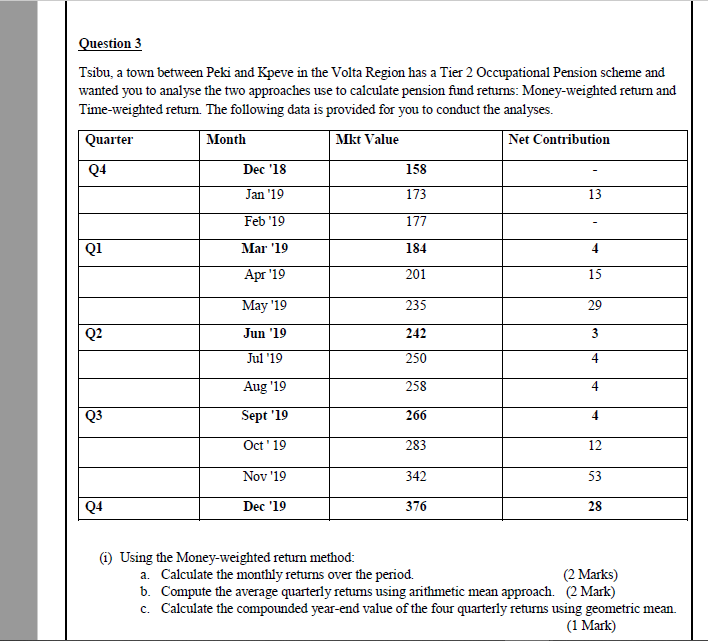

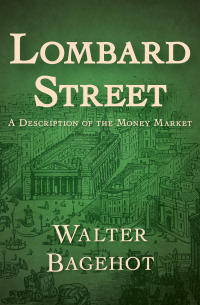

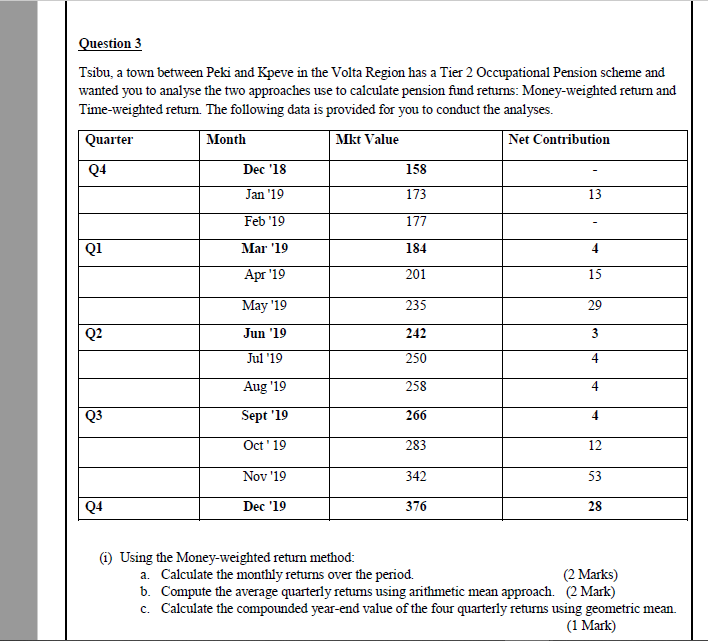

Question 3 Tsibu, a town between Peki and Kpeve in the Volta Region has a Tier 2 Occupational Pension scheme and wanted you to analyse the two approaches use to calculate pension fund returns: Money-weighted return and Time-weighted retum. The following data is provided for you to conduct the analyses. Quarter Month Mkt Value Net Contribution Q4 Dec '18 158 Jan '19 173 13 Feb '19 177 Q1 Mar '19 184 4 Apr '19 201 15 May '19 235 29 Q2 Jun '19 242 3 Jul '19 250 4 Aug '19 258 4 Q3 Sept '19 266 4 Oct 19 283 12 Nov '19 342 53 Q4 Dec '19 376 28 (1) Using the Money-weighted return method: a. Calculate the monthly returns over the period. (2 Marks) b. Compute the average quarterly retums using arithmetic mean approach. (2 Mark) c. Calculate the compounded year-end value of the four quarterly returns using geometric mean. (1 Mark) quaiteily approach. Ivan c. Calculate the compounded year-end value of the four quarterly returns using geometric mean. (1 Mark) Page 3 of 6 (11) Using the Time-weighted return approach: a. Calculate the average quarterly retums over the period. (2 Marks) b. Compute the compounded year-end value of the four quarterly return using geometric mean. (1 Mark) (111) Discuss any two problems associated with Money-weighted method compare to the Time-weighted method (1 Mark) (iv)Calculate the annualised risks associated with the two separate methods: Money weighted and Time weighted retums. (2 Marks) (v) Calculate the covariance for the two methods and explain your result. (2 Marks) (vi)Compute the correlation coefficient and explain your result. (2 Marks) (vii) Given a weight of 45:55 for Money-weighted vs Time-weighted, calculate the portfolio risk. (2 Marks) (viii) Calculate the portfolio beta. (2 Marks) (ix) Calculate the portfolio alpha. (1 Marks) (Total 20Marks) END OF PAPER- Question 3 Tsibu, a town between Peki and Kpeve in the Volta Region has a Tier 2 Occupational Pension scheme and wanted you to analyse the two approaches use to calculate pension fund returns: Money-weighted return and Time-weighted retum. The following data is provided for you to conduct the analyses. Quarter Month Mkt Value Net Contribution Q4 Dec '18 158 Jan '19 173 13 Feb '19 177 Q1 Mar '19 184 4 Apr '19 201 15 May '19 235 29 Q2 Jun '19 242 3 Jul '19 250 4 Aug '19 258 4 Q3 Sept '19 266 4 Oct 19 283 12 Nov '19 342 53 Q4 Dec '19 376 28 (1) Using the Money-weighted return method: a. Calculate the monthly returns over the period. (2 Marks) b. Compute the average quarterly retums using arithmetic mean approach. (2 Mark) c. Calculate the compounded year-end value of the four quarterly returns using geometric mean. (1 Mark) quaiteily approach. Ivan c. Calculate the compounded year-end value of the four quarterly returns using geometric mean. (1 Mark) Page 3 of 6 (11) Using the Time-weighted return approach: a. Calculate the average quarterly retums over the period. (2 Marks) b. Compute the compounded year-end value of the four quarterly return using geometric mean. (1 Mark) (111) Discuss any two problems associated with Money-weighted method compare to the Time-weighted method (1 Mark) (iv)Calculate the annualised risks associated with the two separate methods: Money weighted and Time weighted retums. (2 Marks) (v) Calculate the covariance for the two methods and explain your result. (2 Marks) (vi)Compute the correlation coefficient and explain your result. (2 Marks) (vii) Given a weight of 45:55 for Money-weighted vs Time-weighted, calculate the portfolio risk. (2 Marks) (viii) Calculate the portfolio beta. (2 Marks) (ix) Calculate the portfolio alpha. (1 Marks) (Total 20Marks) END OF PAPER