Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Simon Salt and Paul Pepper were traders, sharing profits and losses in the ratio 3: 1 respectively, and it was agreed that

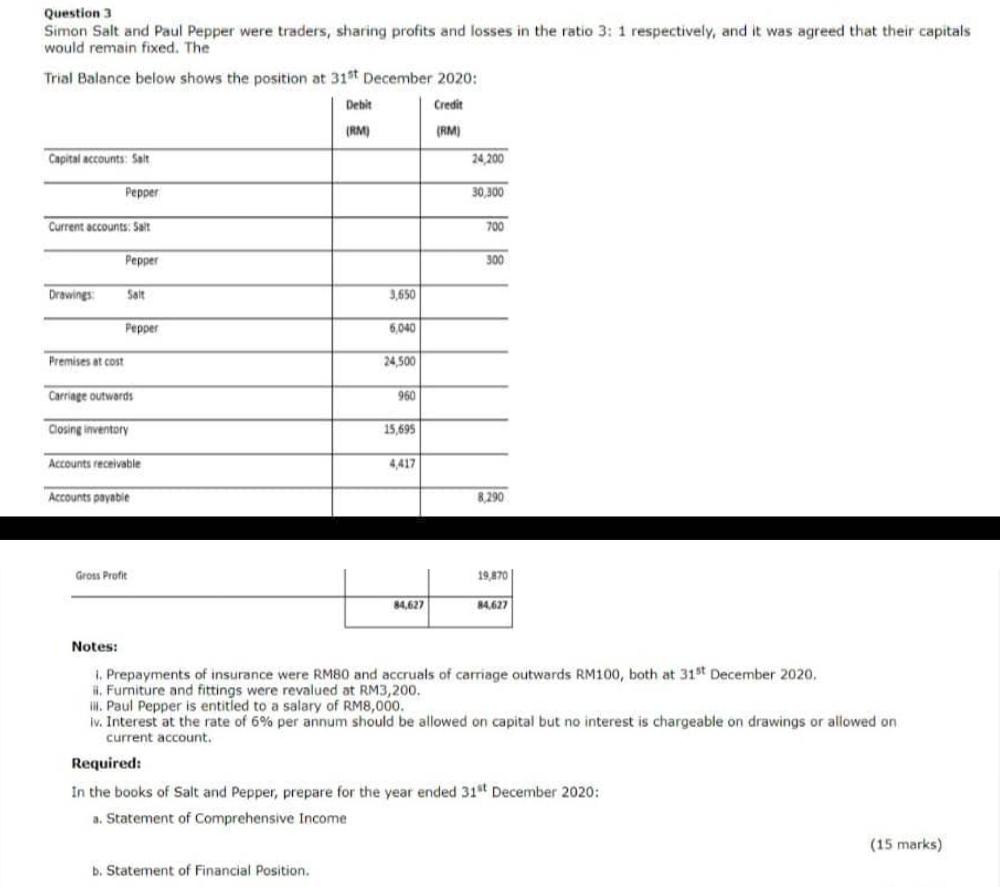

Question 3 Simon Salt and Paul Pepper were traders, sharing profits and losses in the ratio 3: 1 respectively, and it was agreed that their capitals would remain fixed. The Trial Balance below shows the position at 31st December 2020: Debit Credit (RM) (RM) Capital accounts: Salt 24,200 Pepper 30,300 Current accounts: Salt 700 Pepper 300 Drawings Salt 3,650 Pepper 6,040 Premises at cost 24,500 Carriage outwards 960 Closing inventory 15,695 Accounts receivable 4,417 Accounts payable 8,290 Gross Profit 19,870 84,627 84,627 Notes: 1. Prepayments of insurance were RM80 and accruals of carriage outwards RM100, both at 31st December 2020. ii. Furniture and fittings were revalued at RM3,200. ii. Paul Pepper is entitled to a salary of RM8,000. iv. Interest at the rate of 6% per annum should be allowed on capital but no interest is chargeable on drawings or allowed on current account. Required: In the books of Salt and Pepper, prepare for the year ended 31st December 2020: a. Statement of Comprehensive Income b. Statement of Financial Position. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started