Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Suppose you will be selling 11,000 bu of soybeans in May 2020. You hedge your sale with May 20 soybean futures on October

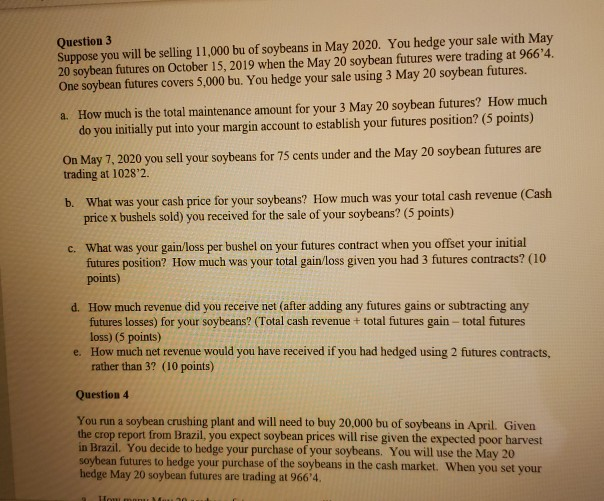

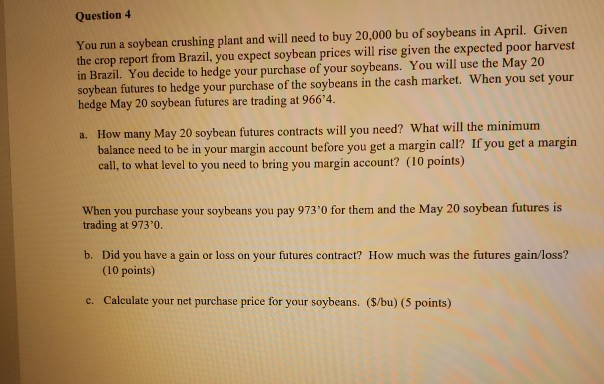

Question 3 Suppose you will be selling 11,000 bu of soybeans in May 2020. You hedge your sale with May 20 soybean futures on October 15, 2019 when the May 20 soybean futures were trading at 966'4. One soybean futures covers 5,000 bu. You hedge your sale using 3 May 20 soybean futures. a. How much is the total maintenance amount for your 3 May 20 soybean futures? How much do you initially put into your margin account to establish your futures position? (5 points) On May 7, 2020 you sell your soybeans for 75 cents under and the May 20 soybean futures are trading at 1028'2. b. What was your cash price for your soybeans? How much was your total cash revenue (Cash price x bushels sold) you received for the sale of your soybeans? (5 points) c. What was your gain/loss per bushel on your futures contract when you offset your initial futures position? How much was your total gain/loss given you had 3 futures contracts? (10 points) d. How much revenue did you receive net (after adding any futures gains or subtracting any futures losses) for your soybeans? (Total cash revenue + total futures gain - total futures loss) (5 points) e. How much net revenue would you have received if you had hedged using 2 futures contracts, rather than 3? (10 points) Question 4 You run a soybean crushing plant and will need to buy 20,000 bu of soybeans in April. Given the crop report from Brazil, you expect soybean prices will rise given the expected poor harvest in Brazil. You decide to hedge your purchase of your soybeans. You will use the May 20 soybean futures to hedge your purchase of the soybeans in the cash market. When you set your hedge May 20 soybean futures are trading at 966'4. Question 4 You run a soybean crushing plant and will need to buy 20,000 bu of soybeans in April. Given the crop report from Brazil, you expect soybean prices will rise given the expected poor harvest in Brazil. You decide to hedge your purchase of your soybeans. You will use the May 20 soybean futures to hedge your purchase of the soybeans in the cash market. When you set your hedge May 20 soybean futures are trading at 966'4. a. How many May 20 soybean futures contracts will you need? What will the minimum balance need to be in your margin account before you get a margin call? If you get a margin call, to what level to you need to bring you margin account? (10 points) When you purchase your soybeans you pay 973'0 for them and the May 20 soybean futures is trading at 973'0. b. Did you have a gain or loss on your futures contract? How much was the futures gain/loss? (10 points) c. Calculate your net purchase price for your soybeans. ($/bu) (5 points) Question 3 Suppose you will be selling 11,000 bu of soybeans in May 2020. You hedge your sale with May 20 soybean futures on October 15, 2019 when the May 20 soybean futures were trading at 966'4. One soybean futures covers 5,000 bu. You hedge your sale using 3 May 20 soybean futures. a. How much is the total maintenance amount for your 3 May 20 soybean futures? How much do you initially put into your margin account to establish your futures position? (5 points) On May 7, 2020 you sell your soybeans for 75 cents under and the May 20 soybean futures are trading at 1028'2. b. What was your cash price for your soybeans? How much was your total cash revenue (Cash price x bushels sold) you received for the sale of your soybeans? (5 points) c. What was your gain/loss per bushel on your futures contract when you offset your initial futures position? How much was your total gain/loss given you had 3 futures contracts? (10 points) d. How much revenue did you receive net (after adding any futures gains or subtracting any futures losses) for your soybeans? (Total cash revenue + total futures gain - total futures loss) (5 points) e. How much net revenue would you have received if you had hedged using 2 futures contracts, rather than 3? (10 points) Question 4 You run a soybean crushing plant and will need to buy 20,000 bu of soybeans in April. Given the crop report from Brazil, you expect soybean prices will rise given the expected poor harvest in Brazil. You decide to hedge your purchase of your soybeans. You will use the May 20 soybean futures to hedge your purchase of the soybeans in the cash market. When you set your hedge May 20 soybean futures are trading at 966'4. Question 4 You run a soybean crushing plant and will need to buy 20,000 bu of soybeans in April. Given the crop report from Brazil, you expect soybean prices will rise given the expected poor harvest in Brazil. You decide to hedge your purchase of your soybeans. You will use the May 20 soybean futures to hedge your purchase of the soybeans in the cash market. When you set your hedge May 20 soybean futures are trading at 966'4. a. How many May 20 soybean futures contracts will you need? What will the minimum balance need to be in your margin account before you get a margin call? If you get a margin call, to what level to you need to bring you margin account? (10 points) When you purchase your soybeans you pay 973'0 for them and the May 20 soybean futures is trading at 973'0. b. Did you have a gain or loss on your futures contract? How much was the futures gain/loss? (10 points) c. Calculate your net purchase price for your soybeans. ($/bu) (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started