, in March 2019, she had been appointed as Finance Director. However due to same personal matter, she will resign on 30 November 2019 3 month Details of her remunerations and benefits received from the company for the year 2019 were as follows 1. Her monthly salary was RM15,000 before deducting 11% EPF and the schedular tax deduction of RM1,000 per month 2. A gratuity of RM120,000 will be paid to her on 30 November 2019. 3. A three month salary was paid as bonus in July 2019. 4. She was provided with a fully furnished condominium from 2015 until 30 November 2019. The rateable value of the condominium is RM3,500 per month including furniture of RM1,000 per 5. The company provided her with a domestic servant with a monthly salary of RMGOO since 2006 until 30 November 2019 6. She was provided with a Nissan Murano costing RM 190,000 for her own use until 30 November 2019 7. A driver was hired by her since 2016 with a salary of RM1,500 per month, the amount was reimbursed by the company to her 8. In March 2019, she went for a vacation to Mabul Island, Sabah, which was fully paid by the company including the scuba diving course. (Total expenses for the vacation was RM5,500 inclusive RM2,500 for the scuba diving course). 9. In August 2019, her mother had undergone a heart-bypass surgery at Institute Jantung Negara costing RM50,000. The bill was paid by ABC Bhd. 10. In February 2019, she was offered an option to buy the company's shares at RM3.00 per unit The market price of the shares at that time was RM5.45 per unit. In March 2019 she exercised the option to buy 25,000 units when the market price was RM7.00 per unit. Few weeks after the acquisition, she sold half of the shares at RM 7.10 per unit 11. She withdrew RM160,000 from unapproved fund of which 60% represents the employer's contribution 12. Phone bills until October 2019 amounted to RM5.000 was paid by the employer eventhough registered under her name 13. The entertainment allowance of RM2,000 per month were credited to her account. The amount expended for official duties was RM25.000. Required: Compute the statutory employment income for Amanda for the year of assessment 2019