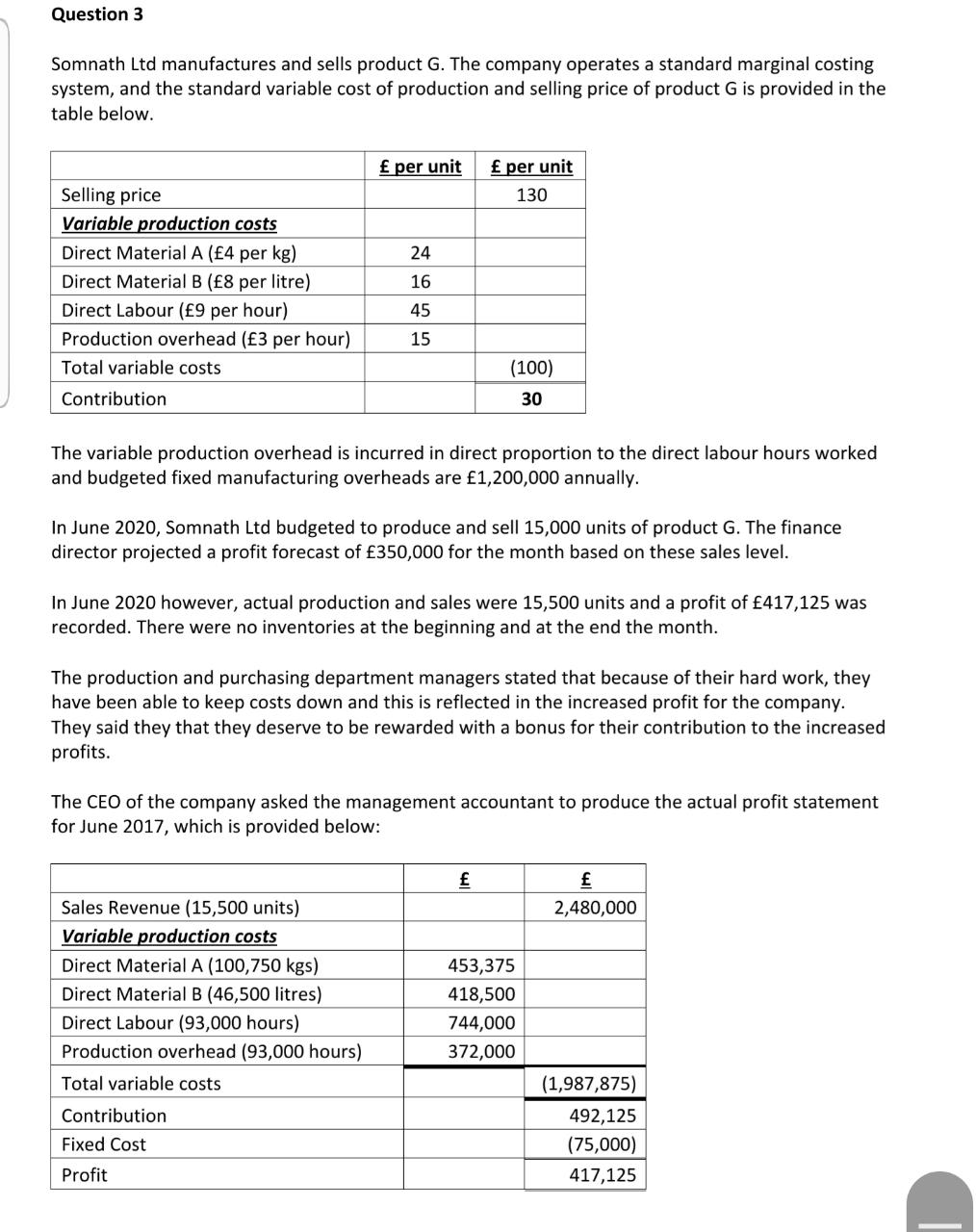

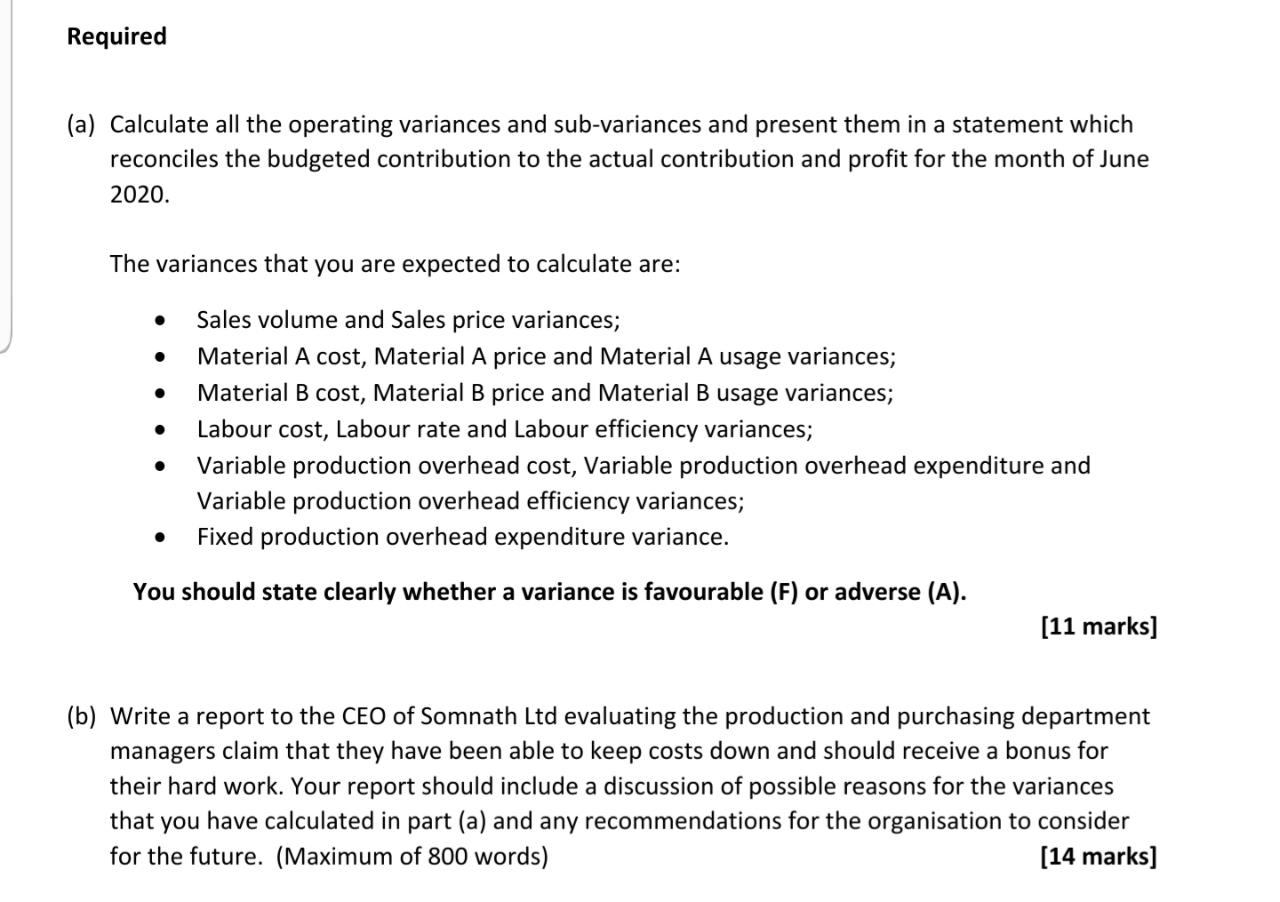

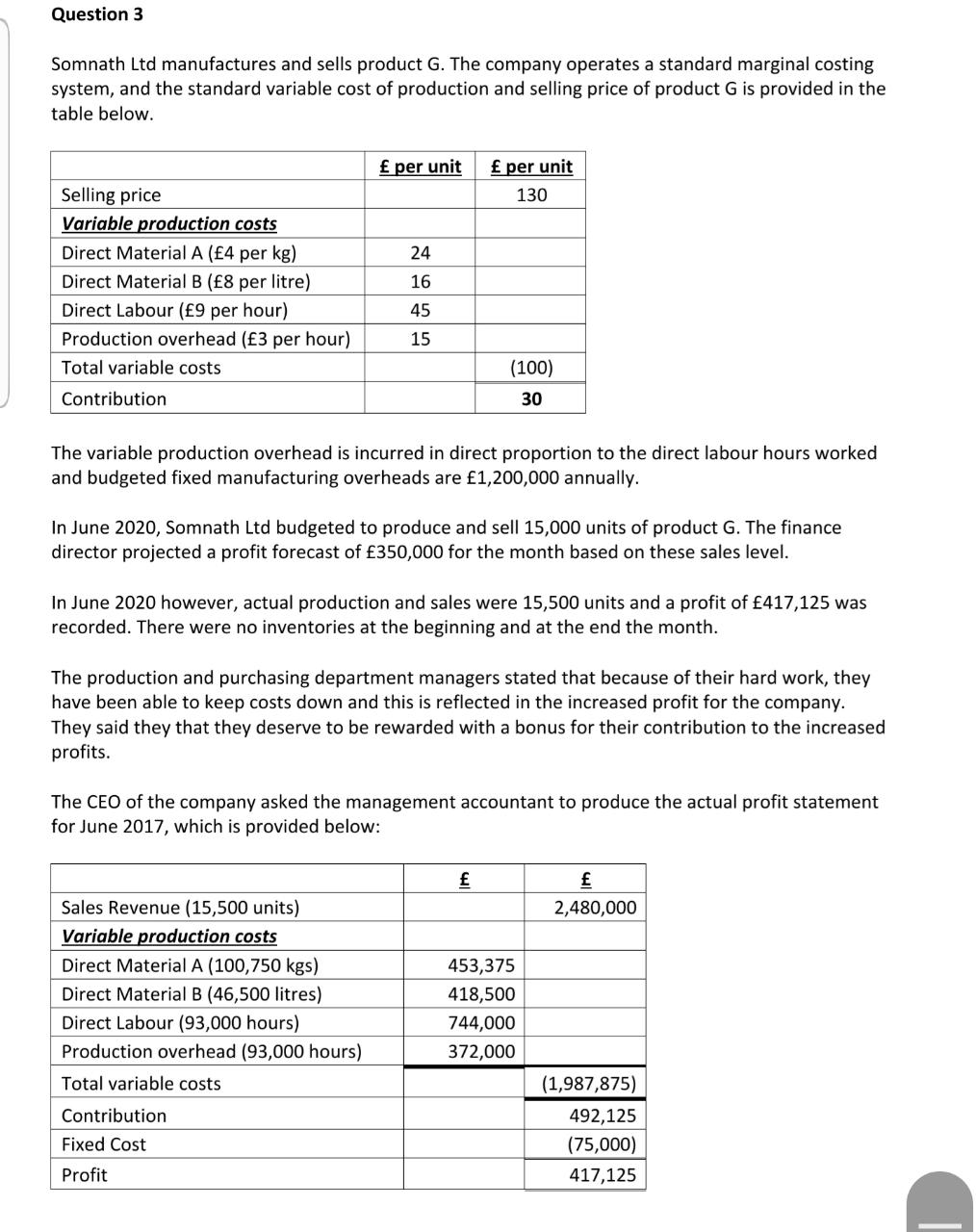

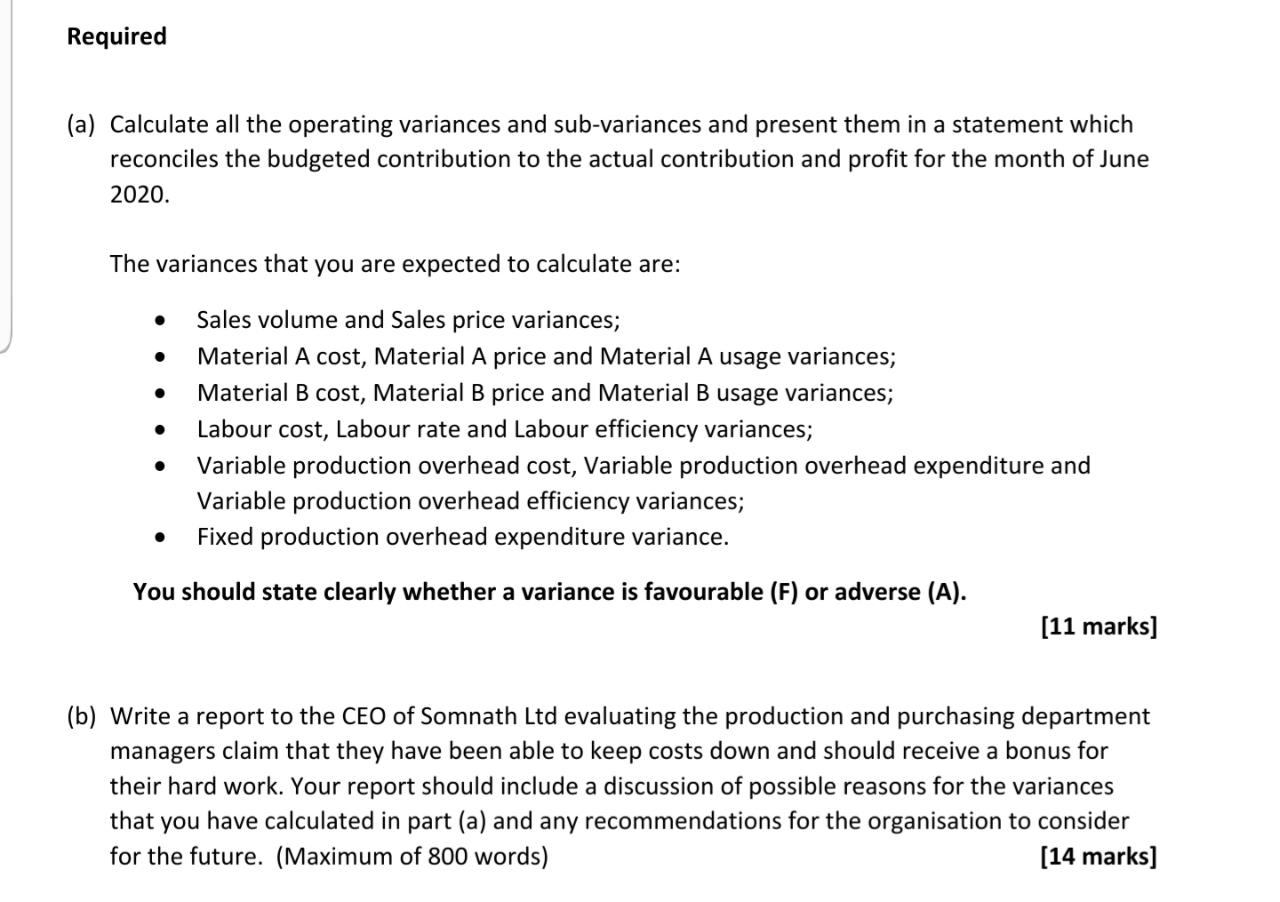

Question 3 Somnath Ltd manufactures and sells product G. The company operates a standard marginal costing system, and the standard variable cost of production and selling price of product G is provided in the table below. per unit per unit 130 24 16 Selling price Variable production costs Direct Material A (4 per kg) Direct Material B (8 per litre) Direct Labour (9 per hour) Production overhead (3 per hour) Total variable costs Contribution 45 15 (100) 30 The variable production overhead is incurred in direct proportion to the direct labour hours worked and budgeted fixed manufacturing overheads are 1,200,000 annually. In June 2020, Somnath Ltd budgeted to produce and sell 15,000 units of product G. The finance director projected a profit forecast of 350,000 for the month based on these sales level. In June 2020 however, actual production and sales were 15,500 units and a profit of 417,125 was recorded. There were no inventories at the beginning and at the end the month. The production and purchasing department managers stated that because of their hard work, they have been able to keep costs down and this is reflected in the increased profit for the company. They said they that they deserve to be rewarded with a bonus for their contribution to the increased profits. The CEO of the company asked the management accountant to produce the actual profit statement for June 2017, which is provided below: 2,480,000 Sales Revenue (15,500 units) Variable production costs Direct Material A (100,750 kgs) Direct Material B (46,500 litres) Direct Labour (93,000 hours) Production overhead (93,000 hours) 453,375 418,500 744,000 372,000 Total variable costs Contribution Fixed Cost Profit (1,987,875) 492,125 (75,000) 417,125 Required (a) Calculate all the operating variances and sub-variances and present them in a statement which reconciles the budgeted contribution to the actual contribution and profit for the month of June 2020. The variances that you are expected to calculate are: Sales volume and Sales price variances; Material A cost, Material A price and Material A usage variances; Material B cost, Material B price and Material B usage variances; Labour cost, Labour rate and Labour efficiency variances; Variable production overhead cost, Variable production overhead expenditure and Variable production overhead efficiency variances; Fixed production overhead expenditure variance. You should state clearly whether a variance is favourable (F) or adverse (A). (11 marks] (b) Write a report to the CEO of Somnath Ltd evaluating the production and purchasing department managers claim that they have been able to keep costs down and should receive a bonus for their hard work. Your report should include a discussion of possible reasons for the variances that you have calculated in part (a) and any recommendations for the organisation to consider for the future. (Maximum of 800 words) (14 marks] Question 3 Somnath Ltd manufactures and sells product G. The company operates a standard marginal costing system, and the standard variable cost of production and selling price of product G is provided in the table below. per unit per unit 130 24 16 Selling price Variable production costs Direct Material A (4 per kg) Direct Material B (8 per litre) Direct Labour (9 per hour) Production overhead (3 per hour) Total variable costs Contribution 45 15 (100) 30 The variable production overhead is incurred in direct proportion to the direct labour hours worked and budgeted fixed manufacturing overheads are 1,200,000 annually. In June 2020, Somnath Ltd budgeted to produce and sell 15,000 units of product G. The finance director projected a profit forecast of 350,000 for the month based on these sales level. In June 2020 however, actual production and sales were 15,500 units and a profit of 417,125 was recorded. There were no inventories at the beginning and at the end the month. The production and purchasing department managers stated that because of their hard work, they have been able to keep costs down and this is reflected in the increased profit for the company. They said they that they deserve to be rewarded with a bonus for their contribution to the increased profits. The CEO of the company asked the management accountant to produce the actual profit statement for June 2017, which is provided below: 2,480,000 Sales Revenue (15,500 units) Variable production costs Direct Material A (100,750 kgs) Direct Material B (46,500 litres) Direct Labour (93,000 hours) Production overhead (93,000 hours) 453,375 418,500 744,000 372,000 Total variable costs Contribution Fixed Cost Profit (1,987,875) 492,125 (75,000) 417,125 Required (a) Calculate all the operating variances and sub-variances and present them in a statement which reconciles the budgeted contribution to the actual contribution and profit for the month of June 2020. The variances that you are expected to calculate are: Sales volume and Sales price variances; Material A cost, Material A price and Material A usage variances; Material B cost, Material B price and Material B usage variances; Labour cost, Labour rate and Labour efficiency variances; Variable production overhead cost, Variable production overhead expenditure and Variable production overhead efficiency variances; Fixed production overhead expenditure variance. You should state clearly whether a variance is favourable (F) or adverse (A). (11 marks] (b) Write a report to the CEO of Somnath Ltd evaluating the production and purchasing department managers claim that they have been able to keep costs down and should receive a bonus for their hard work. Your report should include a discussion of possible reasons for the variances that you have calculated in part (a) and any recommendations for the organisation to consider for the future. (Maximum of 800 words) (14 marks]