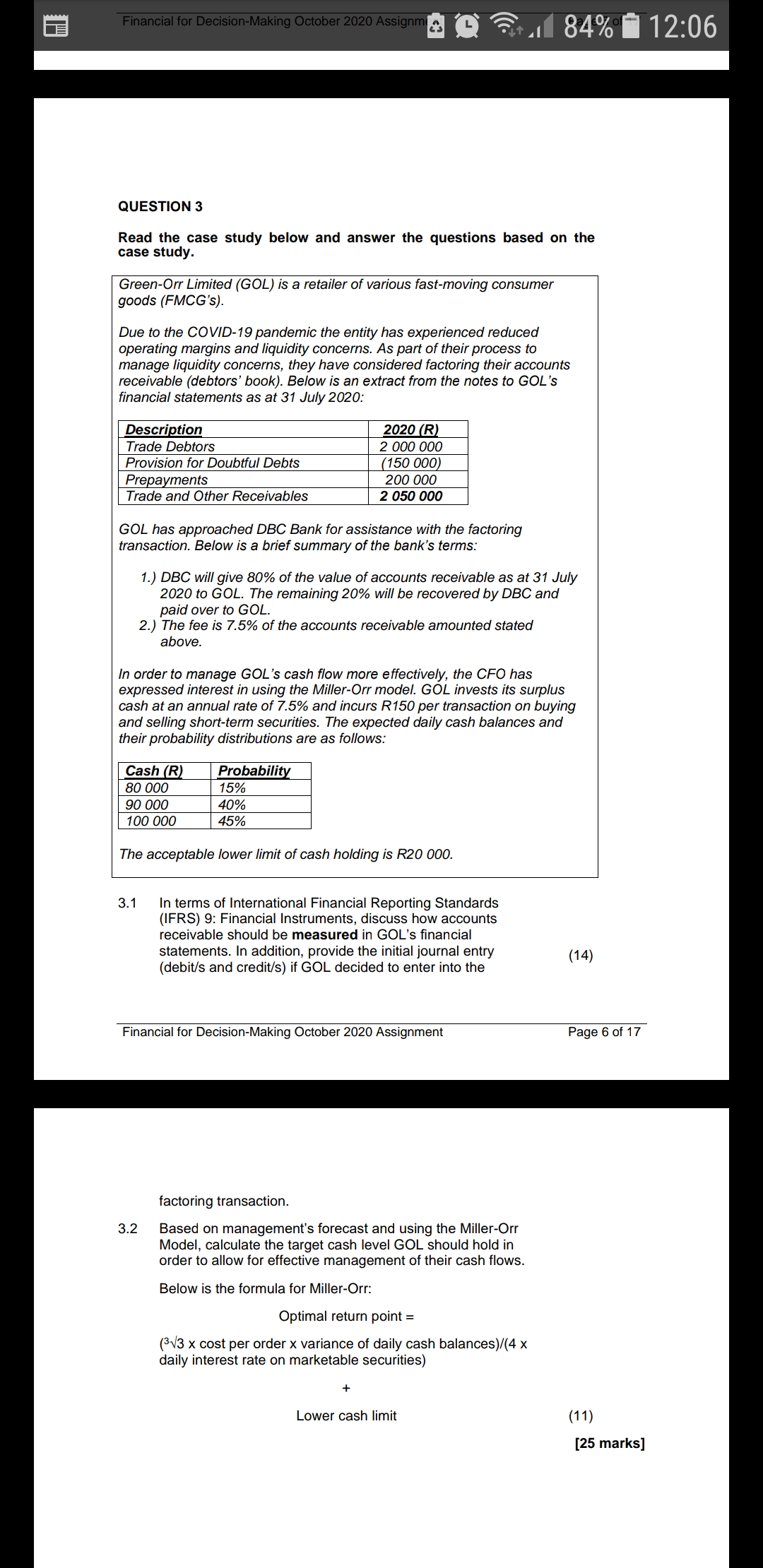

QUESTION 3 Read the case study below and answer the questions based on the case study. Green-Orr Limited (GOL) is a retailer of various fast-moving consumer goods (FMCG's). Due to the CO VlD-'lQ pandemic the entity has experienced reduced operating margins and liquidity concerns. As part of their process to manage liquidity concerns, they have considered factoring their accounts receivable (debtors' book). Below is an extract from the notes to GOL's financial statements as at 31 July 2020: Descrietion 2020 (R! Trade Debtors 2 000 000 Provision for Doubtful Debts (150 000) Prepayments 200 000 Trade and Other Receivables 2 050 000 GOL has approached 030 Bank for assistance with the factoring transaction. Below is a brief summary of the bank's terms: 1.) BBC will give 80% of the value of accounts receivable as at 31 July 2020 to GOL. The remaining 20% will be recovered by BBC and paid over to GOL. 2.) The fee is 7.5% of the accounts receivable amounted stated above. ln order to manage GOL's cash flow more effectively, the CFO has expressed interest in using the Miller-Orr model. GOL invests its surplus cash at an annual rate of 7.5% and incurs R150 per transaction on buying and selling short-term securities. The expected daily cash balances and their probability distributions are as follows: Cash [Rl Probability 80 000 15% 90 000 40% 100 000 45% The acceptable lower limit of cash holding ls mo 000. 3.1 In terms of International Financial Reporting Standards (IFRS) 9: Financial Instruments, discuss how accounts receivable should be measured in GOL's nancial statements. In addition, provide the initial journal entry (debitls and credit/s) if GOL decided to enter into the Financial for Decision-Making October 2020 Assignment Page 6 of 17 factoring transaction. 3.2 Based on management's forecast and using the Miller-Orr Model, calculate the target cash level GOL should hold in order to allow tor effective management of their cash flows. Below is the formula for Miller-Orr: Optimal retum point: (N3 x cost per order x variance of daily cash balances)l(4 x daily interest rate on marketable securities) + Lower cash limit (11) [25 marks]