Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sanggul Biru Sdn Bhd (SBSB), a resident company located in Marang, Terengganu and involved in producing and supplying cosmetic products for Malaysian and international

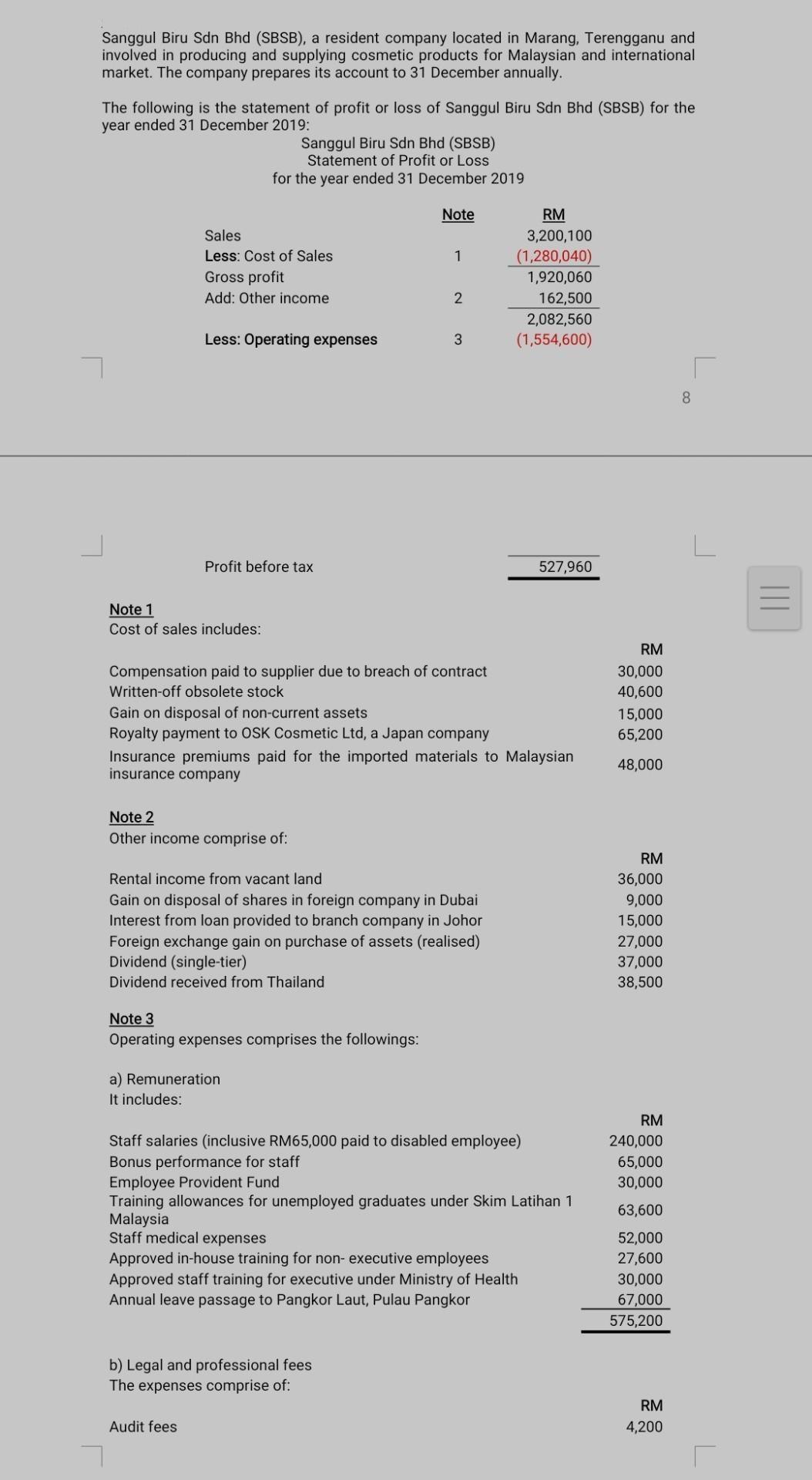

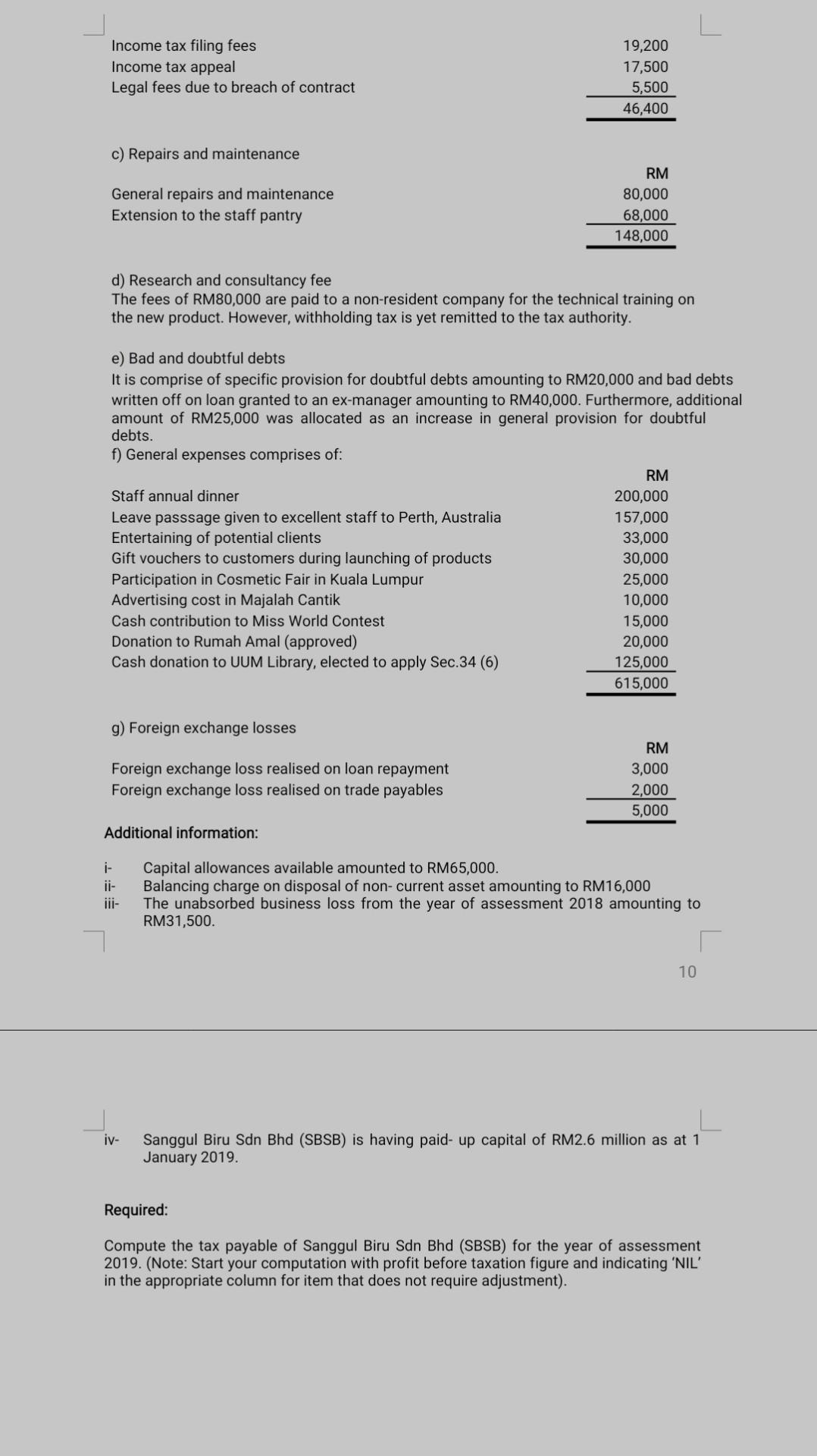

Sanggul Biru Sdn Bhd (SBSB), a resident company located in Marang, Terengganu and involved in producing and supplying cosmetic products for Malaysian and international market. The company prepares its account to 31 December annually. The following is the statement of profit or loss of Sanggul Biru Sdn Bhd (SBSB) for the year ended 31 December 2019: Sales Less: Cost of Sales Gross profit Add: Other income Sanggul Biru Sdn Bhd (SBSB) Statement of Profit or Loss for the year ended 31 December 2019 Less: Operating expenses Note 1 Cost of sales includes: Profit before tax Note 2 Other income comprise of: Compensation paid to supplier due to breach of contract Written-off obsolete stock Note Gain on disposal of non-current assets Royalty payment to OSK Cosmetic Ltd, a Japan company Note 3 Operating expenses comprises the followings: a) Remuneration It includes: 1 2 Audit fees 3 Insurance premiums paid for the imported materials to Malaysian insurance company Rental income from vacant land Gain on disposal of shares in foreign company in Dubai Interest from loan provided to branch company in Johor Foreign exchange gain on purchase of assets (realised) Dividend (single-tier) Dividend received from Thailand b) Legal and professional fees The expenses comprise of: RM 3,200,100 (1,280,040) 1,920,060 162,500 2,082,560 (1,554,600) Staff salaries (inclusive RM65,000 paid to disabled employee) Bonus performance for staff Employee Provident Fund Training allowances for unemployed graduates under Skim Latihan 1 Malaysia Staff medical expenses Approved in-house training for non-executive employees Approved staff training for executive under Ministry of Health Annual leave passage to Pangkor Laut, Pulau Pangkor 527,960 RM 30,000 40,600 15,000 65,200 48,000 RM 36,000 9,000 15,000 27,000 37,000 38,500 RM 240,000 65,000 30,000 63,600 52,000 27,600 30,000 67,000 575,200 RM 4,200 8 J ||| = Income tax filing fees Income tax appeal Legal fees due to breach of contract c) Repairs and maintenance General repairs and maintenance Extension to the staff pantry d) Research and consultancy fee The fees of RM80,000 are paid to a non-resident company for the technical training on the new product. However, withholding tax is yet remitted to the tax authority. Staff annual dinner Leave passsage given to excellent staff to Perth, Australia Entertaining of potential clients e) Bad and doubtful debts It is comprise of specific provision for doubtful debts amounting to RM20,000 and bad debts written off on loan granted to an ex-manager amounting to RM40,000. Furthermore, additional amount of RM25,000 was allocated as an increase in general provision for doubtful debts. f) General expenses comprises of: Gift vouchers to customers during launching of products Participation in Cosmetic Fair in Kuala Lumpur Advertising cost in Majalah Cantik Cash contribution to Miss World Contest Donation to Rumah Amal (approved) Cash donation to UUM Library, elected to apply Sec.34 (6) g) Foreign exchange losses Foreign exchange loss realised on loan repayment Foreign exchange loss realised on trade payables Additional information: 19,200 17,500 5,500 46,400 i- RM 80,000 68,000 148,000 iv- RM 200,000 157,000 33,000 30,000 25,000 10,000 15,000 20,000 125,000 615,000 RM 3,000 2,000 5,000 Capital allowances available amounted to RM65,000. Balancing charge on disposal of non- current asset amounting to RM16,000 The unabsorbed business loss from the year of assessment 2018 amounting to RM31,500. 10 Sanggul Biru Sdn Bhd (SBSB) is having paid- up capital of RM2.6 million as at 1 January 2019. Required: Compute the tax payable of Sanggul Biru Sdn Bhd (SBSB) for the year of assessment 2019. (Note: Start your computation with profit before taxation figure and indicating 'NIL' in the appropriate column for item that does not require adjustment).

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute the tax payable for Sanggul Biru Sdn Bhd SBSB for the year of assessment 2019 we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started