Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (Total: 20 marks) (a) A two-year at-the-money European put option on a stock is priced using the BlackScholes formula. The stock pays dividend

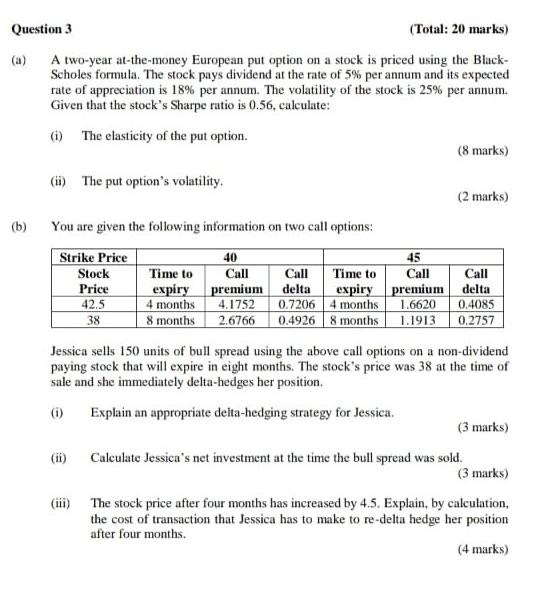

Question 3 (Total: 20 marks) (a) A two-year at-the-money European put option on a stock is priced using the BlackScholes formula. The stock pays dividend at the rate of 5% per annum and its expected rate of appreciation is 18% per annum. The volatility of the stock is 25% per annum. Given that the stock's Sharpe ratio is 0.56, calculate: (i) The elasticity of the put option. (8 marks) (ii) The put option's volatility. (2 marks) (b) You are given the following information on two call options: Jessica sells 150 units of bull spread using the above call options on a non-dividend paying stock that will expire in eight months. The stock's price was 38 at the time of sale and she immediately delta-hedges her position. (i) Explain an appropriate delta-hedging strategy for Jessica. (3 marks) (ii) Calculate Jessica's net investment at the time the bull spread was sold. (3 marks) (iii) The stock price after four months has increased by 4.5. Explain, by calculation, the cost of transaction that Jessica has to make to re-delta hedge her position after four months. (4 marks) Question 3 (Total: 20 marks) (a) A two-year at-the-money European put option on a stock is priced using the BlackScholes formula. The stock pays dividend at the rate of 5% per annum and its expected rate of appreciation is 18% per annum. The volatility of the stock is 25% per annum. Given that the stock's Sharpe ratio is 0.56, calculate: (i) The elasticity of the put option. (8 marks) (ii) The put option's volatility. (2 marks) (b) You are given the following information on two call options: Jessica sells 150 units of bull spread using the above call options on a non-dividend paying stock that will expire in eight months. The stock's price was 38 at the time of sale and she immediately delta-hedges her position. (i) Explain an appropriate delta-hedging strategy for Jessica. (3 marks) (ii) Calculate Jessica's net investment at the time the bull spread was sold. (3 marks) (iii) The stock price after four months has increased by 4.5. Explain, by calculation, the cost of transaction that Jessica has to make to re-delta hedge her position after four months. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started