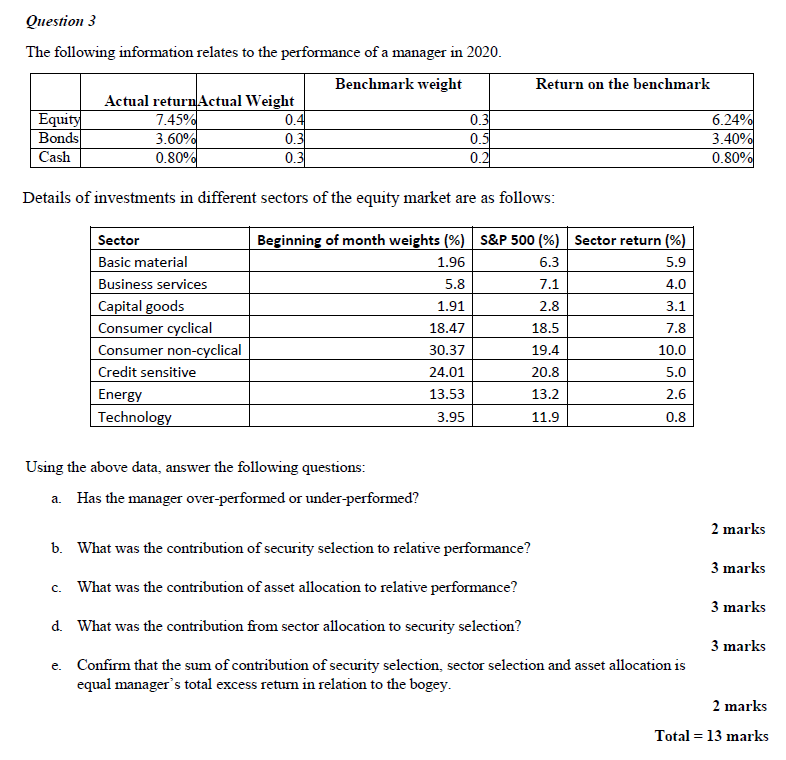

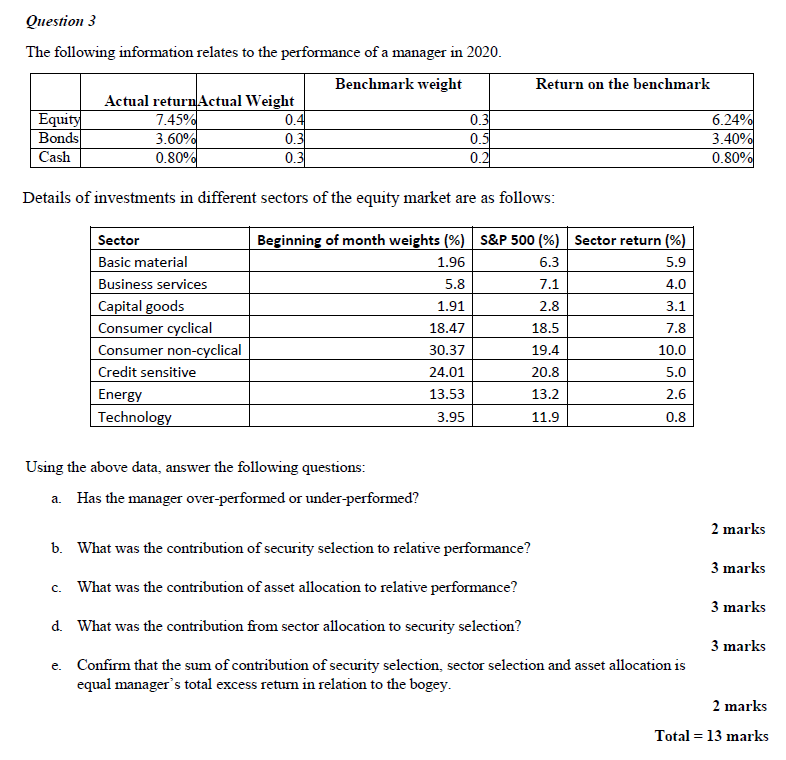

Question 3 The following information relates to the performance of a manager in 2020. Benchmark weight Actual return Actual Weight Equity 7.45% 0.4 0.3 Bonds 3.60 0.3 0.5 Cash 0.80% 0.31 0.2 Return on the benchmark 6.24% 3.40% 0.80% Details of investments in different sectors of the equity market are as follows: 6.3 Sector Basic material Business services Capital goods Consumer cyclical Consumer non-cyclical Credit sensitive Energy Technology Beginning of month weights (%) S&P 500 (%) Sector return (%) 1.96 5.9 5.8 7.1 4.0 1.91 2.8 3.1 18.47 18.5 7.8 30.37 19.4 10.0 24.01 20.8 5.0 13.53 13.2 2.6 3.95 11.9 0.8 Using the above data, answer the following questions: a. Has the manager over-performed or under-performed? 2 marks b. What was the contribution of security selection to relative performance? 3 marks c. What was the contribution of asset allocation to relative performance? 3 marks d. What was the contribution from sector allocation to security selection? 3 marks e. Confirm that the sum of contribution of security selection, sector selection and asset allocation is equal manager's total excess retum in relation to the bogey. 2 marks Total = 13 marks Question 3 The following information relates to the performance of a manager in 2020. Benchmark weight Actual return Actual Weight Equity 7.45% 0.4 0.3 Bonds 3.60 0.3 0.5 Cash 0.80% 0.31 0.2 Return on the benchmark 6.24% 3.40% 0.80% Details of investments in different sectors of the equity market are as follows: 6.3 Sector Basic material Business services Capital goods Consumer cyclical Consumer non-cyclical Credit sensitive Energy Technology Beginning of month weights (%) S&P 500 (%) Sector return (%) 1.96 5.9 5.8 7.1 4.0 1.91 2.8 3.1 18.47 18.5 7.8 30.37 19.4 10.0 24.01 20.8 5.0 13.53 13.2 2.6 3.95 11.9 0.8 Using the above data, answer the following questions: a. Has the manager over-performed or under-performed? 2 marks b. What was the contribution of security selection to relative performance? 3 marks c. What was the contribution of asset allocation to relative performance? 3 marks d. What was the contribution from sector allocation to security selection? 3 marks e. Confirm that the sum of contribution of security selection, sector selection and asset allocation is equal manager's total excess retum in relation to the bogey. 2 marks Total = 13 marks