Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 3) question 5) question 7) question 9) question 10) A company set up Jane Smith as an independent contractor. Jane Smith will also appear

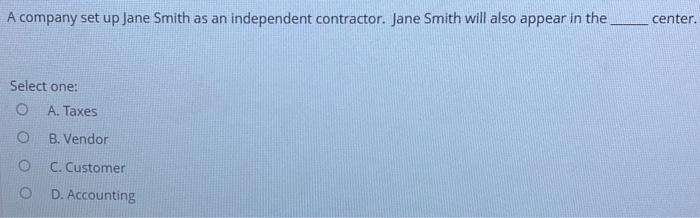

question 3)

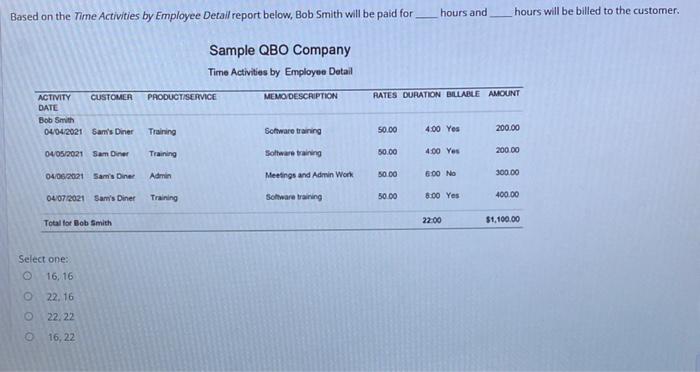

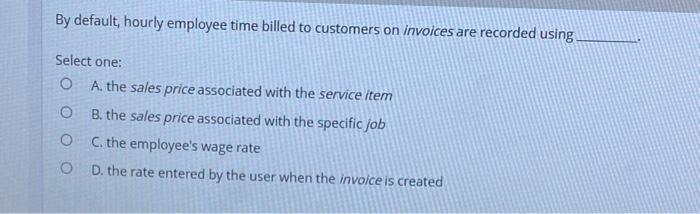

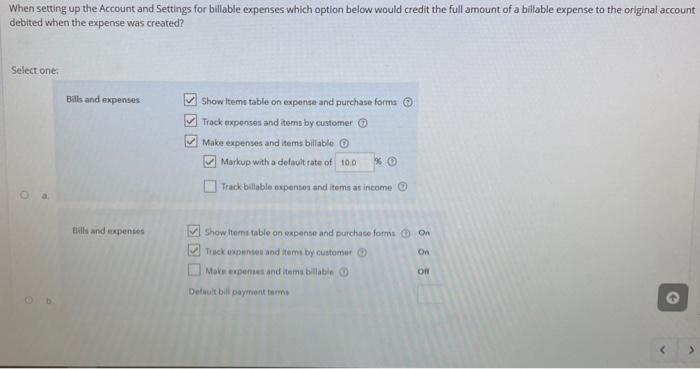

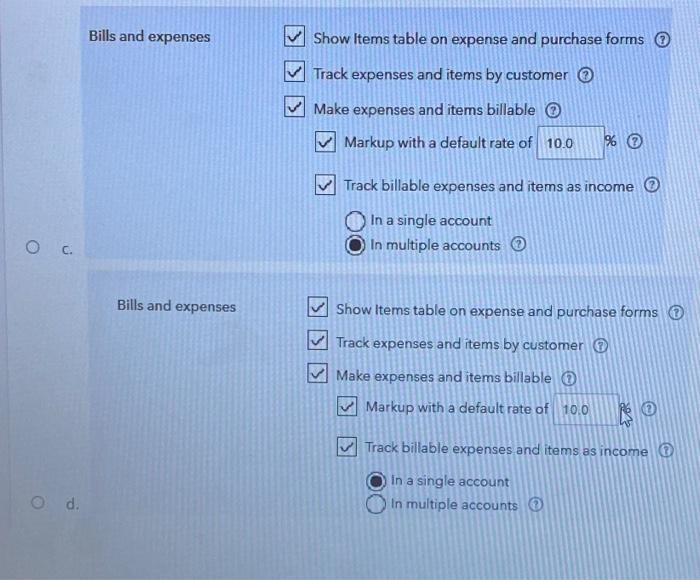

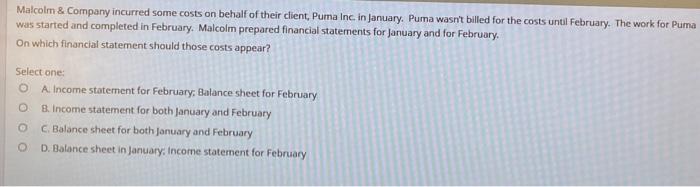

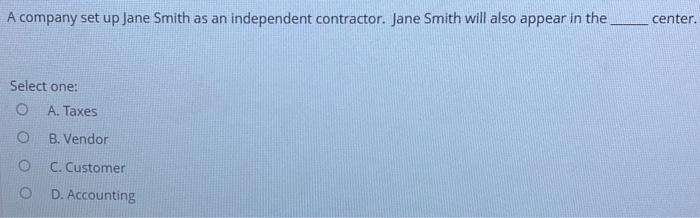

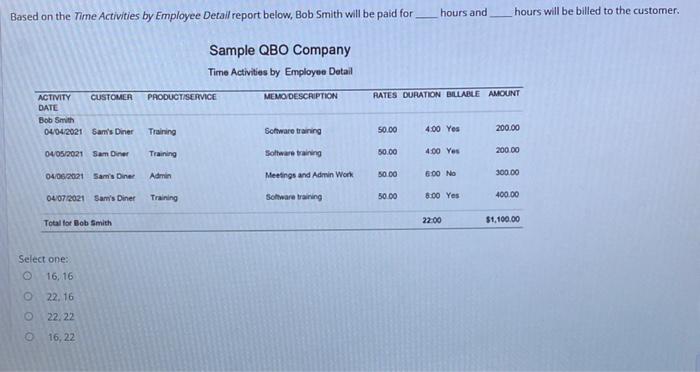

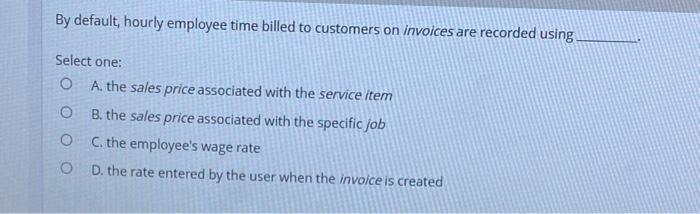

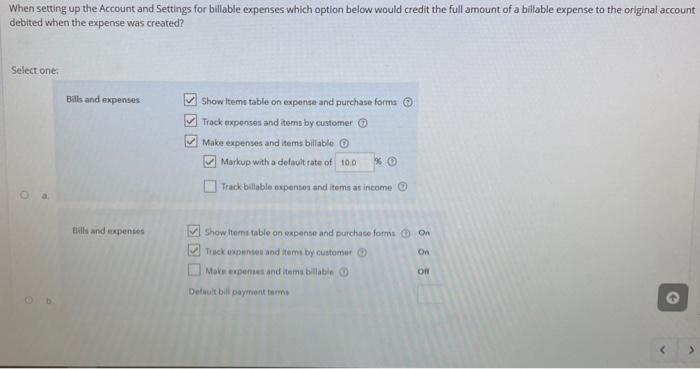

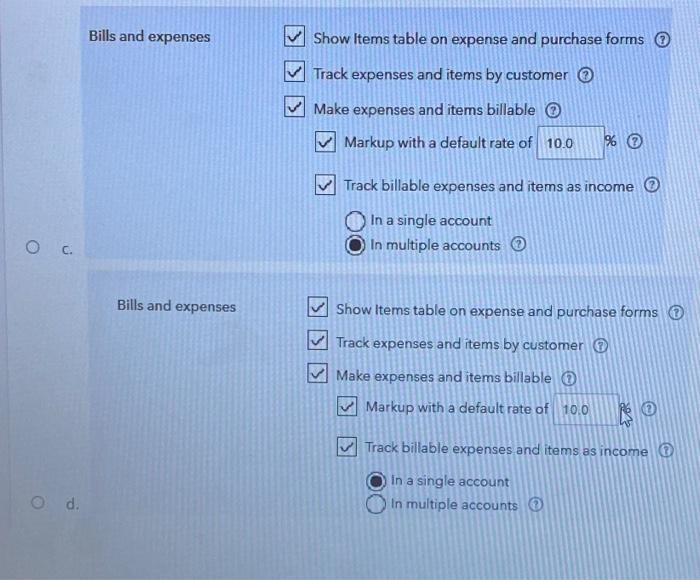

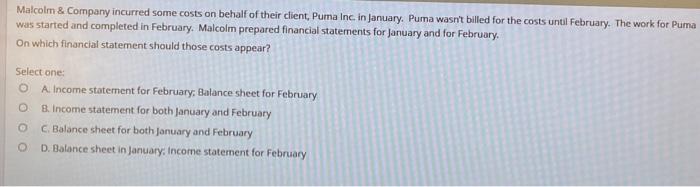

A company set up Jane Smith as an independent contractor. Jane Smith will also appear in the center. Select one: A. Taxes O B. Vendor C. Customer O D. Accounting Based on the Time Activities by Employee Detail report below, Bob Smith will be paid for hours and hours will be billed to the customer. Sample QBO Company Time Activities by Employee Detail PRODUCTISERVICE MEMO DESCRIPTION RATES DURATION BILLABLE AMOUNT ACTIVITY CUSTOMER DATE Bob Smith 0404/2021 Sann's Diner Training Software training 50.00 4.00 Yes 200.00 04/05/2021 Sam Diner Training Software training 50.00 200.00 4.00 Yes 04/06/2021 Admin Sam's Diner Meetings and Admin Work 50.00 300.00 600 No 04/07/2021 Sam's Diner Training Software training 50.00 400.00 8.00 Yes Total for Bob Smith 22.00 $1,100.00 Select one: 16, 16 22. 16 22. 22 16, 22 By default, hourly employee time billed to customers on invoices are recorded using Select one: O A. the sales price associated with the service item o B. the sales price associated with the specific job OC. the employee's wage rate O D. the rate entered by the user when the invoice is created When setting up the Account and Settings for billable expenses which option below would credit the full amount of a billable expense to the original account debited when the expense was created? Select one: Bills and expenses Show Items table on expense and purchase forma Track expenses and items by customer O Make expenses and items billable Markup with a default rate of 100 * Track billable expenses and items as income Bills and expenses M showItemstable on expense and purchase forms on Truck expenses and items by customer On Mave expenses and tumblable ON Desultbill payment to Bills and expenses Show Items table on expense and purchase forms Track expenses and items by customer Make expenses and items billable Markup with a default rate of 10.0 % Track billable expenses and items as income In a single account In multiple accounts . Bills and expenses Show Items table on expense and purchase forms KKK Track expenses and items by customer Make expenses and items billable Markup with a default rate of 10.0 O 3 > Track billable expenses and items as income in a single account In multiple accounts O d. Malcolm & Company incurred some costs on behalf of their client, Puma Inc in January. Puma wasn't billed for the costs until February. The work for Puma was started and completed in February. Malcolm prepared financial statements for January and for February On which financial statement should those costs appear? Select one: A. Income statement for February, Balance sheet for February B. Income statement for both January and February C. Balance sheet for both January and February D. Balance sheet in January, Income statement for February GO

question 5)

question 7)

question 9)

question 10)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started