Answered step by step

Verified Expert Solution

Question

1 Approved Answer

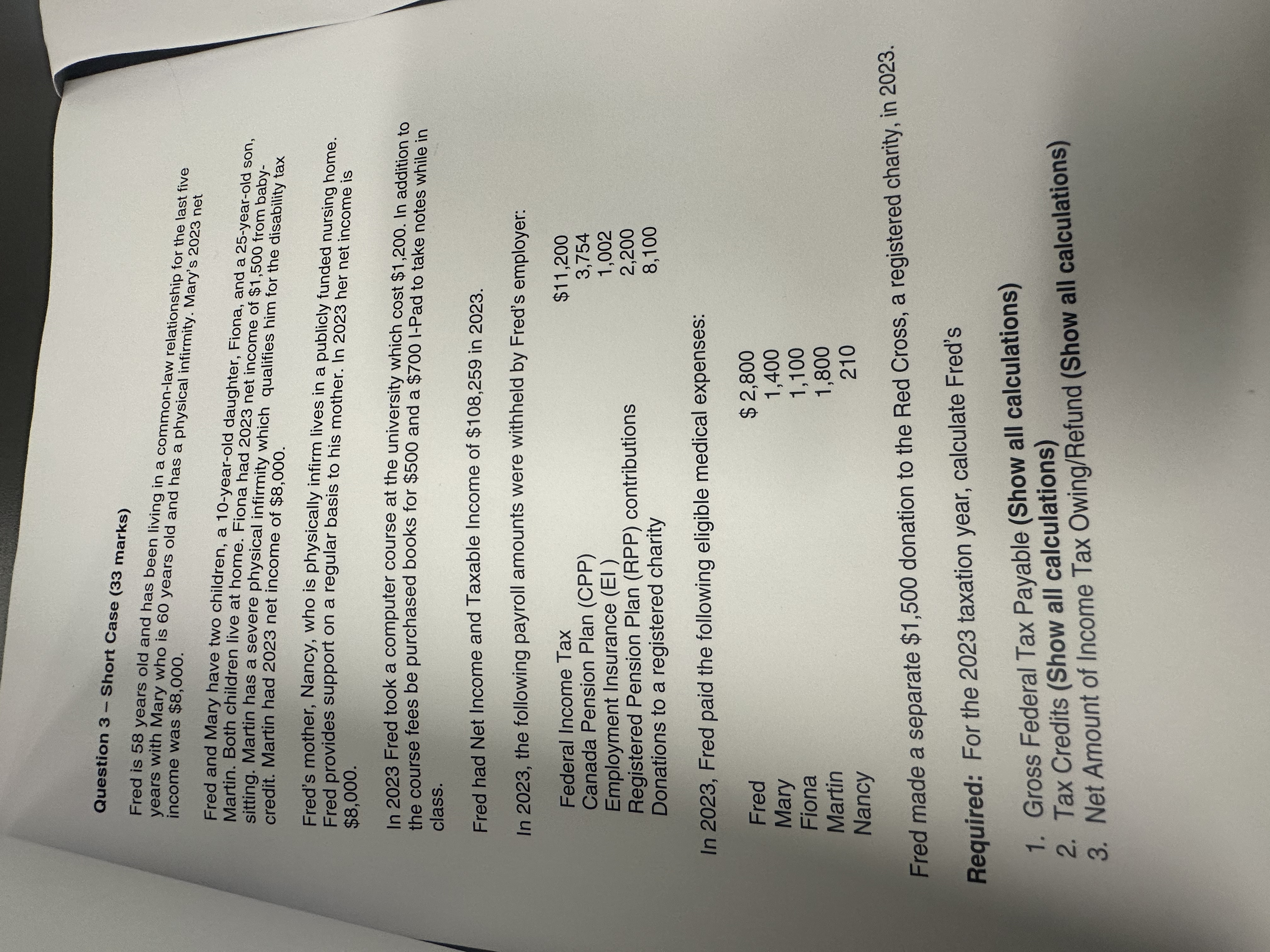

Question 3 - Short Case ( 3 3 marks ) Fred is 5 8 years old and has been living in a common - law

Question Short Case marks

Fred is years old and has been living in a commonlaw relationship for the last five years with Mary who is years old and has a physical infirmity. Mary's net income was $

Fred and Mary have two children, a yearold daughter, Fiona, and a yearold son, Martin. Both children live at home. Fiona had net income of $ from babysitting. Martin has a severe physical infirmity which qualifies him for the disability tax credit. Martin had net income of $

Fred's mother, Nancy, who is physically infirm lives in a publicly funded nursing home. Fred provides support on a regular basis to his mother. In her net income is $

In Fred took a computer course at the university which cost $ In addition to the course fees be purchased books for $ and a $ IPad to take notes while in class.

Fred had Net Income and Taxable Income of $ in

In the following payroll amounts were withheld by Fred's employer:

tableFederal Income Tax,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started