Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: There are three legislators, i = 1,2,3. The legislators are voting on whether to give themselves a pay raise. If they get

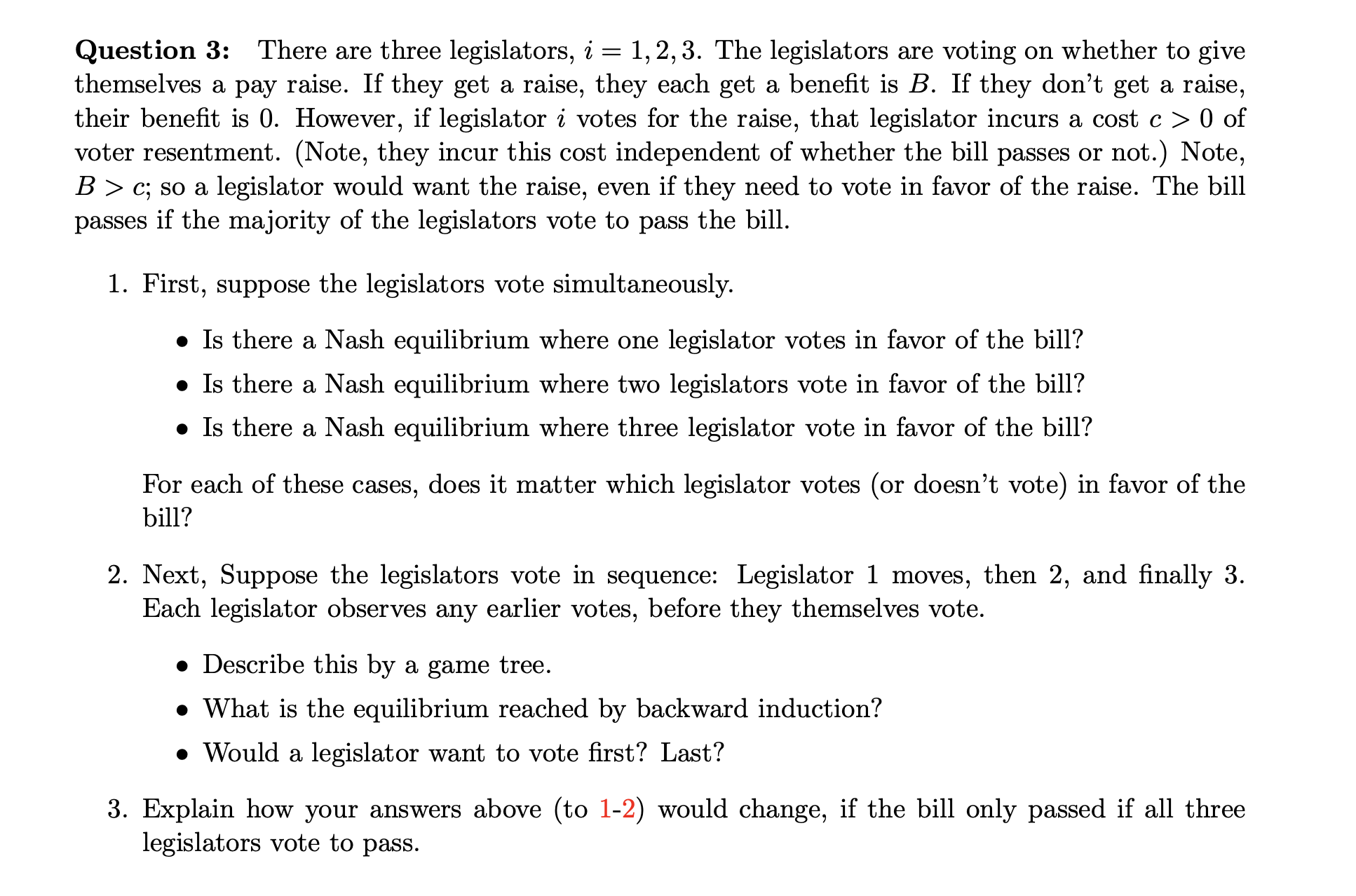

Question 3: There are three legislators, i = 1,2,3. The legislators are voting on whether to give themselves a pay raise. If they get a raise, they each get a benefit is B. If they don't get a raise, their benefit is 0. However, if legislator i votes for the raise, that legislator incurs a cost c > 0 of voter resentment. (Note, they incur this cost independent of whether the bill passes or not.) Note, B > c; so a legislator would want the raise, even if they need to vote in favor of the raise. The bill passes if the majority of the legislators vote to pass the bill. 1. First, suppose the legislators vote simultaneously. Is there a Nash equilibrium where one legislator votes in favor of the bill? Is there a Nash equilibrium where two legislators vote in favor of the bill? Is there a Nash equilibrium where three legislator vote in favor of the bill? For each of these cases, does it matter which legislator votes (or doesn't vote) in favor of the bill? 2. Next, Suppose the legislators vote in sequence: Legislator 1 moves, then 2, and finally 3. Each legislator observes any earlier votes, before they themselves vote. Describe this by a game tree. What is the equilibrium reached by backward induction? . Would a legislator want to vote first? Last? 3. Explain how your answers above (to 1-2) would change, if the bill only passed if all three legislators vote to pass.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Simultaneous Voting 1 Nash Equilibriums One legislator NoVoting yes yields Bc benefitbut others also vote yesso no majority and no gainVoting no gives ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started