Answered step by step

Verified Expert Solution

Question

1 Approved Answer

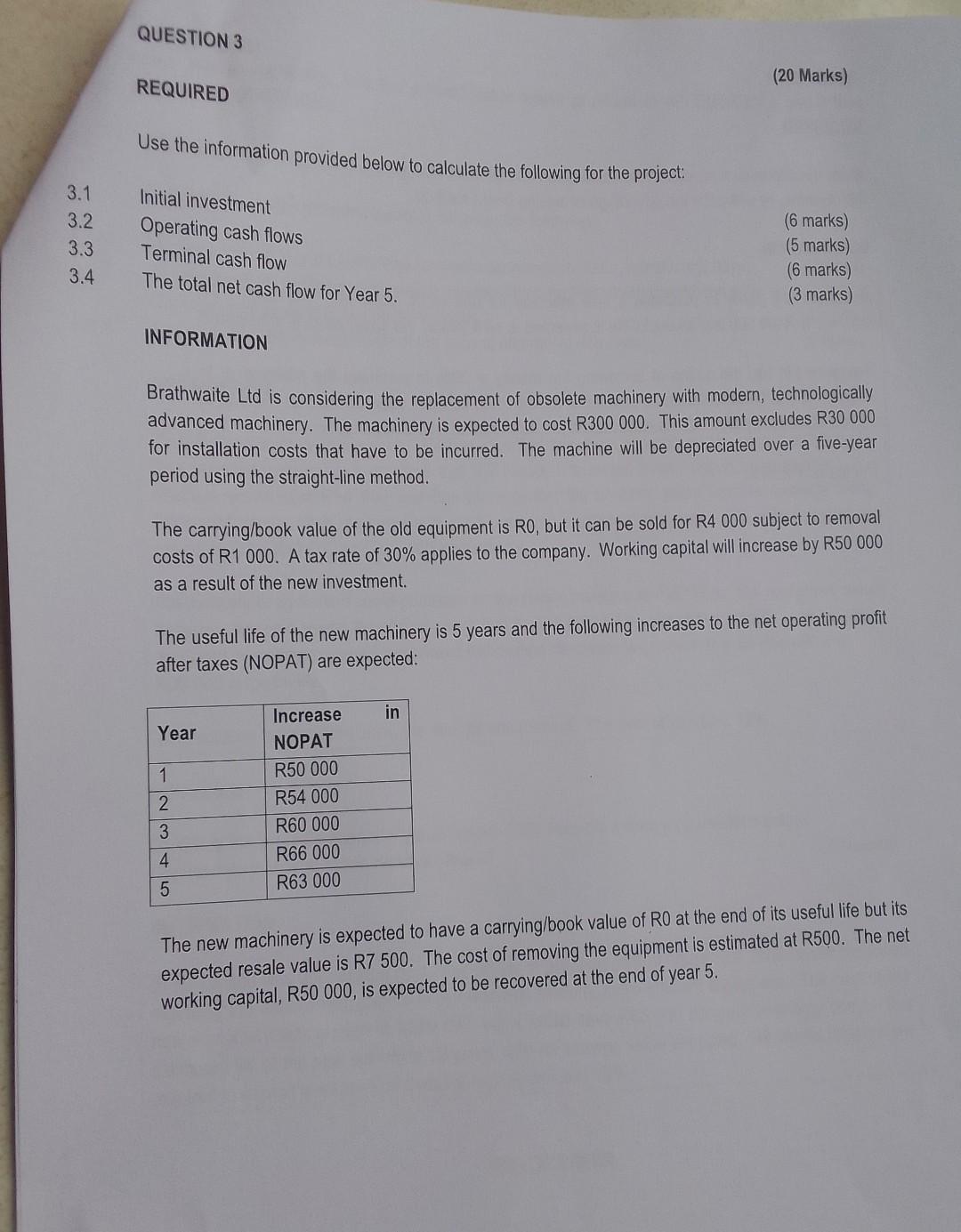

QUESTION 3 REQUIRED Use the information provided below to calculate the following for the project: 333 3.1 Initial investment 3.2 Operating cash flows 3.3

QUESTION 3 REQUIRED Use the information provided below to calculate the following for the project: 333 3.1 Initial investment 3.2 Operating cash flows 3.3 Terminal cash flow 3.4 The total net cash flow for Year 5. (20 Marks) (6 marks) (5 marks) (6 marks) (3 marks) INFORMATION Brathwaite Ltd is considering the replacement of obsolete machinery with modern, technologically advanced machinery. The machinery is expected to cost R300 000. This amount excludes R30 000 for installation costs that have to be incurred. The machine will be depreciated over a five-year period using the straight-line method. The carrying/book value of the old equipment is RO, but it can be sold for R4 000 subject to removal costs of R1 000. A tax rate of 30% applies to the company. Working capital will increase by R50 000 as a result of the new investment. The useful life of the new machinery is 5 years and the following increases to the net operating profit after taxes (NOPAT) are expected: Year Increase in NOPAT 12345 R50 000 R54 000 R60 000 R66 000 R63 000 The new machinery is expected to have a carrying/book value of RO at the end of its useful life but its expected resale value is R7 500. The cost of removing the equipment is estimated at R500. The net working capital, R50 000, is expected to be recovered at the end of year 5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started