Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 The following forecast has been made available for the Dallara business. Today is the 1st of May and the business wants to draw

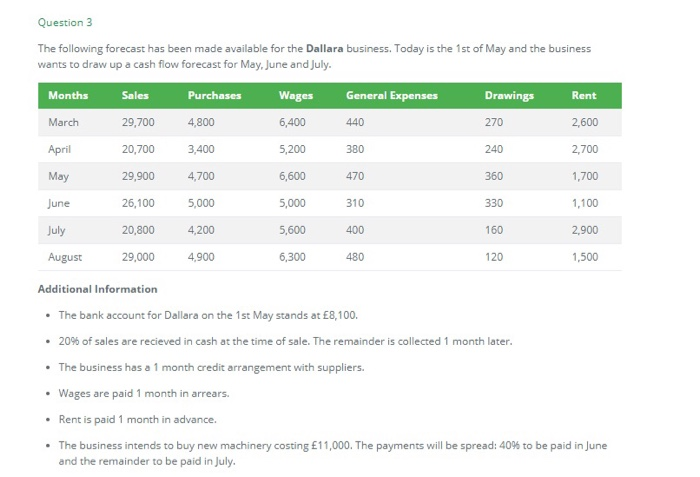

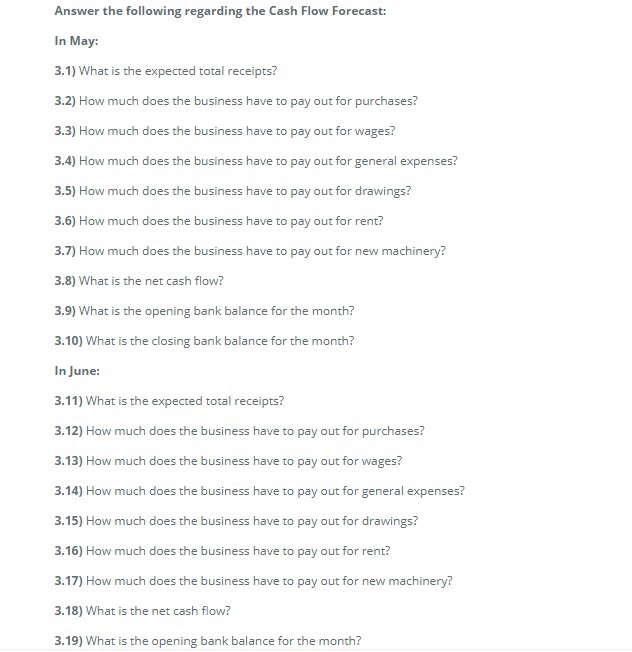

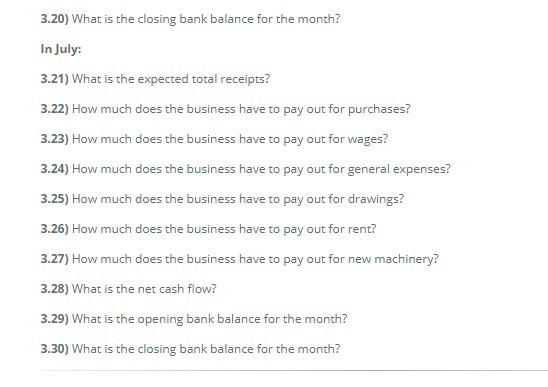

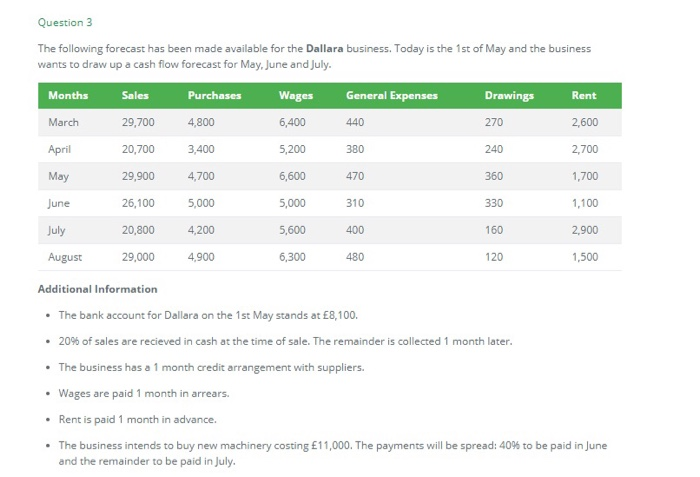

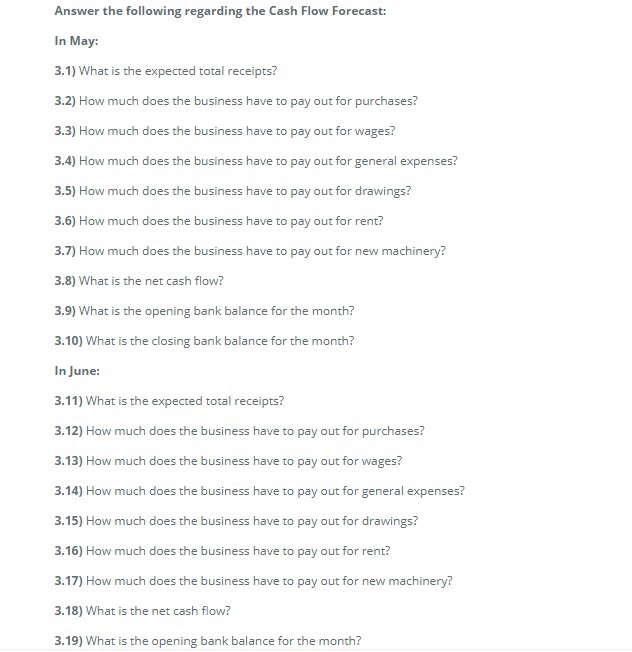

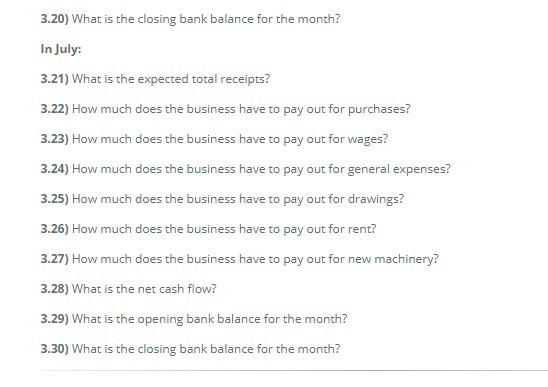

Question 3 The following forecast has been made available for the Dallara business. Today is the 1st of May and the business wants to draw up a cash flow forecast for May, June and July. Months Sales Purchases Wages General Expenses Drawings Rent March 29,700 4,800 6,400 440 270 2,600 April 20,700 3,400 5,200 380 240 2,700 29,900 4,700 6,600 470 360 1,700 May June 26,100 5,000 5,000 310 330 1,100 July 20,800 4,200 5,600 400 160 2,900 August 29,000 4,900 6,300 480 120 1,500 Additional Information The bank account for Dallara on the 1st May stands at 8,100. 20% of sales are recieved in cash at the time of sale. The remainder is collected 1 month later. The business has a 1 month credit arrangement with suppliers. Wages are paid 1 month in arrears. Rent is paid 1 month in advance. The business intends to buy new machinery costing 11,000. The payments will be spread: 40% to be paid in June and the remainder to be paid in July. Answer the following regarding the Cash Flow Forecast: In May: 3.1) What is the expected total receipts? 3.2) How much does the business have to pay out for purchases? 3.3) How much does the business have to pay out for wages? 3.4) How much does the business have to pay out for general expenses? 3.5) How much does the business have to pay out for drawings? 3.6) How much does the business have to pay out for rent? 3.7) How much does the business have to pay out for new machinery? 3.8) What is the net cash flow? 3.9) What is the opening bank balance for the month? 3.10) What is the closing bank balance for the month? In June: 3.11) What is the expected total receipts? 3.12) How much does the business have to pay out for purchases? 3.13) How much does the business have to pay out for wages? 3.14) How much does the business have to pay out for general expenses? 3.15) How much does the business have to pay out for drawings? 3.16) How much does the business have to pay out for rent? 3.17) How much does the business have to pay out for new machinery? 3.18) What is the net cash flow? 3.19) What is the opening bank balance for the month? 3.20) What is the closing bank balance for the month? In July: 3.21) What is the expected total receipts? 3.22) How much does the business have to pay out for purchases? 3.23) How much does the business have to pay out for wages? 3.24) How much does the business have to pay out for general expenses? 3.25) How much does the business have to pay out for drawings? 3.26) How much does the business have to pay out for rent? 3.27) How much does the business have to pay out for new machinery? 3.28) What is the net cash flow? 3.29) What is the opening bank balance for the month? 3.30) What is the closing bank balance for the month

Question 3 The following forecast has been made available for the Dallara business. Today is the 1st of May and the business wants to draw up a cash flow forecast for May, June and July. Months Sales Purchases Wages General Expenses Drawings Rent March 29,700 4,800 6,400 440 270 2,600 April 20,700 3,400 5,200 380 240 2,700 29,900 4,700 6,600 470 360 1,700 May June 26,100 5,000 5,000 310 330 1,100 July 20,800 4,200 5,600 400 160 2,900 August 29,000 4,900 6,300 480 120 1,500 Additional Information The bank account for Dallara on the 1st May stands at 8,100. 20% of sales are recieved in cash at the time of sale. The remainder is collected 1 month later. The business has a 1 month credit arrangement with suppliers. Wages are paid 1 month in arrears. Rent is paid 1 month in advance. The business intends to buy new machinery costing 11,000. The payments will be spread: 40% to be paid in June and the remainder to be paid in July. Answer the following regarding the Cash Flow Forecast: In May: 3.1) What is the expected total receipts? 3.2) How much does the business have to pay out for purchases? 3.3) How much does the business have to pay out for wages? 3.4) How much does the business have to pay out for general expenses? 3.5) How much does the business have to pay out for drawings? 3.6) How much does the business have to pay out for rent? 3.7) How much does the business have to pay out for new machinery? 3.8) What is the net cash flow? 3.9) What is the opening bank balance for the month? 3.10) What is the closing bank balance for the month? In June: 3.11) What is the expected total receipts? 3.12) How much does the business have to pay out for purchases? 3.13) How much does the business have to pay out for wages? 3.14) How much does the business have to pay out for general expenses? 3.15) How much does the business have to pay out for drawings? 3.16) How much does the business have to pay out for rent? 3.17) How much does the business have to pay out for new machinery? 3.18) What is the net cash flow? 3.19) What is the opening bank balance for the month? 3.20) What is the closing bank balance for the month? In July: 3.21) What is the expected total receipts? 3.22) How much does the business have to pay out for purchases? 3.23) How much does the business have to pay out for wages? 3.24) How much does the business have to pay out for general expenses? 3.25) How much does the business have to pay out for drawings? 3.26) How much does the business have to pay out for rent? 3.27) How much does the business have to pay out for new machinery? 3.28) What is the net cash flow? 3.29) What is the opening bank balance for the month? 3.30) What is the closing bank balance for the month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started