Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 - This question has TWO parts (a) and (b) Kate and Todd, both in their late 30 s, jointly own their home worth

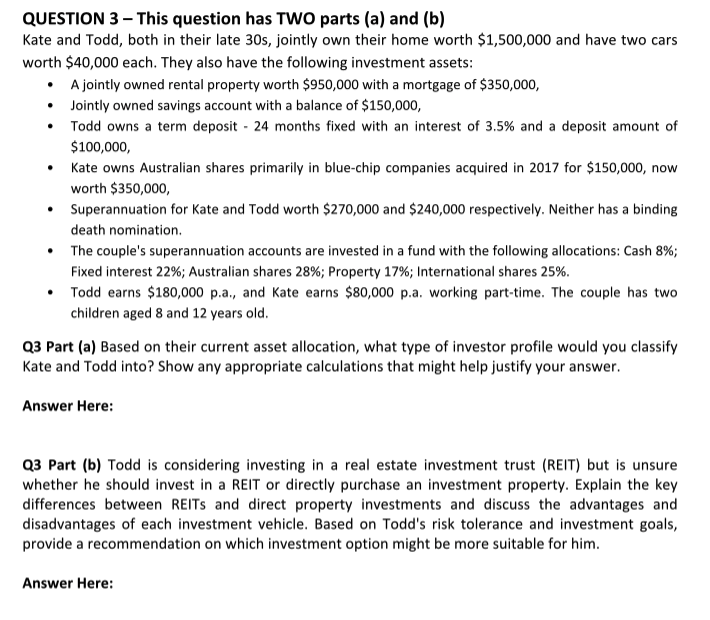

QUESTION 3 - This question has TWO parts (a) and (b) Kate and Todd, both in their late 30 s, jointly own their home worth $1,500,000 and have two cars worth $40,000 each. They also have the following investment assets: - A jointly owned rental property worth $950,000 with a mortgage of $350,000, - Jointly owned savings account with a balance of $150,000, - Todd owns a term deposit - 24 months fixed with an interest of 3.5% and a deposit amount of $100,000, - Kate owns Australian shares primarily in blue-chip companies acquired in 2017 for $150,000, now worth $350,000, - Superannuation for Kate and Todd worth $270,000 and $240,000 respectively. Neither has a binding death nomination. - The couple's superannuation accounts are invested in a fund with the following allocations: Cash 8%; Fixed interest 22%; Australian shares 28%; Property 17%; International shares 25%. - Todd earns $180,000 p.a., and Kate earns $80,000 p.a. working part-time. The couple has two children aged 8 and 12 years old. Q3 Part (a) Based on their current asset allocation, what type of investor profile would you classify Kate and Todd into? Show any appropriate calculations that might help justify your answer. Answer Here: Q3 Part (b) Todd is considering investing in a real estate investment trust (REIT) but is unsure whether he should invest in a REIT or directly purchase an investment property. Explain the key differences between REITs and direct property investments and discuss the advantages and disadvantages of each investment vehicle. Based on Todd's risk tolerance and investment goals, provide a recommendation on which investment option might be more suitable for him

QUESTION 3 - This question has TWO parts (a) and (b) Kate and Todd, both in their late 30 s, jointly own their home worth $1,500,000 and have two cars worth $40,000 each. They also have the following investment assets: - A jointly owned rental property worth $950,000 with a mortgage of $350,000, - Jointly owned savings account with a balance of $150,000, - Todd owns a term deposit - 24 months fixed with an interest of 3.5% and a deposit amount of $100,000, - Kate owns Australian shares primarily in blue-chip companies acquired in 2017 for $150,000, now worth $350,000, - Superannuation for Kate and Todd worth $270,000 and $240,000 respectively. Neither has a binding death nomination. - The couple's superannuation accounts are invested in a fund with the following allocations: Cash 8%; Fixed interest 22%; Australian shares 28%; Property 17%; International shares 25%. - Todd earns $180,000 p.a., and Kate earns $80,000 p.a. working part-time. The couple has two children aged 8 and 12 years old. Q3 Part (a) Based on their current asset allocation, what type of investor profile would you classify Kate and Todd into? Show any appropriate calculations that might help justify your answer. Answer Here: Q3 Part (b) Todd is considering investing in a real estate investment trust (REIT) but is unsure whether he should invest in a REIT or directly purchase an investment property. Explain the key differences between REITs and direct property investments and discuss the advantages and disadvantages of each investment vehicle. Based on Todd's risk tolerance and investment goals, provide a recommendation on which investment option might be more suitable for him Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started