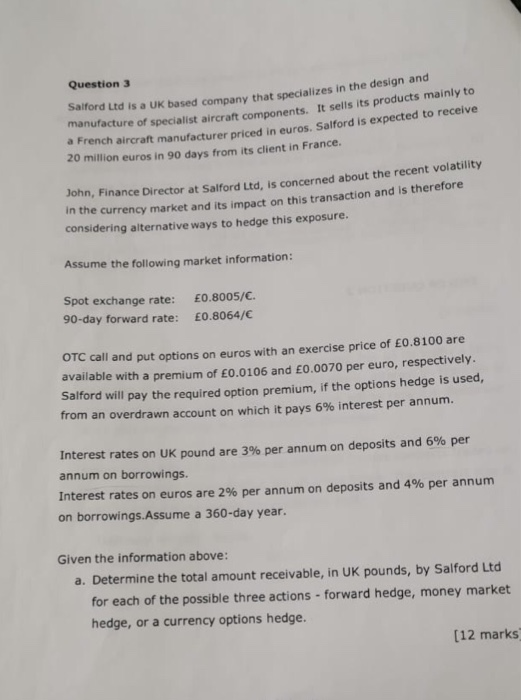

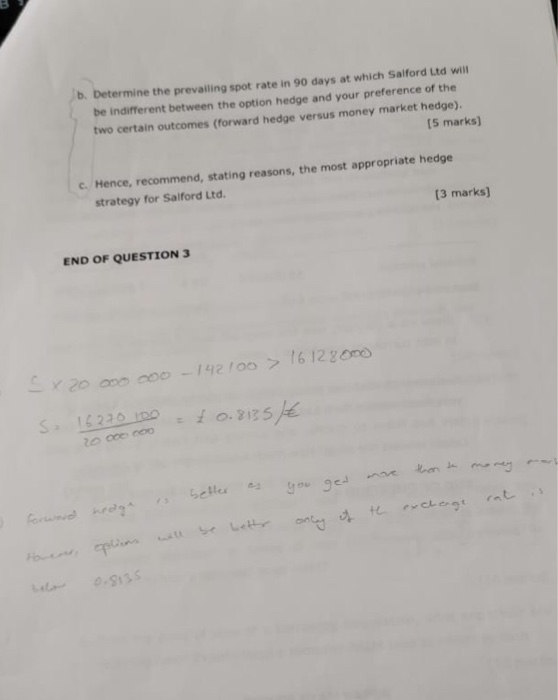

Question 3 Salford Ltd is a UK based company that specializes in the design and manufacture of specialist aircraft components. It sells its products mainly to a French aircraft manufacturer priced in euros. Salford is expected to receive 20 million euros in 90 days from its client in France. 1ohn, Finance Director at Salford Ltd, is concerned about the recent volatility in the currency market and its impact on this transaction and is therefore considering alternative ways to hedge this exposure. Assume the following market information: Spot exchange rate: E0.8005/C. 90-day forward rate: E0.8064/ OTC call and put options on euros with an exercise price of EO,8100 are available with a premium of 0.0106 and E0.0070 per euro, respectively. Salford will pay the required option premium, if the options hedge is used, from an overdrawn account on which it pays 6% interest per annum. Interest rates on UK pound are 3% per annum on deposits and 6% per annum on borrowings. Interest rates on euros are 2% per annum on deposits and 4% per annum on borrowings.Assume a 360-day year. Given the information above: a. Determine the total amount receivable, in UK pounds, by Salford Ltd for each of the possible three actions-forward hedge, money market hedge, or a currency options hedge. [12 marks b. Det ermine the prevailing spot rate in 90 days at which Salford Ltd will be indifferent between the option hedge and your preference of the two certain outcomes (forward hedge versus money market hedge). [S marks) c. Hence, recommend, stating reasons, the most appropriate hedge strategy for Salford Ltd 13 marks) END OF QUESTION 3 000 -142100 1612 Question 3 Salford Ltd is a UK based company that specializes in the design and manufacture of specialist aircraft components. It sells its products mainly to a French aircraft manufacturer priced in euros. Salford is expected to receive 20 million euros in 90 days from its client in France. 1ohn, Finance Director at Salford Ltd, is concerned about the recent volatility in the currency market and its impact on this transaction and is therefore considering alternative ways to hedge this exposure. Assume the following market information: Spot exchange rate: E0.8005/C. 90-day forward rate: E0.8064/ OTC call and put options on euros with an exercise price of EO,8100 are available with a premium of 0.0106 and E0.0070 per euro, respectively. Salford will pay the required option premium, if the options hedge is used, from an overdrawn account on which it pays 6% interest per annum. Interest rates on UK pound are 3% per annum on deposits and 6% per annum on borrowings. Interest rates on euros are 2% per annum on deposits and 4% per annum on borrowings.Assume a 360-day year. Given the information above: a. Determine the total amount receivable, in UK pounds, by Salford Ltd for each of the possible three actions-forward hedge, money market hedge, or a currency options hedge. [12 marks b. Det ermine the prevailing spot rate in 90 days at which Salford Ltd will be indifferent between the option hedge and your preference of the two certain outcomes (forward hedge versus money market hedge). [S marks) c. Hence, recommend, stating reasons, the most appropriate hedge strategy for Salford Ltd 13 marks) END OF QUESTION 3 000 -142100 1612